Archives of “July 7, 2020” day

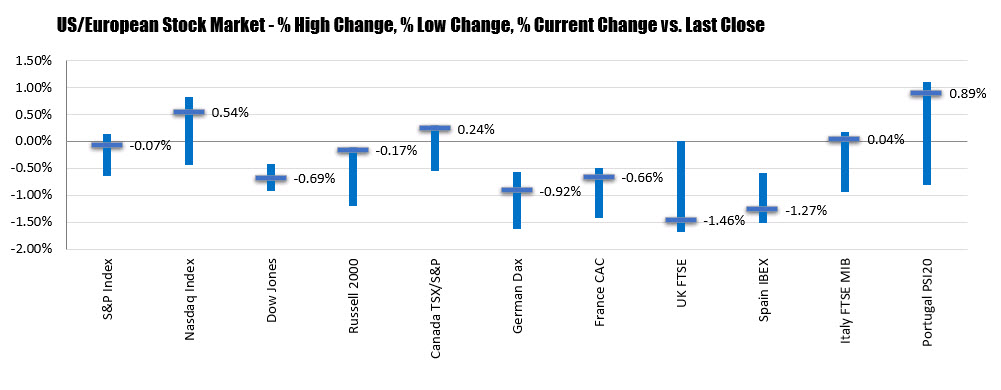

rssEuropean shares end the session mostly lower

UK FTSE 100 the weakest. Portugal’s PSI 20 strongest

The major European indices are ending the session mostly lower. The UK FTSE 100 was the weakest of the major indices. The Portuguese PSI 120 was the strongest. Italy’s FTSE MIB was unchanged.

- German DAX, -0.92%

- France’s CAC, -0.66%

- UK’s FTSE 100, -1.46%

- Spain’s Ibex, -1.27%

- Italy’s FTSE MIB unchanged

- Portugal’s PSI 120+0.89%

In the US market, the NASDAQ index remains higher. The S&P index did move into the black briefly, but the Dow industrial average remains negative on the day at -0.69%. The S&P index and NASDAQ index are on a 5 day winning streak.

In the US market, the NASDAQ index remains higher. The S&P index did move into the black briefly, but the Dow industrial average remains negative on the day at -0.69%. The S&P index and NASDAQ index are on a 5 day winning streak.

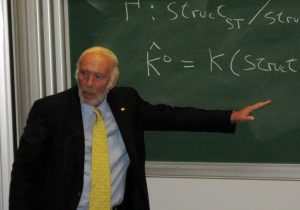

12 Top Jim Simons Trading Quotes

Jim Simons is a hedge fund manager and a mathematician. He is a quantitative investor and the founder of the hedge fund Renaissance Technologies. His hedge fun specializes in systematic trading using quantitative models derived from mathematical and statistical analyses. Mr. Simons primary models were on pattern recognition. He contributed to the development of string theory by providing a theoretical framework to combine geometry and topology with quantum field theory. Jim Simons was a mathematics professor from 1968 to 1978, and chair of the mathematics department at Stony Brook University. He founded his hedge fund in 1982. His net worth is currently estimated at $21.5 billion.

“Renaissance’s flagship Medallion fund, which is run mostly for fund employees, “Is famed for one of the best records in investing history, returning more than 35 percent annualized over a 20-year span”. From 1994 through mid-2014 it averaged a 71.8% annual return.Renaissance offers two portfolios to outside investors—Renaissance Institutional Equities Fund (RIEF) and Renaissance Institutional Diversified Alpha (RIDA).” via Wikipedia

Here are some of his top trading quotes that distill some of his wisdom:

“Past performance is the best predictor of success.” – Jim Simons

“There’s no such thing as the goose that lays the golden egg forever.” – Jim Simons

“In this business it’s easy to confuse luck with brains.” – Jim Simons

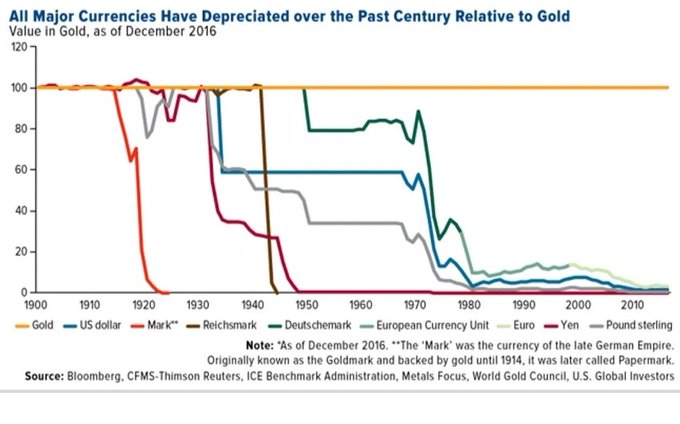

Gold rises to fresh 7-year high as it hits $1790

Gold breaks last week’s high

“Only gold is money, the rest is credit.” JP Morgan

“Approximately 90% of government bonds in developed markets have an annual yield of less than 1%.”

