Archives of “July 10, 2020” day

rssEuropean stocks are close higher for the day

Major indices are mixed for the week

The European stocks are closing higher for the day. All the major indices are closing in the black. For the week however, the results are mixed.

The provisional closes for the day are showing:

- German DAX, +1.09%

- France’s CAC, +0.88%

- UK’s FTSE 100, +0.76%

- Spain’s Ibex, +1.17%

- Italy’s FTSE MIB, +1.2%

For the week, the German DAX led the way with a modest 0.78% gain. The results for the week show:

- German DAX, +0.78%

- France’s CAC -0.8%

- UK’s FTSE 100, -0.89%

- Spain’s Ibex, -1.18%

- Italy’s FTSE MIB, +0.1%

TRADERS AND THEIR IRRATIONAL BELIEFS

- What goes up must come down and vice versa. That’s Newton’s law, not the law of trading. And even if the market does eventually self-correct, you have no idea when it will happen. In short, there’s no point blowing up your account fighting the tape.

- You have to be smart to make money. No, what you have to be is disciplined. If you want to be smart, write a book or teach at a university. If you want to make money, listen to what the market is telling you and trade to make money — not to be “right.”

- Making money is hard. Nope. Sorry. Making money is actually easy. Statistically, you’re going to do it about half the time. Keeping it, now that’s the hard part.

- I have to have a high winning percentage to be profitable. Not true. How often you are right on a trade is only half of the equation. The other half is how much do you make when you’re right and how much you lose when you’re wrong. You can remember that with this formula: Probability (odds of it going up or down) x Magnitude (how much it goes up or down) = Profitability.

- To be successful, I have to trade without emotions. That is both wrong and impossible. You are human so you have emotions. Emotions can be a powerful motivator to your trading.

IEA warns that oil demand recovery is at risk from coronavirus resurgence

IEA remarks in its latest monthly report

- Global oil supply fell by 2.4 mil bpd in June to a 9-year low of 86.9 mil bpd

- Demand decline in Q2 2020 was less severe than expected

- Raises 2020 oil demand forecast by 400k bpd to 92.1 mil bpd

- Crude oil floating storage fell by 34.9 million barrels to 176.4 million barrels from all-time high seen in May

If you go by the numbers, the latest take by the IEA is certainly encouraging but they reserve caution amid the accelerating number of coronavirus cases. Adding that they see the risks skewed towards the downside for the oil market.

The agency says that demand should rebound sharply in Q3 as economic activity resumes but a flare-up in virus cases is “casting a shadow over the outlook”.

If anything, the fact that some countries have vowed not to return to mass lockdown is good news for oil – in the sense we won’t see a similar collapse as we did in April. But rising virus cases and partial lockdowns will still limit demand conditions moving forward.

