- China’s parliament is expected to pass a new security law givng central authorities more control over HK

- teison in Hong Kong remain elevated, weekend protests

- China reassured judiciary independence will remain

- In other recent US-China development:

- The US blacklisted dozens of Chinese firms

- China has accused the US of stirring new cold war starins

- China warned the US on Taiwan also

Archives of “May 2020” month

rssNZD “remains at the mercy of global risk sentiment near term”

An updated NZD view from Westpac, they nail it with that headline comments.

- Remains at the mercy of global risk sentiment near term

- potential for gains to 0.6400 during the next few weeks

- Further out, though, economic data releases over the next few months will be dire, potentially denting sentiment further. There’s potential to revisit 0.5900 during the next few months.

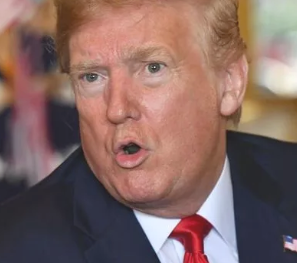

Trump vague about potential sanctions on China, says will have more by end of the week

US President Trump was asked about potential sanction on China over Hong Kong.

- Says doing something about it but did not provide detail

- says will hear more about US sanctions on China by the end of the week

- Trump and Pompeo meeting to discuss sanctions on Chinese officials

An Oil ICYMI – Russia, oil majors discuss extending the crude output cut further

Overnight oil news with a report that Russia’s Energy Minister Alexander Novak met with domestic major oil companies on Tuesday

- Discussions centred on implementing oil production curbs

- possible extension of the current level of cuts beyond June

- Russian President Putin has ordered bail out measures for Russia’s oil industry

Thought For A Day

Testosterone and Cortisol in Trading for Traders – Anirudh Sethi

Books and films often dramatize financial-market traders as macho gamblers. Now there may be scientific evidence to back up differently as two researchers have linked testosterone levels to the success of traders in one London market while another researcher has linked testosterone and cortisol able to increase financial risk and may destabilize markets.

According to researchers stressful and competitive working environments could be increasing hormone levels and having an impact on decision-making. Experts agreed it was important to know how hormones affected traders.

Both cortisol and testosterone occur naturally in the body. The levels of cortisol do increase when we experience psychological or physical stress. This causes the blood sugar levels to rise and prepares the body for a “fight or flight” response.

The hormones testosterone and cortisol may reflect different stress triggers.

Changes in hormone levels may affect success in the financial markets.

As soon as we sense danger, our body will release adrenaline and cortisol. The adrenaline increases our blood pressure and heart rate and boosts our energy supplies, whereas cortisol has a different job.

Cortisol is also known as the stress hormone. It is a steroid hormone made in the cortex of the adrenal glands, which is released into the blood and transported all over the body. This release in our body leads to our senses being heightened and our heart rate rising. It primes us for our ‘fight or flight’ state to help us survive and get away from danger.

Cortisol is very good for the body in terms of the benefits it provides, unless you have too much of it. Our body is set to react to danger, release cortisol and adrenaline, before calming down once the danger is gone. But, if you are constantly in a state of stress, the cortisol is going to

stay being produced in your body and that’s when it can cause problems.

Nearly every cell has receptors for cortisol and this can cause different reactions taking place. When our body is preparing for fight or flight, there are functions that aren’t needed at that point in time, which means other important systems shut down. Our immune system, digestive system and reproductive system all start to shut down. These reactions are great if you’re just needing that fight or flight mode to escape a predator, but not so good if you spend all day being stressed-out about your trades.

One other issue is that you will be more susceptible to getting ill, while your immune system is

down. It goes without saying that if you’re recovering in bed, you’re not going to be trading (more…)

Psychology in branding

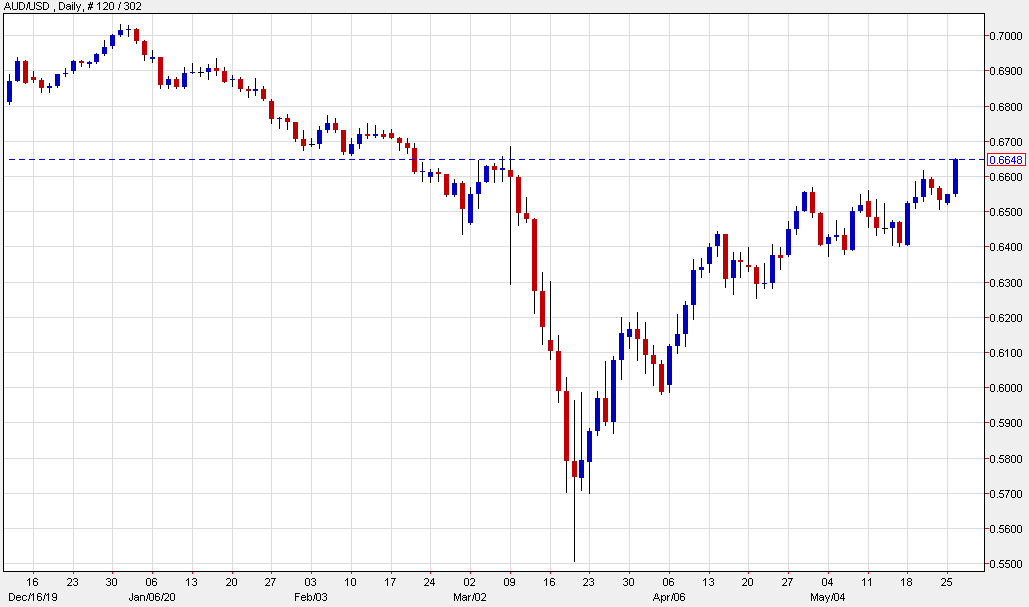

The #AUD has completed the coronavirus comeback

AUD/USD is back to where it was in mid-February

China needs food >>China’s #pork imports in April jump 170% to record high

Global Economic Policy Uncertainty Index (April)