Archives of “July 30, 2020” day

rssCountries with higher corporate debt.

Closing changes for the main European bourses:

- UK FTSE -2.5% (worst since June 24)

- German DAX -3.65% (worst since June 11)

- French CAC -2.4%

- Spain IBEX -2.7%

- Italy MIB -3.4%

Three new Chinese gold ETFs launched in April. (ICBC, Huaxia, Qianhai).

Oil falls 2.5% in worst decline since July 7

Oil defensive today

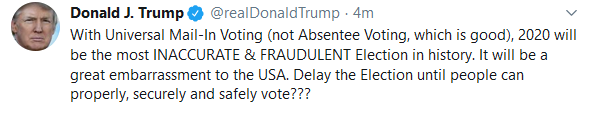

Trump floats the idea of delaying the US election

That’s a big change

With Universal Mail-In Voting (not Absentee Voting, which is good), 2020 will be the most INACCURATE & FRAUDULENT Election in history. It will be a great embarrassment to the USA. Delay the Election until people can properly, securely and safely vote???

US five-year yields hit a fresh record low as bonds rally

The bond market isn’t sending a great message

Global Times: US government helped the coronavirus kill as many American people as possible

Hu Xijin is Editor-in-chief of Chinese and English editions of the Global Times

More info on that Russian COVID-19 vaccine: 30 million doses in Russia by end of year and 170 million worldwide

The Russian vaccine speculation is not new, but here is more on it if you need.

- Russia aims to secure approval for the first Covid-19 vaccine in the first two weeks of August

- expects to produce 30 million doses in Russia by end of year and 170 million worldwide

Recap of the FOMC, “as expected” … but US Congress fiscal policy remains an unknown

Via CIBC Research on Wednesday’s FOMC policy statement.

“Today’s FOMC announcement unfolded largely as expected, with policymakers commenting that economic activity and employment remain well below where they stood prior to the pandemic, despite picking up somewhat in recent months. Indeed, the outlook has become increasingly uncertain since the last meeting on account of the surge in virus cases and the re-tightening of social distancing in many states, with the Fed noting that the path forward for the economy depends significantly on the virus which is expected to weigh heavily on activity in the near term. While the Fed stands ready to do more to support the recovery, as shown by the extension in several credit facilities beyond their initial deadlines, the fiscal support package being discussed by Congress remains an unknown”

“As a result, they appear to have opted to wait for the September meeting, when the next set of forecasts are due, to provide more concrete forward guidance on future rate hikes by perhaps tying them to the outcome of a macro variable. Tomorrow’s Q2 GDP report will provide a starting point for assessing the scale of the output gap”