Archives of “June 16, 2020” day

rssFed’s Harker: Expects 2020 to show a sharp recession

Fed’s Harker speaking

- expects 2020 to show a sharp recession

- expects 2021 will be a growth year with GDP and employment picking up

- growth seen next year may not be enough to return economy to levels seen at beginning of this year

- some of the jobs lost because of Covid 19 crisis may never return

- the Fed is fully committed to building a culture of inclusion

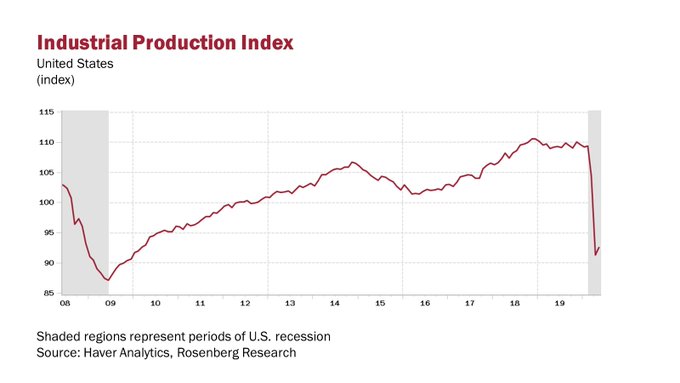

Here’s your recovery. Enjoy!

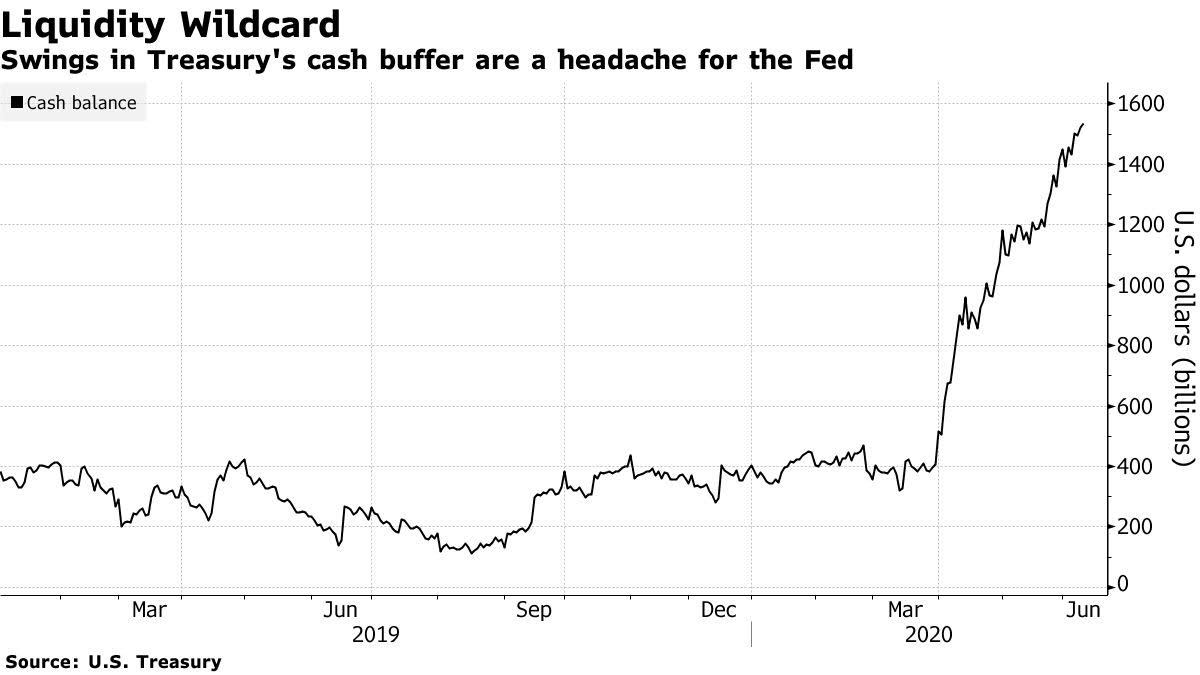

Treasury’s Record Cash Pile Is Jerome Powell’s $700 Billion Headache

The Chinese side suffered 43 casualties including dead and seriously injured.

Congress to be part of discussions

There’s nothing concrete on this coming until July but it’s an important narrative on the easy-money side. The over-under on the stimulus has been around $1 trillion for awhile.

Today’s report from Fox Business’ Charlie Gasparino says the White House is in ‘deep discussions’ about +$1 trillion in spending.

“Infrastructure likely part of bill. Other measures: State aid; liability protection; unemployment extension. Administration also pushing “return to work incentives,” he tweeted.

Obviously, the White House is only one party in the discussions. The trick will be getting the House and Senate on board. The above wish-list sounds awfully expensive.There’s talk that states alone need $1 trillion.

