Archives of “June 14, 2020” day

rssBig Week Ahead

Two G7 central banks meet and at least half a dozen emerging market central banks. There is a European Summit and perhaps a political effort to reinvigorate the UK-EU trade talks, which seem to be crashing on the shoals of stubbornness. The ECB offers its most generous long-term targeted loan that is bound to see earlier loans rolled into this new one. Further evidence that the world’s largest economy has taken a baby step toward recovery.

Let’s unpack next week’s events. But first, note that the events will take place as the recovery in risk assets appears to have come to an end with a flourish last week. That correction, which seemed overdue, appears to have more room to run. Also, the Covid virus continues to spread globally, and businesses, investors, and policymakers are sensitive to the so-called second-wave as countries and states re-open. Below are thumbnail sketches of the events and data that shape the macro picture.

- EU Summit: The European Council (heads of state) hold a virtual meeting on June 18 to ostensibly discuss the EU’s May 27 Recovery Fund proposal. Some have heralded the proposal as a key turning point in the evolution of Europe, and the possibility of a so-called Hamiltonian moment, a major set toward fiscal union, has been suggested. We have been less sanguine; recognizing the potential scaffolding for a greater union, but also that projecting emergency actions into the future is fraught with danger. Austria and Denmark, which have pushed back against grants instead of loans, could be won over by assurances that their rebates will remain intact. Others, including Eastern and Central European members, may be more difficult to persuade. Although expectations are running high, we suspect an agreement will remain elusive, in which case another try will be at the July summit, which, with a little luck, could be in person. Disappointment could weigh on the euro.

Crucial Technical Update : WTI & BRENT -Anirudh Sethi

To read more enter password and Unlock more engaging content

An Update :GOLD ,SILVER ,PALLADIUM ,PLATINUM ,BASE METALS : Anirudh Sethi

To read more enter password and Unlock more engaging content

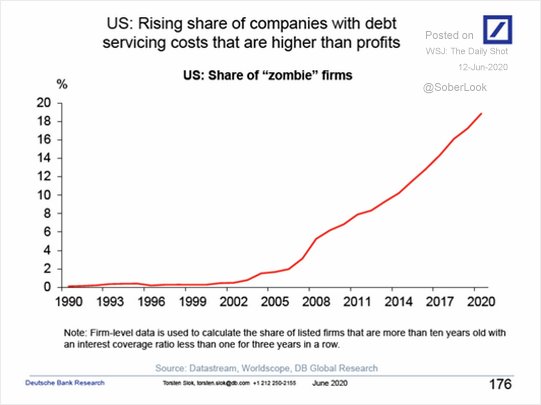

The share of US companies whose debt service costs exceed profits continues to rise #ZombieFirms

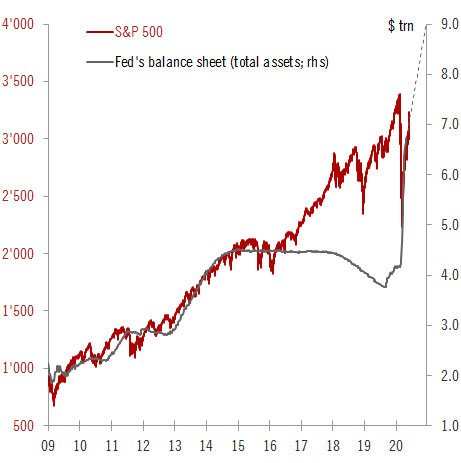

At this rate, it appears that the S&P 500 has little choice but to keep climbing.

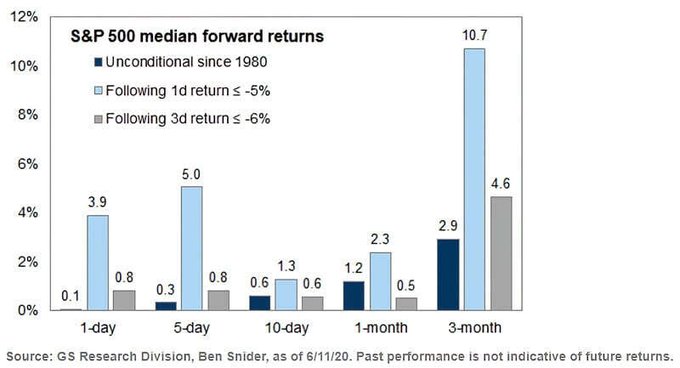

Big falls are usually accompanied by big climbs.

Rise in US coronavirus cases could unnerve markets at the open, but there are caveats

Big focus on a second US wave

The market has turned its focus away from the reopening story and back to the virus; and the risk that even with the economy reopened, no one is going to show up.

