Archives of “July 2020” month

rssEuropean equity close: Watch and wait ahead of the Fed

Closing changes for the main bourses:

- UK FTSE 100 flat

- German DAX flat

- French CAC +0.7%

- Italy MIB -0.3%

- Spain IBEX -0.4%

Italian stocks have backtracked after trying to break out in the middle of the month.

US weekly oil inventories -10611K vs +450K expected

Weekly US oil inventory data

- Prior oil was +4892K

- Gasoline +654K vs -2000K expected

- Distillates +503K vs +1000K exp

- Refinery utilization +1.6% vs +0.5% exp

- Production 11.1 mbpd vs 11.1 prior

API data from late yesterday:

- Crude -6829K

- Cushing +1144K

- Gasoline +1083K

- Distillates +187K

Oil prices rose about 15 cents on the headlines. That’s the largest draw of the year and it’s entirely due to a 10462K draw at PADD 3, which is on the gulf coast.

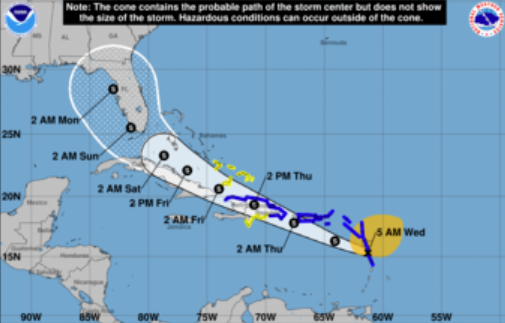

In terms of oil, one thing to watch is a potential tropical cycle in the mid-atlantic. It’s on a track that could hit the gulf and Florida.

Valuation of the top 5 companies in the S&P 500 and the remaining 495.

Trump: Admin and Democrats are far apart on virus relief bill

You never know what the real state of play is

There have been so many positive and (mostly) negative reports from top officials about the state of play on negotiations. Ultimately, everyone believes in some kind of compromise and it could happen quickly. The congressional recess is Aug 6, so expect something right before that.

As for the near-term, expect Powell to offer several reminders to Congress to get moving.

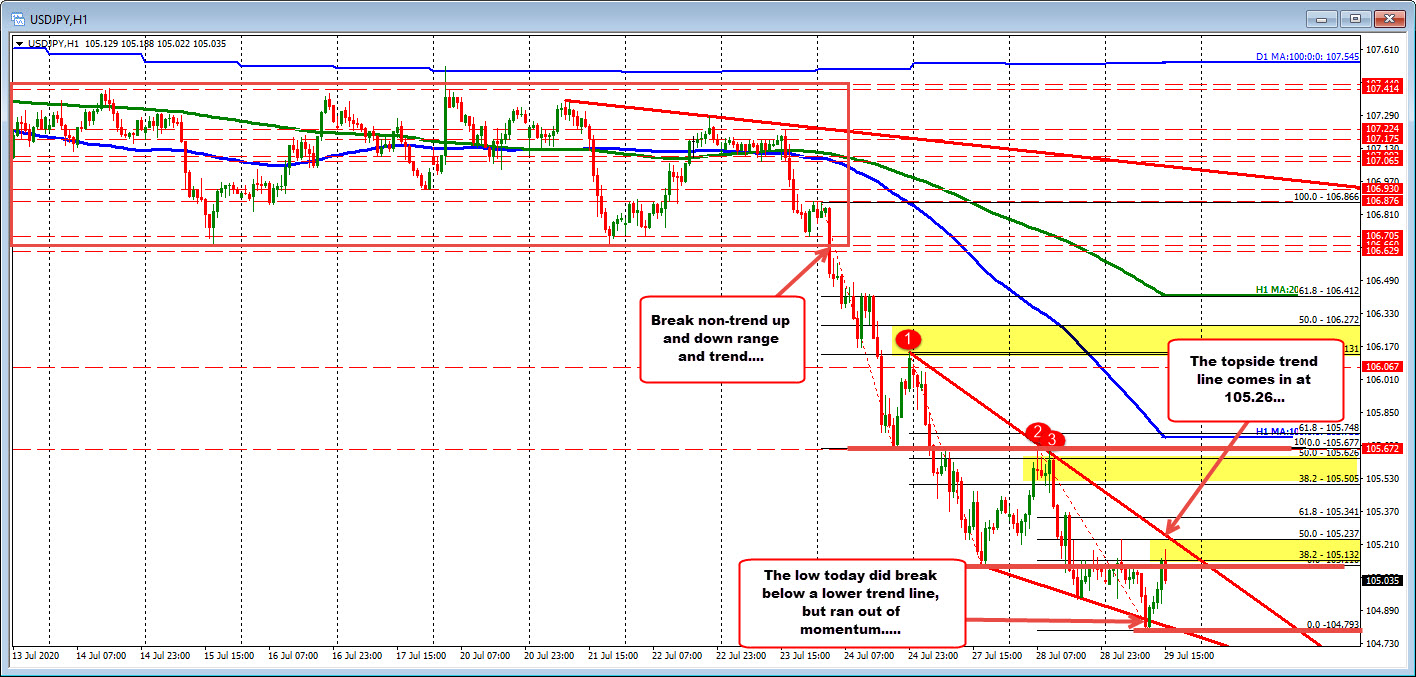

USDJPY consolidates near lows. Some intraday bull and bear.

