Archives of “July 6, 2020” day

rssIn 1921, the Weimar Republic was saddled with war debts

In 1921, the Weimar Republic was saddled with war debts that it could not afford, a problem exacerbated by printing money without any economic resources to back it A loaf of bread that cost around 160 Marks at the end of 1922 cost 200,000,000,000 Marks by late 1923!

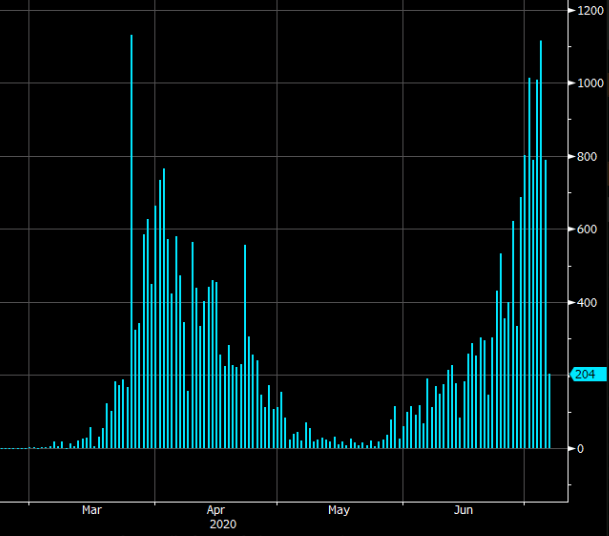

Israel to close bars, event halls and gyms immediately

Israel has had a complete backslide

That chart is a warning to every country that believes it has the virus contained.

Stock-market fever grips China

Wild move in Chinese stock markets

What to make of the nearly 14% rally in the Shanghai Composite in the past five days?

We’ve seen parabolic moves in individual stocks for months but this is a parabolic move in an entire index and it’s extreme even by Chinese standards.

This looks like a mania stoked by Chinese media cheerleading. State-owned Shanghai Securities News ran a story on Friday titled “Hahahahaha! The signs of a bull market are more and more clear.” The China Securities Journal also talked up the market.

The volumes have been massive on this upmove and many are pointing to 2014-2015 when state media cheerleading led to a spectacular rally in stocks.

Bloomberg data shows margin loans in China at the highest since 2015.

The ability of stock to rally everywhere despite the economic threats from the virus highlight the opportunity for a summer melt-up everywhere.

Total Outstanding Balance of Margin Transactions in China vs CSI300.

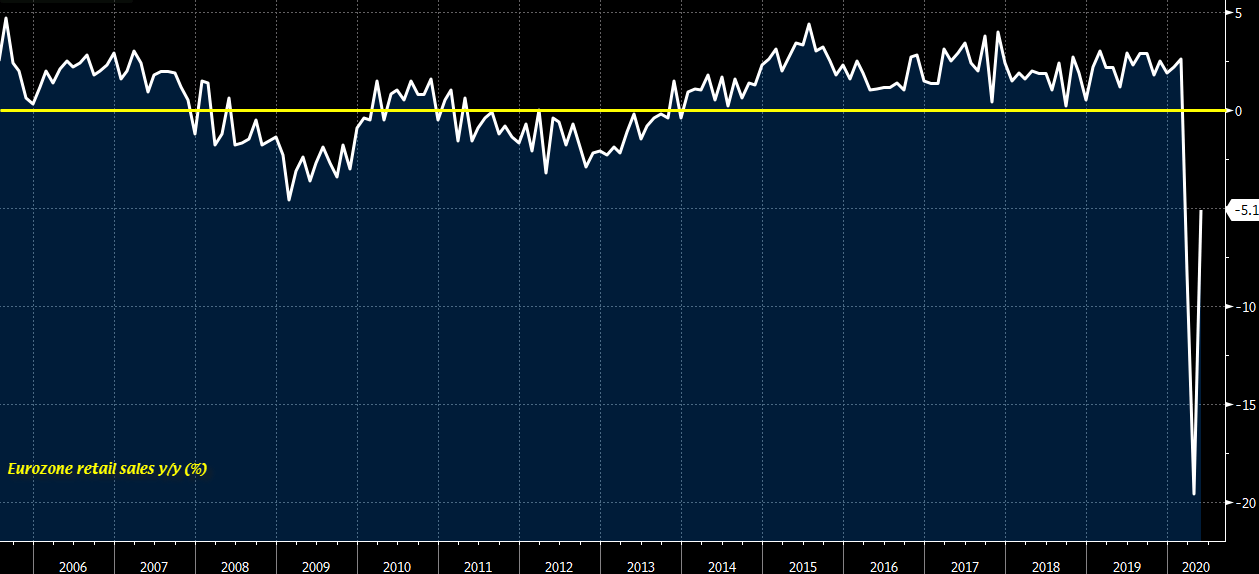

Eurozone May retail sales +17.8% vs +15.0% m/m expected

Latest data released by Eurostat – 6 July 2020

- Prior -11.7%; revised to -12.1%

- Retail sales -5.1% vs -6.5% y/y expected

- Prior -19.6%

Retail sales activity rebounded strongly in the euro area in May, as lockdown restrictions were eased in most countries. But relative to a year ago, retail sales is still seen lower by a little over 5% – I would argue that the bounce has a lot to do with pent-up demand.