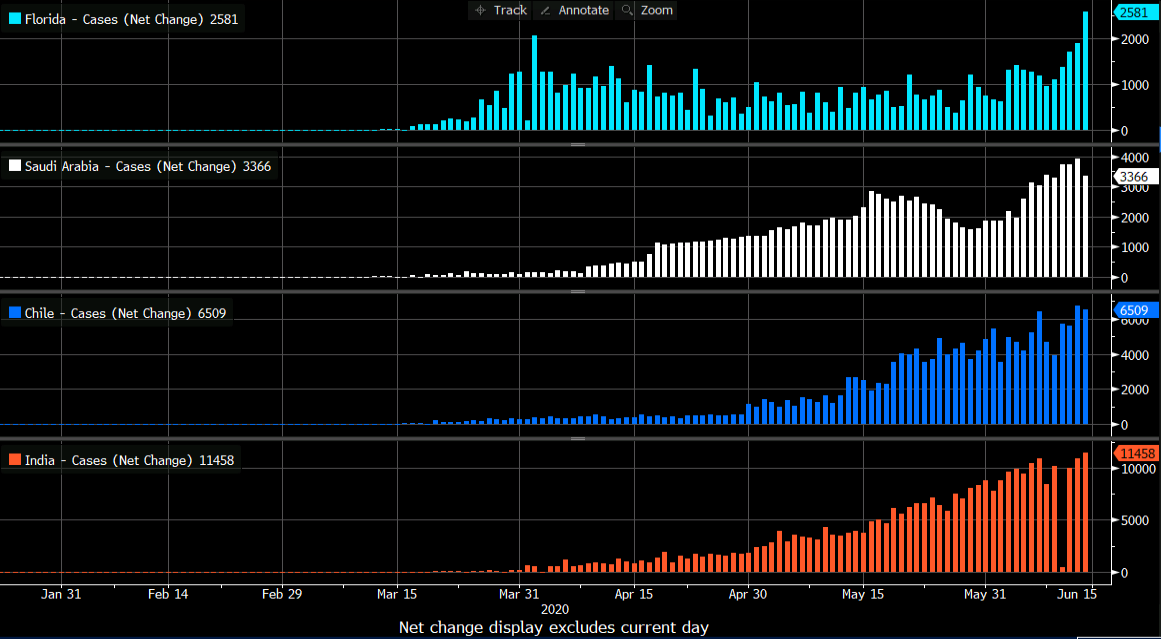

The main theme at the moment is rising cases in a number of US states, along with growing cases in Latin America and India.

The US is a complicated picture. New York has drastically curtailed cases, which rose just 0.2% yesterday.

The fear is that numbers continue to climb elsewhere. Yesterday, total US cases rose 1.4%, which was the biggest jump so far in June. There are a handful of states showing an acceleration. Here’s a short list, with the % increase in cases yesterday:

- California +2.3%

- Texas +2.3%

- Florida +3.6%

- Louisiana +2.9%

- North Carolina +3.4%

- South Carolina +4.6%

- Arizona +4.9%

Those are some of the most-populous states in the country but there are some important things to keep in mind. Florida, for instance, has 73.5K cases total, which is a fraction of the 382K in New York.

The weekend headline that got the most attention was the jump in Florida cases to 2581 from the previous day (also a record) of 1902. That looks like a dangerous escalation but Florida Governor Ron DeSantis has downplayed the rising totals, saying it reflected increased testing, isolated outbreaks in long-term care facilities along with more testing at prisons and among migrant farm workers.

Other virus news:

- Iran on Saturday also reported 107 new deaths, which was its highest in two months.

- Beijing locked down part of the city due to an outbreak

- Saudi Arabia reported 4233 cases on Sunday, a record high

- Tokyo reported 47 cases, the most since May 5. About half were traced back to nightclubs

- Globally, the WHO reported 142,672 new cases Saturday, a record

- UK stores are set to reopen on Monday

Overall, the virus theme is beginning to overwhelm the easy-money theme and fear is starting to creep back into markets. The bounce late on Friday was constructive but I expect we will start the week with a negative tone.

A technical look at the major currency pairs heading into the new trading week

What are the technical’s saying for the major currencies.

EURUSD: The EURUSD extended the week’s trading range in the NY afternoon (taking out the low from Tuesday at 1.12402. The break took the price to the 38.2% of the move up from the May 25 low. That level comes in at 1.12105.

The high for the week reached 1.1421.

The price decline on Thursday and Friday, took the price back below the 100 hour MA at 1.1325 and the 200 hour MA at 1.12927. Into the new trading week, staying below each of those levels would keep the sellers in play.

What is in the favor of the buyers is that the correction this week could only get to the 38.2% retracement. That is just a plain vanilla correction. It will take a move below that level to give sellers more confidence and more control.

USDJPY: The USDJPY trended to the downside with the high for the week on Monday, and the double bottom low yesterday and today (today was a pip higher but close enough).

(more…)“Master traders consistently stretch beyond their comfort zone…”