Archives of “July 2020” month

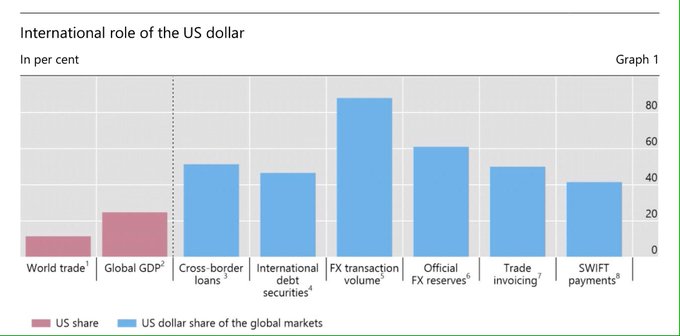

rssInternational role of the US dollar

Fitch affirms Italy at BBB- with a stable outlook

Fitch ratings on Italy

How could a country borrowing at only 1.226% for 10 years be rated BBB-?

A great move from Fitch would be if they upgraded them to AA on the implicit guarantee from Germany.

CFTC Commitments of Traders: Euro longs grow, CAD shorts trimmed

Weekly FX speculative positioning data from the CFTC:

- EUR long 104K vs 98K long last week

- GBP short 16K vs 21K short last week

- JPY long 17K vs 24K long last week

- CHF long 4K vs 4K long last week

- AUD short 1k vs 3K short last week

- NZD short 0K vs 0K short last week

- CAD short 17k vs 21K short last week

The timing on trimming the CAD shorts was sub-optimal with the pair lagging this week.

Facebook considers political ad blackout ahead of election

Bloomberg report

Oh no, that would be awful…

The blackout would only be in the ‘days leading up to the US election’. Couldn’t we make it permanent? And block all political posts in general on Facebook?

Thought For A Day

THE TRADER’S MINDSET: PROBLEMS AND SOLUTIONS

European stocks are close higher for the day

Major indices are mixed for the week

The European stocks are closing higher for the day. All the major indices are closing in the black. For the week however, the results are mixed.

The provisional closes for the day are showing:

- German DAX, +1.09%

- France’s CAC, +0.88%

- UK’s FTSE 100, +0.76%

- Spain’s Ibex, +1.17%

- Italy’s FTSE MIB, +1.2%

For the week, the German DAX led the way with a modest 0.78% gain. The results for the week show:

- German DAX, +0.78%

- France’s CAC -0.8%

- UK’s FTSE 100, -0.89%

- Spain’s Ibex, -1.18%

- Italy’s FTSE MIB, +0.1%

TRADERS AND THEIR IRRATIONAL BELIEFS

- What goes up must come down and vice versa. That’s Newton’s law, not the law of trading. And even if the market does eventually self-correct, you have no idea when it will happen. In short, there’s no point blowing up your account fighting the tape.

- You have to be smart to make money. No, what you have to be is disciplined. If you want to be smart, write a book or teach at a university. If you want to make money, listen to what the market is telling you and trade to make money — not to be “right.”

- Making money is hard. Nope. Sorry. Making money is actually easy. Statistically, you’re going to do it about half the time. Keeping it, now that’s the hard part.

- I have to have a high winning percentage to be profitable. Not true. How often you are right on a trade is only half of the equation. The other half is how much do you make when you’re right and how much you lose when you’re wrong. You can remember that with this formula: Probability (odds of it going up or down) x Magnitude (how much it goes up or down) = Profitability.

- To be successful, I have to trade without emotions. That is both wrong and impossible. You are human so you have emotions. Emotions can be a powerful motivator to your trading.

IEA warns that oil demand recovery is at risk from coronavirus resurgence

IEA remarks in its latest monthly report

- Global oil supply fell by 2.4 mil bpd in June to a 9-year low of 86.9 mil bpd

- Demand decline in Q2 2020 was less severe than expected

- Raises 2020 oil demand forecast by 400k bpd to 92.1 mil bpd

- Crude oil floating storage fell by 34.9 million barrels to 176.4 million barrels from all-time high seen in May

If you go by the numbers, the latest take by the IEA is certainly encouraging but they reserve caution amid the accelerating number of coronavirus cases. Adding that they see the risks skewed towards the downside for the oil market.

The agency says that demand should rebound sharply in Q3 as economic activity resumes but a flare-up in virus cases is “casting a shadow over the outlook”.

If anything, the fact that some countries have vowed not to return to mass lockdown is good news for oil – in the sense we won’t see a similar collapse as we did in April. But rising virus cases and partial lockdowns will still limit demand conditions moving forward.