Archives of “July 2020” month

rss$277 gold spread between Mumbai and Shanghai.

Key economic releases and events for next week’s trading

Big week for stock earnings. Advance GDP to be released

In addition to a slew of big-name earnings including Apple, Amazon, Google the key economic releases and events for next week include:

Monday, July 27

- US durable goods, 8:30 AM ET/1230 GMT

Tuesday, July 28

- RBA assistant governor can’t speaks at 8 PM ET, Monday/0030 GMT

- Spanish unemployment rate, 3 AM ET/0700 GMT

- US consumer confidence, 10 AM ET/1400 GMT

Wednesday, July 29

- Australia CPI QoQ, 9:30 PM ET Tuesday/0130 GMT

- US pending home sales, 10 AM ET/1400 GMT

- FOMC decision and statement, 2 PM ET/1800 GMT

- FOMC press conference, 2:30 PM ET/1830 GMT

Thursday, July 30

- German preliminary GDP quarter on quarter, 4 AM ET/0 800 GMT

- US advance GDP for the 2nd quarter annualized, 8:30 AM ET/1230 GMT

- US initial claims for unemployment, 8:30 AM ET/1230 GMT

Friday, July 31

- China manufacturing PMI, 9 PM ET Thursday/0100 GMT

- Canada GDP, 8:30 AM ET/12:30 GMT

- US core PCE price index 8:30 AM ET/1230 GMT

- Chicago purchasing managers index, 9:45 AM ET/1345 GMT

- University of Michigan consumer sentiment revised, 10 AM ET/1400 GMT

In addition, the US coronavirus relief package will continue to be worked out between Republicans and Democrats.

Trump signs four executive orders on drug costs

- Order passing along discounts on insulin, EpiPen

- order to allow legal importation of drugs

- US will allow the legal importation of prescription drugs from Canada and other countries where prices are lower

- orders will completely restructure prescription drug market

- Medicare will be required to purchase drugs at the same price that other countries pay

Dow and S&P post the 1st negative week in 4 weeks

NASDAQ down for the 2nd week in a row

US major indices are ending the session with declines. For the week each of the major indices are also lower. It was the 1st negative week for the Dow and S&P in 4 weeks. For the NASDAQ is on a 2 week losing streak. The NASDAQ led the way to the downside this week with a -1.33% decline.

The final numbers for the day show:

- S&P index -20.03 points or -0.62% at 3215.63

- NASDAQ index -98.24 points or -0.94% at 10363.13

- Dow -182.44 points or -0.68% at 26469.89

For the week, the NASDAQ led the way to the downside:

- S&P index -0.28%

- NASDAQ index -1.33%

- Dow industrial average -0.76%

Year to date, the S&P index turned back negative on the year:

- S&P index -0.47%

- NASDAQ index +15.5%

- Dow industrial average -7.25%

For the last year:

- S&P index +6.49%

- NASDAQ index +24.53%

- Dow -2.93%

Thought For A Day

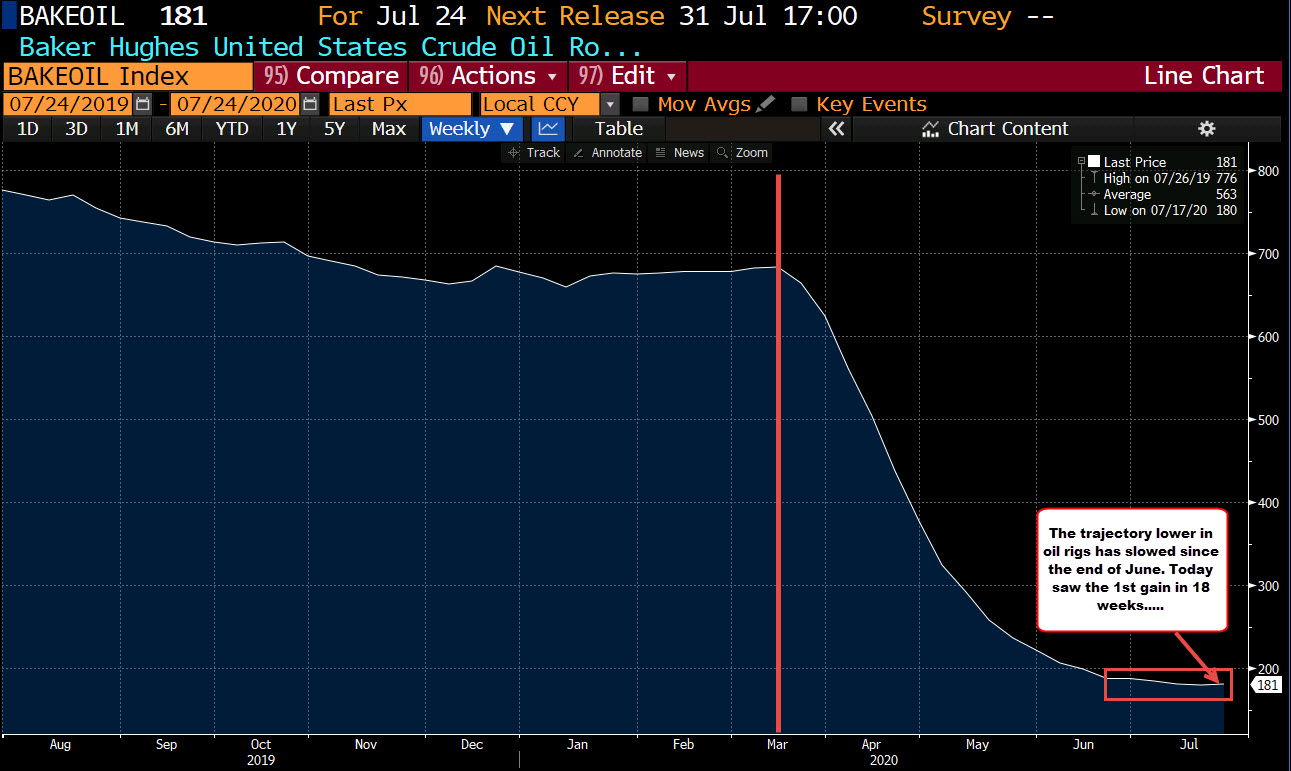

Baker Hughes oil rig counts come in at 181 vs. 179 estimate

Baker Hughes rig count for the week of July 24

- Oil rigs 181 vs. 179 estimate and 180 last week

- Gas rigs 68 vs. 74 estimate and 71 last week

- Total rig count 251 vs. 255 estimate, and 253 last week

The rise in the oil rigs was the 1st since March 13. That represents the 1st fall in 18 consecutive weeks.

USDCHF test the low close going back to 2018

Lows close going back to 2018 was at 0.92176. The low today reached 0.92184.

The USDCHF this week peaked on Monday at 0.94093. That that high was just below the 200 hour moving average at 0.9411. Sellers leaned against that level and it took until Tuesday to break below a floor area between 0.93618 and 0.93701 (see yellow area) to get the ball rolling more to the downside.

Each day this week has moved lower. The close from yesterday came in at 0.9252. That was just above the low closing price for the year (2020) at 0.9250.

Today the price did trade briefly higher to a high of 0.92598, but over the last 8 or so hours has moved back to the downside. In the process the price has traded to the lowest level going back to March 9. The low for the day reached 0.92184.

For your guide the lowest close going back to 2018 comes in at 0.92176. Like yesterday when the price tested the 2020 year low close, today’s low came just above the low close from 2018. Buyers are trying to lean against the 2018 low close like they tried to lean against the 2020 low yesterday.

A break below that level would open the door for a retest of the March 2020 low of 0.91747.

Fauci: Some places may want to pause reopening, go back

Speaking on Fox News

Dr. Fauci is speaking on Fox news and says:

- Some places may want to pause reopening, go back

- He has a good relationship with Trump

- some southern states need to step back on reopening

- US shutdown was about 50% in reality, EU is 90%

- footballs return is more complicated than baseball

- he supports CDC’s school reopening guidelines

- task force members are getting the message out

- vaccine seen widely available by several months into 2021

Yesterday threw out the first pitch in Washington DC before the game between the Washington Nationals and the New York Yankees. He is obviously spending too much time focused on infection control.

- By the end of this year/beginning of next year we will see if vaccine is safe and effective

- Vaccine will be widely available several months into 2021

Some positive comments on vaccines from infectious disease expert Dr. Fauci

European shares end the day lower

German DAX falls close to 2% on the

The European markets are closed for the day and the week, and the results today showed sharp falls in the major indices. The provisional closes are showing:

- German DAX, -1.97%

- France’s CAC, -1.57%

- UK’s FTSE 100, -1.41%

- Spain’s Ibex, -1.0%

- Italy’s FTSE MIB, -1.8%

For the week, the major indices are also trading lower:

- German DAX, -0.60%

- France’s CAC -2.27%

- UK’s FTSE 100, -2.6%

- Spain’s Ibex -1.78%

- Italy’s FTSE MIB -1.6%