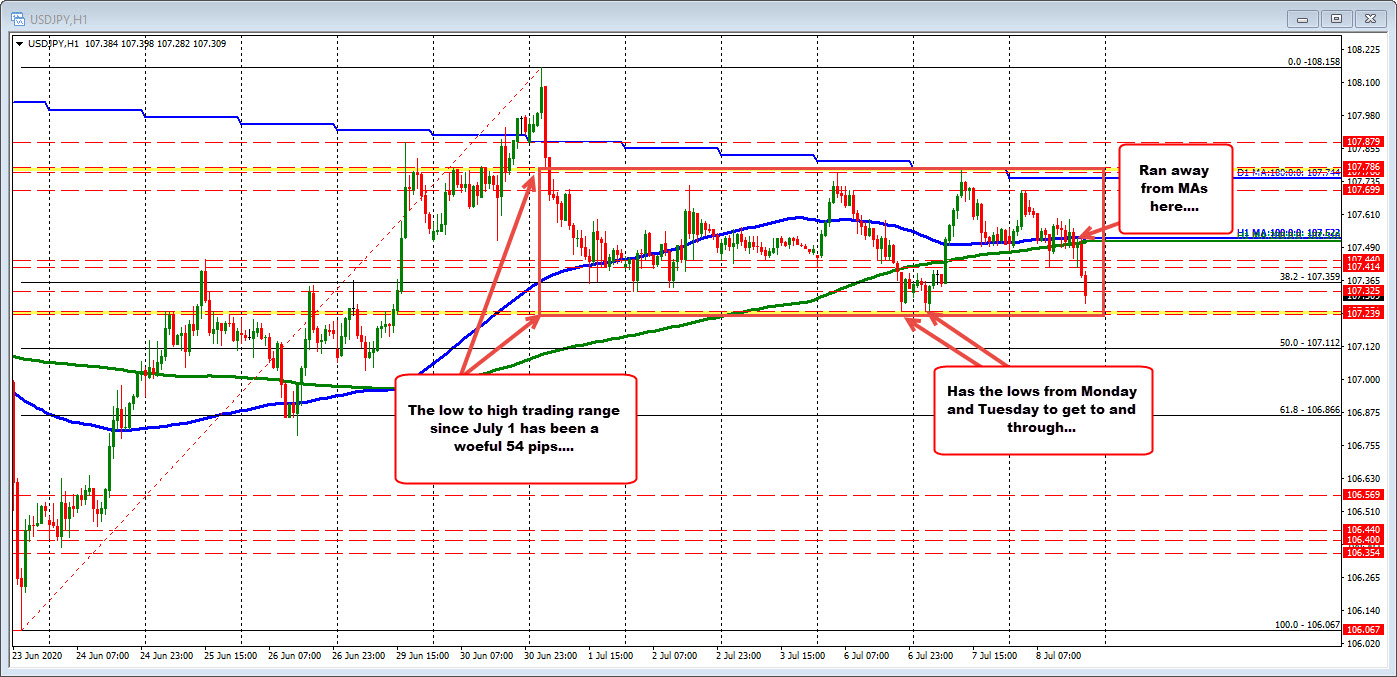

Range is only 54 pips over since July 1

The USDJPY moved below and stayed below its 100/200 hour moving averages at the 107.52 area and stayed below. That give sellers the go ahead to push lower. The overall dollar selling also has helped the bias (in a more limited move however compared to other currencies).

The fall has taken the price to 107.28. That is just above the swing lows from Monday and Tuesday between 107.239 and 107.25.

The range since July 1 has only been 54 pips with a low at 107.24 and a high at 107.78. Moving below the lower extreme should open up the door for a test of the 50% retracement of the move up from the June 23 low. That level comes in at 107.112.

The range for the day is now 42 pips. The average over the last month of trading is 59 pips. So there is room to roam on a break. However, that requires a break below the week’s lows.