Archives of “July 2020” month

rssCoronavirus – Oxford University is leading in the vaccine race

A piece in The Economist says a team at the university in the UK is a front runner in COVID-19 vaccine hunt.

- Oxford’s vaccine is already in three late-stage trials.

- Only one other vaccine, developed by Sinopharm, a Chinese firm, has started a late-stage trial, and it does not have the global support and finance that Oxford’s does.

- AstraZeneca, a British pharmaceutical company, is building an international supply chain to make sure that the vaccine is available “widely and rapidly”.

The Economist is usually tightly gated, but New Zealand press have the article here if you want more.

Article is from pre-weekend so its not fresh news.

Goldman Sachs forecast for US GDP growth revised down

Goldman Sachs economists revised down their projection for economic growth in the US, to a contraction of 4.6% this year (from previous projection at -4.2%)

- Contraction this quarter

- bounce back on track from September

- expect the US economy to grow 25% in Q3 (prior forecast of 33% for the qarter)

- expect growth of 5.8% next year

Report published over the weekend.

GS citing:

- some states imposing fresh restrictions to counter the spread of coronavirus

- consumer spending likely to stall this month & next

- “A combination of tighter state restrictions and voluntary social distancing is already having a noticeable impact on economic activity”

—

Last week from GS:

- face mask mandate could potentially substitute for lockdowns that would otherwise subtract nearly 5% from GDP

Some of the US administration are getting this through their skulls, VP Pence for example is now advocating mask wearing. Trump has not yet done so but surely its only a matter of time before he stops sacrificing people’s livelihoods on the alter of this stupid culture war?

Texas coronavirus hospitalisations at a record high, again – 7th day in a row

Wear a mask ladies and gentlemen, its not just about protection for yourself but helping stop the spread to others. Simple courtesy (I know, a lot of folks will have to Google what that is).

Meanwhile in Texas

- Covid-19 current Hospitalizations +291 to a record of 8,181. That is the 7th consecutive day to register a new high for hospitalisations. new highs

- Coronavirus Cases +3,449 to 195,239 total (Sunday numbers)

Thought For A Day

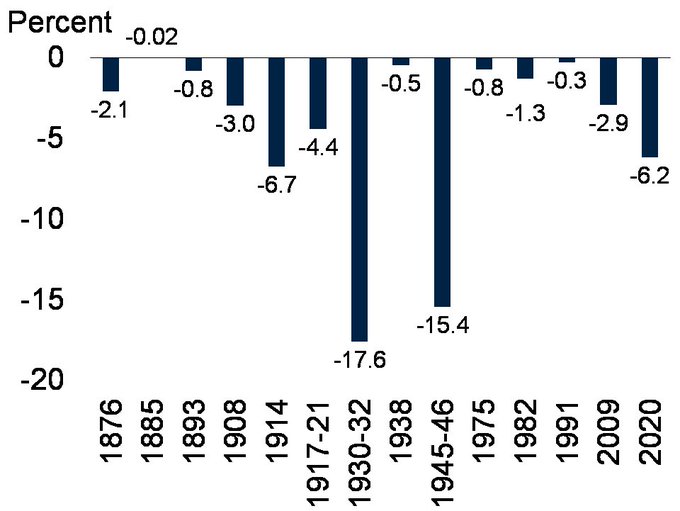

Recessions in the US

On this day in 1994: Amazon was founded by Jeff Bezos in his garage.

Cognitive Bias Examples

Here are four examples of how these types of biases can affect people in the business world:

Familiarity Bias: An investor puts her money in “what she knows”, rather than seeking the obvious benefits from portfolio diversification. Just because a certain type of industry or security is familiar doesn’t make it the logical selection.

Self-Attribution Bias: An entrepreneur overly attributes his company’s success to himself, rather than other factors (team, luck, industry trends). When things go bad, he blames these external factors for derailing his progress.

Anchoring Bias: An employee in a salary negotiation is too dependent on the first number mentioned in the negotiations, rather than rationally examining a range of options.

Survivorship Bias: Entrepreneurship looks easy, because there are so many successful entrepreneurs out there. However, this is a cognitive bias: the successful entrepreneurs are the ones still around, while the millions who failed went and did other things.

An Update :US Dollar Index ,Euro ,JPY ,GBP ,CAD ,AUD ,YUAN ,GOLD ,CRUDE -Anirudh Sethi

The dollar fell against all the major currencies last week, save the Japanese yen. All five of the best performers (NOK 2.1%, NZD 1.6%, AUD 1.0%, GBP 1.0%, and CAD 0.9%) appeared to take out downtrend lines that were in place since around June 10. What is striking about the dollar’s slump is that it took place as the Federal Reserve’s balance sheet was shrinking for the third consecutive week and the unsecured overnight rate in the eurozone fell to new record lows, often cited as dollar-supportive.

The same is true of the JP Morgan Emerging Market Currency Index. It snapped a three-week downdraft with a 1.1% rally that lifted the benchmark above the downtrend line begun with a key reversal of June 10. The greenback had been trending higher against the Mexican peso since then as well and last week’s 2.7% decline pushed it below the trendline.

To read more enter password and Unlock more engaging content

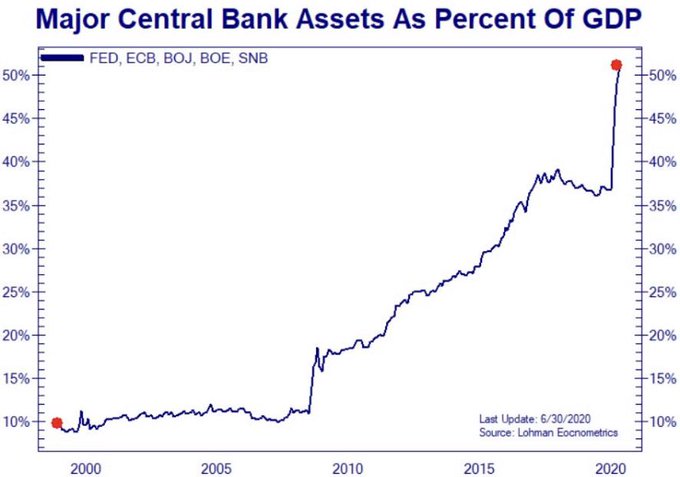

THIS CHART WILL BE STUDIED IN 100 YEARS… 2020… THE YEAR CENTRAL BANKS WENT BRRRRR