The real challenge will be to see how retail sales and consumption activity fare in Q3, once the new normal conditions start to become a base for the economy.

That will be more telling about how actual economic conditions are faring in the region and how consumer demand is holding up as we move on from the crisis in general.

EUR/USD continues to stay underpinned at around 1.1280-90 levels, but is keeping just under the high last week around 1.1300 for the time being.

Eurozone July Sentix investor confidence -18.2 vs -10.4 expected

Latest data released by Sentix – 6 July 2020

- Prior -24.8

Investor confidence gets a mild boost relative to the June survey, but is staying more depressed than expected. If anything, this just reaffirms that there is still a lot of uncertainty still in the air and that any quick path to a recovery is fleeting by the day.

Oil traders thought Apple had the ‘holy grail’ of oil data.

Turns out they didn’t, via Reuters

Getting an edge in the markets is a constant pursuit of investors keen to be on the right side of trades as early as possible. A few weeks ago oil traders thought that they had found just such an edge from Apple and the way they could potentially monitor real time fuel demand.

Nearly three quarters of all oil consumption world wide is through vehicles movement. As a result the news that Apple could monitor real time fuel demand was particularly valuable. Especially so as traders had been looking for any clues on the speed of recovery post major COVID-19 lockdowns.

Apple’s tracking oil demand

The data from Apple came mid April when Apple revealed new data on human mobility trends. This captured user’s activity in looking for directions on smartphones.

However, it was not as effective as thought

The user’s data was found out to be ineffective in finding fuel demand. This was simply because user’s search data did not translate into actual activity. US Memorial Day normally starts the US summer driving season, but demand for oil fell for the week including the holiday by ~6% according to the US Energy Information Administration (EIA). The problem with the data is that it was based on search information rather than actual distance travelled. This makes sense as I often use my phone to find directions to place without ever intending to travel to them. Sometimes I might just want to search for the location of a business to see how far away it is in case of an order problem.

Other sources energy traders use

RBC analyst Michael Tran said currently, he finds TomTom more reliable than Apple searches. He attributes this in part because most people don’t use apps to map out their commute. RBC combines TomTom data with other geolocation data that is used in house for their research purpose.

Citi says no longer bearish on risk assets

From a Citi analysts client note – the bank has switched from bearish to neutral

Says markets seem to be less troubled about the rising number COVID-19 cases, due to:

- falling hospital and fatality trends

- better targeted economic restrictions

- medical breakthroughs are possible

Now look to buy dips in US equites (S&P500), look for higher ahead of earnings season

- USD bias probably now negative

- could be EUR/USD upside (Citi cite the EU recovery fund, less threat from the German court ruling on BUBA bond buying)

via Bloomberg

The China bull is stoking the risk-on mood in markets

Chinese state media is pushing the narrative that a bull market is here

China equities are trading well higher on the day so far, with both the CSI 300 and the Shanghai Composite posting gains of over 4% currently.

What is even more impressive is that trading volumes are surging, with daily turnover exceeding ¥1 trillion on Thursday and Friday last week – and likely to exceed that mark once again today. That represents a sign of surging risk appetite.

This comes on the back of news that China International Capital Corp. is forecasting the stock market to double in the next 5-10 years while the Securities Times’ said a “healthy” bull market is now more important to the economy than ever.

Frankly speaking, China trying to “guide” asset prices towards one direction isn’t anything new and any state media narrative is often a strong hint of what local authorities are willing to do in order to support said narrative to turn it into reality.

Of note, Bloomberg highlights that the number of mainland commentaries and retweets containing the term “bull market” over the weekend was more than 10 times the average that is seen over the past 90 days, according to the Baidu index.

That’s pretty much all investors need so long as state media and local authorities are also pushing the same narrative, reaffirming the technical breakouts since last week.

While China is continuing to signal that they have moved on from the coronavirus, the more bullish tone is feeding into risk-on sentiment across markets today. However, coronavirus developments elsewhere are less than ideal or convincing.

Sure, the sheer exuberance could override fears for a day or two but it won’t change the fact that we are still likely to see more pessimistic news over the next few weeks on virus developments elsewhere – especially the US – unless something changes.

It’ll be interesting to see how the market decides to interpret that version of reality when push comes to shove.

For today, look out for the S&P 500 as futures (up by over 1%) are pointing towards the cash market testing key daily resistance at 3,153 to 3,155 once again: