Asian stocks tumble amid the risk-off mood today

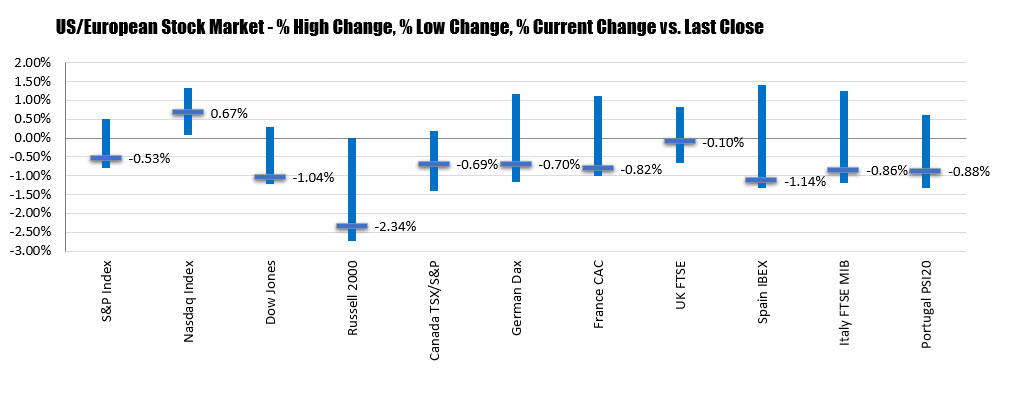

Risk is on the defensive following the Fed decision yesterday, with US futures down by over 1.8% currently and that is dragging the overall mood in the market today.

The Hang Seng is down by 1.7% while the Shanghai Composite is down by 0.6%, with the Kospi and STI also seeing losses of over 2% and 3% respectively on the session.

Meanwhile, bonds are rallying with 10-year Treasury yields dragged all the way down to 0.71% and the dollar is holding firmer across the board alongside the yen.

AUD/USD is seen down by over 1% to 0.6927 currently, retracing lower after resistance around 0.7000 and the December high at 0.7032 continues to hold.

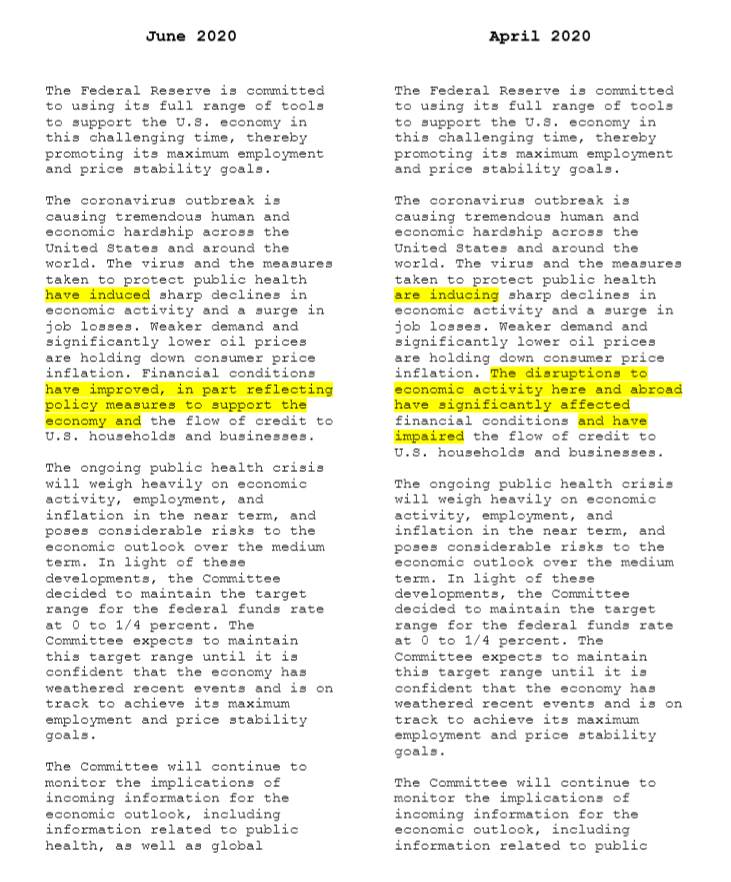

There’s chatter of the Fed serving a dire outlook to markets and fears of a second wave of infections in the US weighing on the risk mood here, but I’d argue it is more to do with the Fed not really goosing the market further despite not removing the punch bowl.