This was written in 1880 – Speculation As A Fine Art by Dickson G. Watts. (Take print out and keep on Desk )

Moody’s Investors Service (“Moody’s”) has today downgraded the Government of India’s foreign-currency and local-currency long-term issuer ratings to Baa3 from Baa2. Moody’s has also downgraded India’s local-currency senior unsecured rating to Baa3 from Baa2, and its short-term local-currency rating to P-3 from P-2. The outlook remains negative.

The decision to downgrade India’s ratings reflects Moody’s view that the country’s policymaking institutions will be challenged in enacting and implementing policies which effectively mitigate the risks of a sustained period of relatively low growth, significant further deterioration in the general government fiscal position and stress in the financial sector.

The negative outlook reflects dominant, mutually-reinforcing, downside risks from deeper stresses in the economy and financial system that could lead to a more severe and prolonged erosion in fiscal strength than Moody’s currently projects.

Moody’s also lowered India’s long-term foreign-currency bond and bank deposit ceilings to Baa2 and Baa3, from Baa1 and Baa2, respectively. The short-term foreign-currency bond ceiling remains unchanged at Prime-2, and the short-term foreign-currency bank deposit ceiling was lowered to Prime-3 from Prime-2. The long-term local currency bond and bank deposit ceilings were lowered to A2 from A1.

A full list of affected ratings is provided towards the end of this press release.

RATINGS RATIONALE

RATIONALE FOR THE RATING DOWNGRADE TO Baa3

POLICYMAKERS WILL BE CHALLENGED TO MITIGATE RISKS OF BROAD EROSION IN INDIA’s CREDIT PROFILE (more…)

Top Trader Frustrations

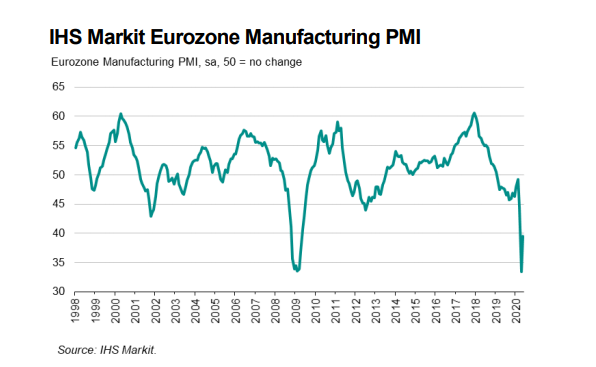

“The manufacturing downturn looks to have bottomed-out in April, with production falling at a markedly slower rate in May. The improvement in part merely reflects the comparison against a shockingly steep fall in April, but more encouragingly was also linked to companies restarting work as virus lockdowns were eased. The further lifting of COVID-19 restrictions in coming months should provide a further boost to manufacturers.

“While we are still set to see unprecedented falls in industrial production and GDP in the second quarter, the survey brings hope that the goodsproducing sector may at least see some stabilisation – and even potentially a return to growth – in the third quarter.

“Whether growth can achieve any serious momentum remains highly uncertain, however, as demand – both domestically and in export markets – looks set to remain subdued by social distancing measures, high unemployment and falling corporate profits for some time to come.

“Headcounts continue to be cut at a rate not seen since the height of the global financial crisis in 2009 as firms scale-back capacity in line with weak demand. Prices charged for goods are meanwhile also still falling at a pace not exceeded over the past decade as manufacturers offer discounts to help clear warehouses of unsold stock. The labour market and profits could therefore deteriorate further in coming months, holding any recovery in check.“