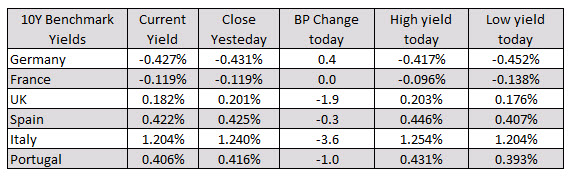

European Commission forecasts deeper slump amid ‘more pronounced’ economic divergences

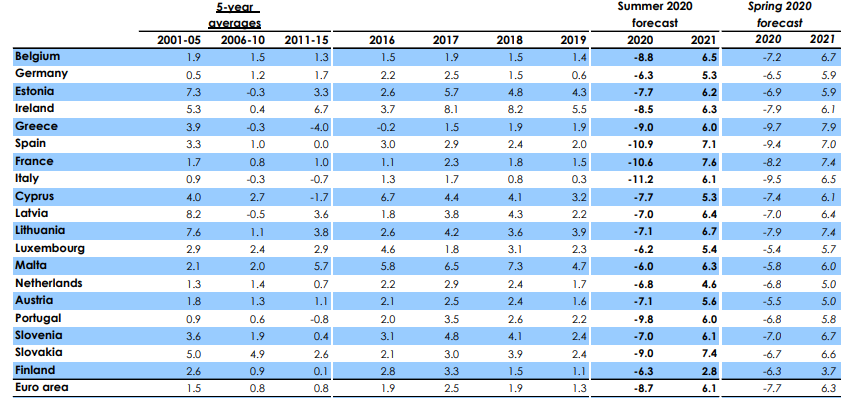

EU now sees 2020 GDP at -8.7% vs -7.7% back in the May forecast

- Euro area economy probably shrank by 13.5% in Q2

- Economic recovery will be uneven across member states

- There are ‘sever’ risks to the economic outlook, tilted to the downside

- Euro area economic divergences are ‘more pronounced’

- Spain, France, Italy economies likely to shrink by more than 10% in 2020

- German economy likely to shrink by 6.3% in 2020

That isn’t quite comforting news for the euro but make no mistake, this will start to present a problem for the region in the months/years ahead.

Iron Ore headed for downside?

Iron ore has negative factors now

Ifo says that German industrial firms expect production to rise in the coming months

Ifo remarks based on their latest production index in June

Full statement of the RBA July monetary policy decision

The full statement of the 7 July monetary policy decision by the RBA

At its meeting today, the Board decided to maintain the current policy settings, including the targets for the cash rate and the yield on 3-year Australian Government bonds of 25 basis points.

The global economy has experienced a severe downturn as countries seek to contain the coronavirus. Many people have lost their jobs and there has been a sharp rise in unemployment. Leading indicators have generally picked up recently, suggesting the worst of the global economic contraction has now passed. Despite this, the outlook remains uncertain and the recovery is expected to be bumpy and will depend upon containment of the coronavirus. Over the past month, infection rates have declined in many countries, but they are still very high and rising in others.

Globally, conditions in financial markets have improved. Volatility has declined and there have been large raisings of both debt and equity. The prices of many assets have risen substantially despite the high level of uncertainty about the economic outlook. Bond yields remain at historically low levels.

In Australia, the government bond markets are operating effectively and the yield on 3-year Australian Government Securities (AGS) is at the target of around 25 basis points. Given these developments, the Bank has not purchased government bonds for some time, with total purchases to date of around $50 billion. The Bank is prepared to scale-up its bond purchases again and will do whatever is necessary to ensure bond markets remain functional and to achieve the yield target for 3-year AGS. The yield target will remain in place until progress is being made towards the goals for full employment and inflation.

The Bank’s market operations are continuing to support a high level of liquidity in the Australian financial system. Authorised deposit-taking institutions are continuing to draw on the Term Funding Facility, with total drawings to date of around $15 billion. Further use of this facility is expected over coming months. (more…)