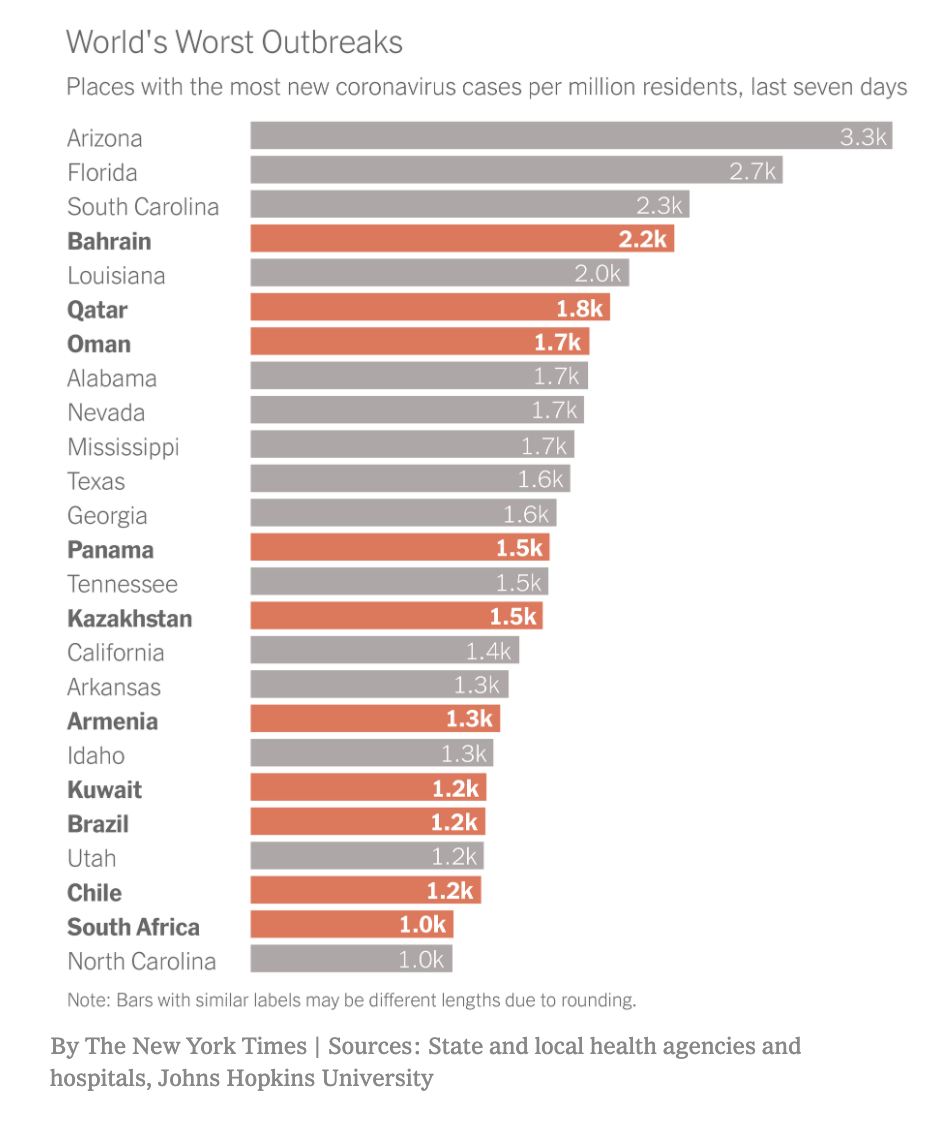

If U.S. states were countries, they would be 13 of the world’s 20 worst covid outbreaks (per capita)

Gold is going to $1,900 by the end of 2020 – “central bank policy is a strong driver”

Gold market analysis via ABN Amro, in summary. First, updated forecast:

- year-end forecast is $1,900 (was 1,700)

- for end of 2021 is $2,000 (was 1,800)

Reasoning:

1. central bank policy is a strong driver behind higher gold prices

- official rates … in a large number of countries … will unlikely go up in our forecast horizon

- (plus) quantitative easing

2. number of countries … negative rates (official and/or government bond rates)

- Gold is not paying any interest rates. So negative rates are another major support to gold prices especially versus the euro

3. the US may not have negative official rates or government bond yields, but nominal rates corrected for inflation expectations (real rates) are in negative territory

4. governments … large-scale fiscal stimulus to support the economy

- As a result, fiscal deficits in a large number of countries have risen substantially, even to double digit numbers. This development has made some investors nervous, especially in combination with the substantial amount of monetary policy stimulus

5. technical outlook is positive

- psychological resistance of $1,800 per ounce has been surpassed

- It seems that investors will only be satisfied if the former peak in gold prices at $1,931 per ounce is reached and taken out

- Above that the important psychological level of $2,000 per ounce is within reach

Fitch says Canada’s mortgage market was fueled by responsible lending. Good joke.

China’s bond yields are soaring as everyone pours into stocks.

The Nasdaq 100 is up 63% of sessions this year. This is the highest percentage since its inception in 1985.

NASDAQ closes at another record high

S&P index and Dow slip lower on the day

the US stocks are ending the session with mixed results. On the positive side the NASDAQ index continues to outperform.

- It moved higher for the 7th of the last 8 trading days.

- Apple, Facebook, Amazon, Microsoft will close at record high levels

- the NASDAQ is up 17.56% on the year. It is far outpacing the S&P index at -2.44%. The Dow industrial average is down nearly 10% on the year

The S&P index and Dow industrial average underperformed. Each of those indices fell on the day.

The final numbers are showing:

- S&P index -17.84 points or -0.56% at 3152.10

- NASDAQ index +55.25 points or 0.53% at 10547.75

- Dow industrial average -360 points or -1.39% at 25706.10