Archives of “July 12, 2020” day

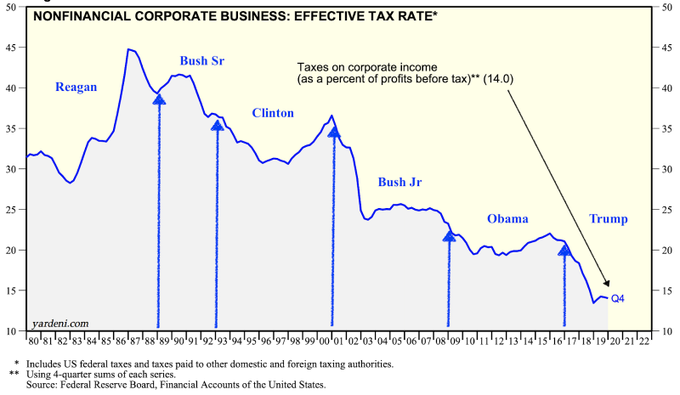

rssEffective tax rate of North American nonfinancial companies.

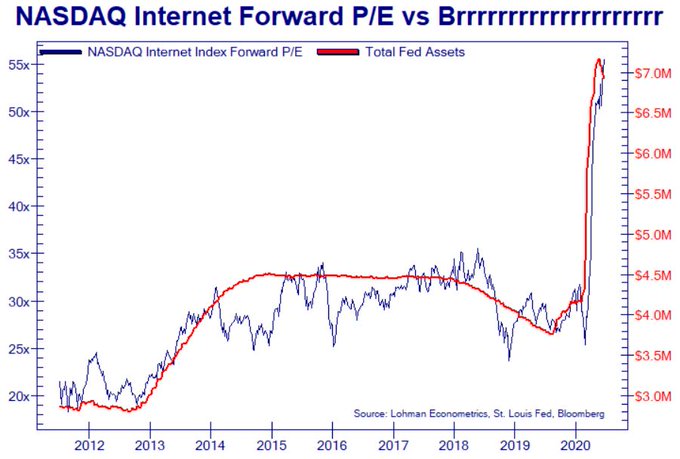

The assets of the Fed and the PER of internet stocks.

TRADE WHAT IS NOT WHAT YOU THINK SHOULD BE

Trade what is… for in doing so your trading is based on fact, substance and reality. It provides clarity, confidence, manageability, and useful feedback for consistent success where appreciation for winning, and respect for losing, keeps you in the game.

Do not trade what you think should be….for in doing so your trading is based on egotism, a false sense of foresight, the desire for validation and approval, and the “win at all cost” mentality, which leads to confusion, anxiety, anger, and despair…not to mention the inability to trade another day.

SOMETIMES I JUST SITS

Sitting is ok when the markets are not set up for your trading edge…if you have one. If you do have a trading edge experience has taught you that there are certain times when it works, and works well, and other times when it doesn’t. The quicker you recognize the difference and make the necessary adjustments to suit market conditions, the quicker you can limit losses, thus leading to greater gains.

And right here let me say one thing: After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level, which should show the greatest profit. And their experience invariably matched mine –that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance.

Jesse Livermore, Reminiscences of a Stock Operator

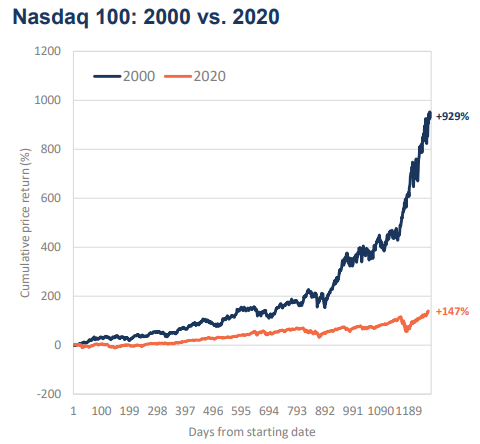

This time is different.

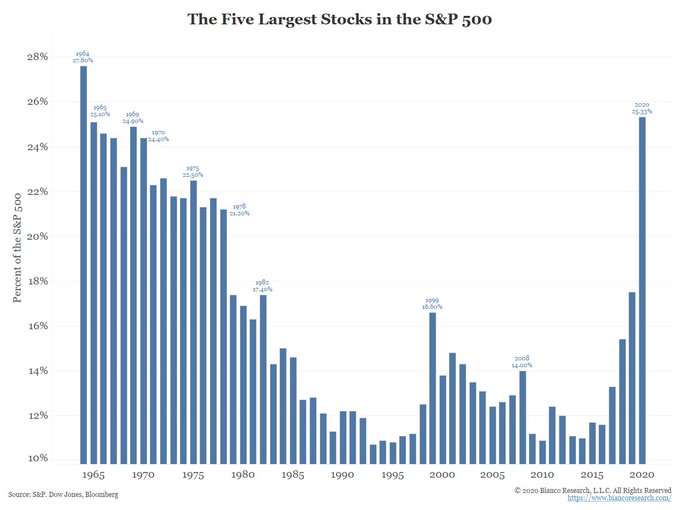

5 largest stocks within S&P 500 now represent their own quartile

Tesla now same market cap as the largest US bank

Thought For A Day