Battle near the lows as buyers and sellers more balanced at the levels

The USDJPY transitioned from non-trend to trend on Friday – breaking below the swing lows at the 106.65 area. The pair has trended lower with the price moving down to a low of 104.793 earlier today. Looking at the hourly chart, that low was able to get below a lower trendline, but momentum stalled and the price has rebounded back up toward the closing level from yesterday and the highs for today.

The inability to extend lower and a declining momentum, gives dip buyers some hope. However, the pair still needs to get above the 38.2 to 50% retracement of the most recent trend leg lower in the 105.13 to 105.237 area (see lower yellow area in the chart above).

The pair has been stepping down with 3 separate trend legs on the way down since breaking lower on Friday.

The 1st move lower corrected toward the 38.2% retracement (see higher yellow area) and resumed the trend lower.

The 2nd leg down found sellers near the 50% retracement (at 105.626) and the low from Friday at 105.677 and resumed the trend lower (see middle yellow area).

The last leg down has the “correction zone” of the 38.2-50% between 105.132 and 105.237. The high price has stalled between those 2 levels so far today.

Getting above the 50% of the last trend leg lower, is the minimum requirement (and staying above) if the buyers are to try to take more control. The downward sloping trendline is moving toward that level as well and would need to be broken (and stay broken).

Failure to break above those levels, keeps the sellers in control. Putting it another way, the buyers are not taking control. The buyers have to prove that they can start to break the back of the trend sellers They did show up near the low trend line today, but they have more to prove if there is to be more upside probing from these levels.

US dollar catches an early bid on Fed day

USD/JPY pops

Short-term speculators are no-doubt short the US dollar so some position squaring early today into the FOMC decision make sense. We’re also closing in on month-end so flow driven trades are going to be a factor.

The Fed decision is at 1800 GMT with Powell 30 minutes later. I’ll be looking for commentary on the economy as the top market mover. If it’s negative, the Fed will have to offer more strong hints at easing to keep the equity babies bulls at bay.

Other economic data today is a mish-mash of second tier data including:

- US trade balance (advance goods)

- Wholesale inventories

- Pending home sales

- Weekly oil inventories.

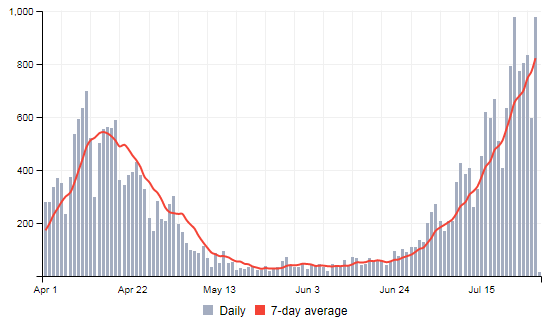

Dollar set for worst month in a decade

The US dollar is on course to record its worst July since 2010. This is according to Bloomberg data from the Commodity Futures Trading Commission which show that asset managers added to net long positions on the yen, euro and Canadian Dollar. These moves further added to the weakness in the Bloomberg Dollar Spot Index seeing it fall 3.4% this month. The net result is that the Index is on track for its worst July since 2010.

The reasons for dollar weakness

There are a number of reasons for dollar weakness:

- The further deterioration in the relationship between US and China

- The expanding COVID-19 case count in the US

- The uncertainties around a November presidential election

- Growing expectations that the Fed will need to cut policy rates further.

What to expect from the Fed tonight?

The Fed is expected to signal more accommodation tonight. So, if there is any talk of yield curve control or negative interest rates expect that to add further weakness to the USD. However, that seems unlikely as the Fed will most likely just stay in a wait and see mode. The Dollar Index has broken through a key monthly trend line and a clean break opens the way up for more sellers. The key monthly support sits below in the 90.00 region.

Japan to release several growth forecasts for fiscal year 2020, 2021 – report

Reuters reports, citing four government sources familiar with the matter

The multiple forecasts are due to the uncertainty over how long the coronavirus pandemic will last, with the government planning to release several scenarios for both fiscal year 2020 and also fiscal year 2021.

It is reported that the government will give projections for GDP based on two assumptions i.e. either the pandemic would end quickly or be prolonged.

As unusual as it may be for policymakers to do so, it is only prudent given the current situation. But as mentioned before, take forecasts during this period with a pinch of salt.

It is an evolving process and view, depending on how the virus situation plays out globally.

As for Japan itself, the country recorded another 981 new virus cases yesterday – a new daily record – with ~8,300 active infections seen currently. For some context, there was “only” ~1,000 active cases on 30 June.

Nikkei 225 closes lower by 1.15% at 22,397.11

Asian equities trade more mixed on the session

Japanese stocks end the day lower, following the softer mood from Wall Street overnight as risk sentiment keeps more cautious ahead of the Fed later today.

The mood in Asia is more mixed with the Hang Seng up by 0.3% while Chinese equities are gaining strongly, with the Shanghai Composite up 1.5% on a technical rebound and bargain hunting following a correction last week.

Overall, the risk mood is rather stalled as the focus turns towards the FOMC meeting later. Major currencies are keeping in narrower ranges still, with USD/JPY seen just above 105.00 and AUD/USD seen around 0.7165 – little changed on the day.