Major European shares close with solid gains

Gains of 3% for most of the major indices

The European stock market is closed and the major indices that maintain solid gains on the day. The provisional closes are showing:

- German DAX, +3.4%

- France’s CAC, +3.0%

- UK’s FTSE 100, +3.0%

- Spain’s Ibex, +3.0%

- Portugal’s PSI 20, +2.44%

- Italy’s FTSE MIB, +3.5%

The US indices maintain solid gains but well off there high levels as concerns about acceleration in Florida, China, Texas sent shares lower. However they are off session lows as well:

- S&P index +56.93 points or 1.86% at 3123.50. The low reached 3076.06. The high extended to 3153.45

- NASDAQ index +159 points or 1.63% at 9884.51. The low reached 9748.38. The high extended to 9963.63

- Dow industrial average +482 points or 1.87% at 26247. The low reached 25811.70. The low price extended to 26611.03.

WTI crude oil futures has been caught in the coronavirus fears and has dipped toward unchanged on the day. It currently trades at $37.28. That’s up $0.16. The low price reached $36.38 the high price extended to $39.36.

Four headlines hit at virtually the same time to undercut sentiment

Risk trades leg lower in a big way

Commodity currencies and stocks were caught in a quick downdraft after at least four headlines hit at virtually the same time:

- Florida virus cases spike

- Beijing moved to phase-2 containment on the latest virus outbreak, closing schools

- Texas virus hospitalizations rose 8.3% to hit a record

- Powell indicated that corporate bond buying probably won’t be aggressive and is more of a contingency

The S&P 500 is up just 0.45% after rising nearly 3% at the open.

Trump rant about Powell incoming…

US dollar rises as flows head out of currencies

Flows into the safety of the US dollar

As China reacts to increases in coronavirus cases in Beijing and Florida spooked the market with a surge in their cases, the flow funds into the forex market has been into the US dollar.

EURUSD: The EURUSD it is looking to test the lows from yesterday at the 1.12256 level. Below that the Friday low at 1.12119 would be eyed. The price fell below a trendline at 1.1260 level.

GBPUSD: The GBPUSD cracked below its 200 hour and 100 hour moving averages at 1.26455 and 1.26175 respectively. The price low just reached 1.2641. The 100 day moving average is down at 1.25274 today. Yesterday on Friday the price traded above and below that level but based at the 100 day moving average and ran higher in the afternoon New York session yesterday. There should be support on the 1st test should the price continue to move lower from here.

USDCHF. The USDCHF has moved up to test its 100 hour moving average at 0.95168. We currently trade at 0.95119. A move above the 200 day moving average should solicit more upside momentum.

Powell set to speak to Congress

Powell will deliver part 1 of Humphrey Hawkins in the Senate

The Fed tends to be a punching bag when the economy is in bad shape or when they try something new. If I were a politician, I would certainly be trying to score points on a central bank buying junk bonds and calling a program delivering loans up to $300m as ‘Main Street’ lending.

But I don’t think the market cares. Powell has all the canned answers ready, saying that inflation is low and that the aim is to lower employment.

The criticism of the Fed chair last week was that he was too downcast. Perhaps he will try to correct that but I don’t think it’s warranted. The most-important thing for the market is that he reiterates that the FOMC will “act forcefully, proactively and aggressively.” I don’t see that changing.

One area that is a bit of a minefield is unwinding all the March programs. For instance, the stated goal of the corporate bond buying program is to restore market functioning and it’s set to expire in September. They’ve already achieved the goal — spreads are narrow. Will he start to move the goalposts?

The headlines will be out at the top of the hour and the Q&A will start 20-30 mins later.

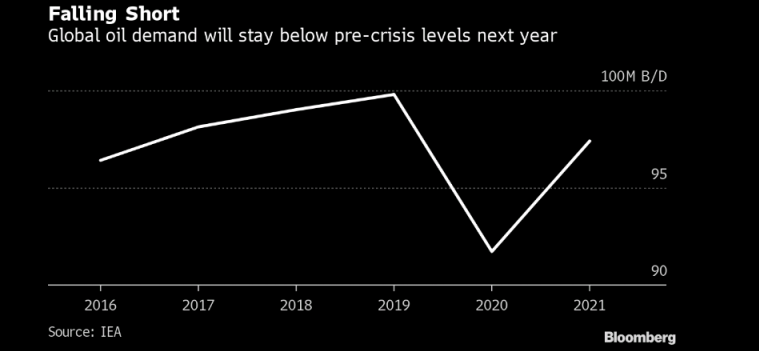

IEA says oil demand won’t fully recover until at least 2022

IEA comments on the oil market in its latest report

- Floating storage of crude oil in May fell by 6.4 mil barrels m/m to 165.8 mil barrels

- Global oil supply fell by 11.8 mil bpd in May

- Helped by OPEC+ countries reducing output by 9.4 mil bpd

- Sees oil demand next year to rise by 5.7 mil bpd, but still lower than in 2019

- Oil demand next year to remain 2.4 mil bpd below 2019 levels

On OPEC+, IEA says that they made a “strong start” and delivered 89% of its pledge to cut output but warns that rising prices could pose a problem:

“The market may present producers with an opportunity to ramp up more quickly than dictated by current OPEC+ policy, or US and other non-OPEC production could recover more strongly than forecast.”

With oil prices having moved up back close to $40, nobody – even US shale drillers – will want to miss out on the party.