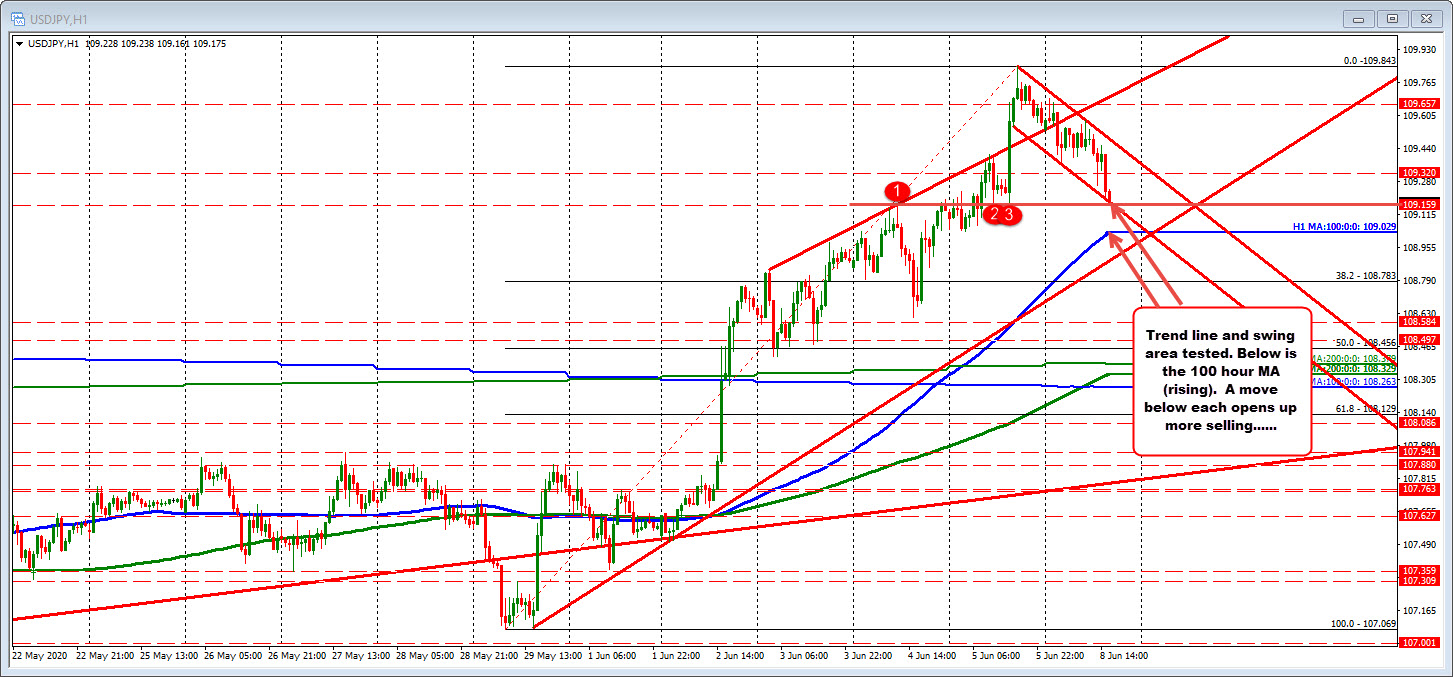

Rising 100 hour MA at 109.029.

The USDJPY has corrected toward a lower trend line at 109.157 area. Just below that, a swing high from Thursday and swing lows from Friday at 109.159. Below that is the rising 100 hour MA at 109.029. The price has not been below the 100 hour MA since June 2.

The price last week moved steadily higher (stocks and yields moved higher helping to support the pair) with an acceleration on Friday above a topside trend line to the high at 109.843. However, momentum stalled (could not be sustained), and the price action today took the price back below the topside trend line (and has stayed below today). Now the pair is testing a lower support target.

Do the buyers come in, or does the probe lower continue with a retest of the 100 hour MA. That is the intraday question now as price trades at lows.