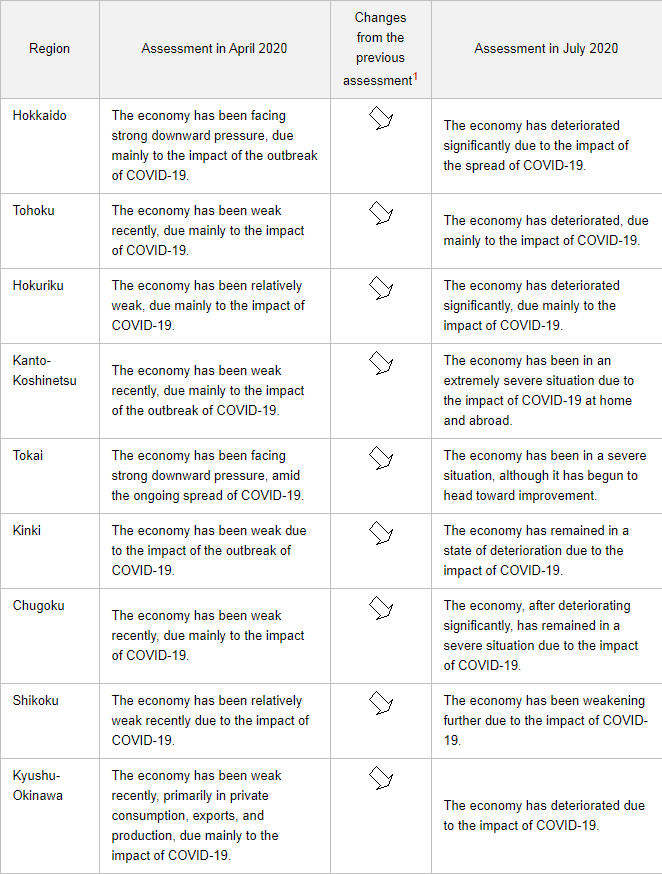

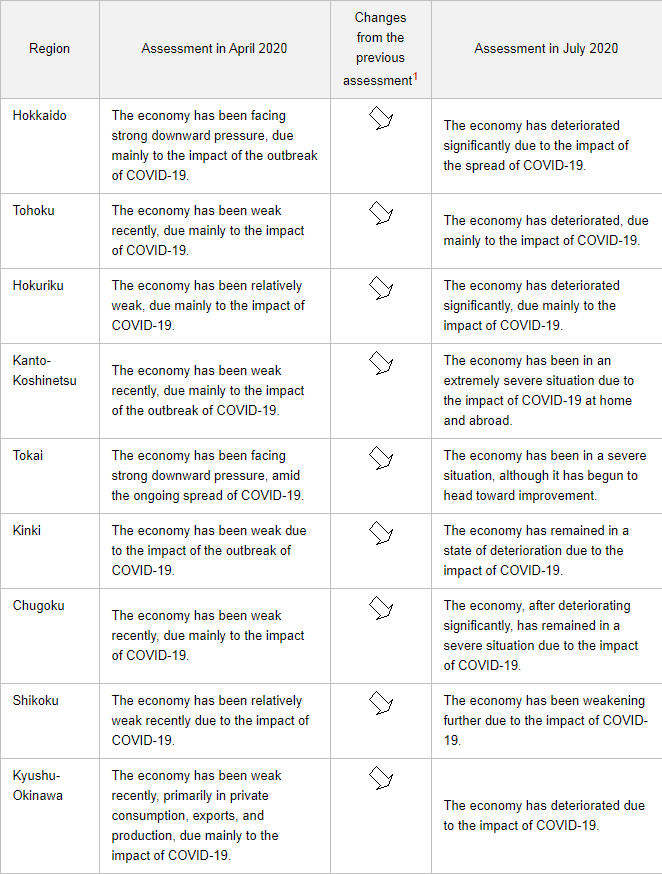

BOJ sees all of Japan’s regional economies as worsening or in a severe state

This isn’t much of a surprise as the downgrades to the assessments are all attributed to the economic fallout from the virus outbreak impact:

This isn’t much of a surprise as the downgrades to the assessments are all attributed to the economic fallout from the virus outbreak impact: