Archives of “June 2020” month

rssChina infrastructure investment over the next 5years expected to be $1.4 trillion

The Wall Street Journal totalling up the many projects underway and planned and coming up with the figure.

- Since the start of the year, municipal governments in Beijing, Shanghai and more than a dozen other localities have pledged 6.61 trillion yuan ($935 billion) to the cause, according to a Wall Street Journal tally.

- Chinese companies, urged on by authorities, are also putting up money.

- Under a plan outlined earlier this year by China’s Ministry of Industry and Information Technology, these efforts would contribute to at least $1.4 trillion in investments during the next five years in artificial intelligence, data centers, mobile communications and other projects.

Link for more (may be gated)

The next few months will be instructive on how well the country is recovering from the virus outbreak.

US is considering suspending H-1B visas through to October

his week BTW).

- US considering a proposal to suspend employment-based immigration visas, including the H-1B high-skilled visa

WSJ citing administration officials familiar with the talks

- proposed suspension could extend to the beginning of Oct.

Link here to the Journal for more (may be gated)

North Korea says the US is ‘hell-bent’ on exacerbating tensions

Someone appears to have rattled the North Korean cage, KCNA on comments from the NK foreign minister:

- says relations with the US have now shifted into despair

- US is hell-bent on exacerbating tensions

- US policy proves US remains long-term threat to our people

- NK says sees no improvement in relations to be made by maintaining relationship between Kim and Trump

- says will build up more reliable force to confront US military threats

I thought romcoms were supposed to have happy endings?

Major indices have worst day since March 16th.

Dow and S&P down for the 3rd day in a row

The major indices had there worst day since March 16 as concerns about the growth prospects and increases in coronavirus cases weigh on equities. Initial jobless claims should another 1.5 million increase which certainly did not help.

- The Dow is closing at the lowest level since May 27.

- The Dow and S&P are down for the 3rd day in a row

- all 30 of the Dow stocks close lower with Boeing the weakest at -16.42%

- worst day since March 16 for the major indices

- The NASDAQ index snapped it’s a 4 day win streak

- Dow and S&P on track for its worst week in 3 months

- S&P index closes below its 200 day moving average at 3013

- the Dow industrial average is within 300 points of a 10% decline from the high (24824 is the level)

- the Dow industrial average fell back below its 100 day moving average at 25123.55, but is closing just above that level at 25128.13

The final numbers are showing:

- S&P index -188.04 points or -5.89% up 3002.10. The low for the day reached 2999.49. The high was way up at 3123.53

- NASDAQ index fell -527.62 points or -5.27% to 9492.72. That was just above the low for the day at 9491.30. The high was up at 9868.02

- The Dow industrial average fell 1861.82 points or -6.9% to 25128.13. The low for the day reached 25082.72. The high was up at 26294.08

big losers today included:

- Boeing, -16.42%

- United Airlines, -16.09%

- Delta Air Lines, -14.01%

- Citigroup, -13.37%

- Schlumberger, -11.60%

- Southwest Airlines, -11.58%

- Marriott, -10.91%

- Fiat Chrysler, -10.10%

- Bank of America, -10.0%

- Ford Motor, -9.9%

- Wells Fargo, -9.83%

- PNC financial, -9.62%

- Goldman Sachs, -9.14%

- IBM, -9.12%

- J.P. Morgan, -8.37%

The pattern of airlines and financials are chief among the biggest decliners today.

The biggest gainer in the Dow 30 today was Walmart which only fell by -0.87%. Procter & Gamble was the next best performer with a -2.41% decline.

Were there any winners today?

- Zoom increase by 0.54%

Thought For A Day

European indices close lower once again

Major indices down for the 4th consecutive day

The European indices are closing lower once again with today’s declines accelerating the fall. The indices have been down each day this week after peaking on Monday but failing to extend higher. The provisional closes are showing:

- German DAX, -4.0%

- France’s CAC, -4.3%

- UK’s FTSE 100, -3.7%

- Spain’s Ibex, -5.2%

- Italy’s FTSE MIB, -4.3%

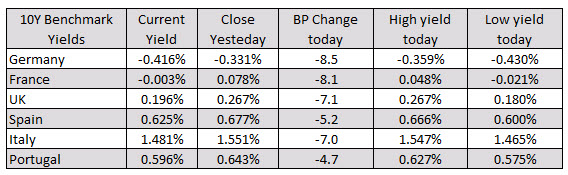

In the benchmark 10 year yields investors have been buyers across all countries today. The German 10 year note is down -8.5 basis points and is seen the most buying interest.

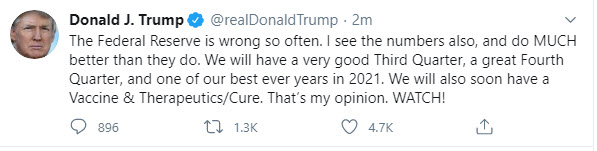

Pres. Trump blames the Fed? At the least, he is mentioning them.

Stocks are down so the blame game may be on (again)

It is the president back on the Fed’s case. He just came out with the tweet starting with “The Federal Reserve is wrong so often”.

I guess he came up a little short of blaming the Fed for the declines today, but you can only imagine what he may be thinking.

Anxiety about the upcoming election seems be hinging on the performance of the stock market. The S&P index erased all that’s declines for the year on Monday, but has moved down about -4.66% since the peak to the low today. It is currently down -4.43% YTD.. The NASDAQ index is still outperforming with a year to a gain of 9.10%. The Dow is back down -9% YTD after the fall over the last 3 trading days.

Regret is Worse Than Fear or Anger

- Fear doesn’t feel good nor does anger, but that feeling that you made a mistake — sometimes a very serious one — and there isn’t anything you can do about it, is worse. You are powerless to change the past, and feeling powerless leads to feeling depressed.

- Getting over regret is harder than recovering from other feelings. It tends to nag at us.. “if, only if”. You dream of being in the alternative situation and have to relive the reversion back to reality.

- Missing entries blasts the fear of regret-o-meter.

Powell delivered everything the market could have hoped for, but it wasn’t enough

Have we reached the limit?

Equity bulls couldn’t have scripted the FOMC any better yesterday. The pace of QE was higher than expected and this may have been the most-dovish phrase uttered in the history of central banking:

“We’re not thinking about raising rates, we’re not even thinking about thinking about raising rates.”

Couple that with a promise to act forcefully, aggressively and proactively and it’s never been more clear that the Fed put is in play.

Yet as the dust settles, S&P 500 futures are 2.6% lower.

The message may be that we’ve hit the limit of what monetary policy can do for risk assets. In a sense, that’s a relief because the market can go back to focusing on reality instead of cheap money. A narrative about a second wave is starting to take hold.

There’s an argument that Powell didn’t do enough, or that he was too sombre but I don’t buy that. Yield curve control wasn’t on the table for this meeting and numerous Fed members made that extraordinarily clear. Anything more optimistic would have been misinterpreted as a hint about taking away the punch bowl.

So now we watch and see how it all shakes out. This is an emotion-driven market; the only thing that’s working is technical analysis and risk management. The market could fall 7% today and it wouldn’t surprise me, nor would an epic buy-the-dip.

I think the name of the game today is to try to read the sentiment of the market. For weeks all we heard was skepticism and the market ate it up. Is there a lot of negativity now? I don’t see it. he first headline I saw this morning was this:

I mean, wouldn’t it be poetic if the COVID-bounce died in rush by Robinhood traders to buy bankrupt companies?

Does anyone really believe in this economy? Starbucks yesterday was sobering. Even in China where 99% of stores are open and COVID cases are nil, sales were down 14% in the final week of May.

That kind of news has been steamrolled by the market for 10 weeks but between that an Trump’s epic victory lap after the Friday jobs report, maybe we’ve hit the limit.