Former German finance minister, Wolfgang Schaeuble, comments

- It is very possible the existence of the euro is now put into question

- Because every national constitutional court can decide for itself

- The situation makes nobody happy

- It is difficult if the German court cannot accept the ECJ decision

- But it is also not easy to refute the German decision

The German constitutional court ruling earlier this week is sort of like the first shot being fired in this declaration of war. If the narrative starts to grow from here, it could mean serious issues and complications being posed to the whole idea of the euro itself.

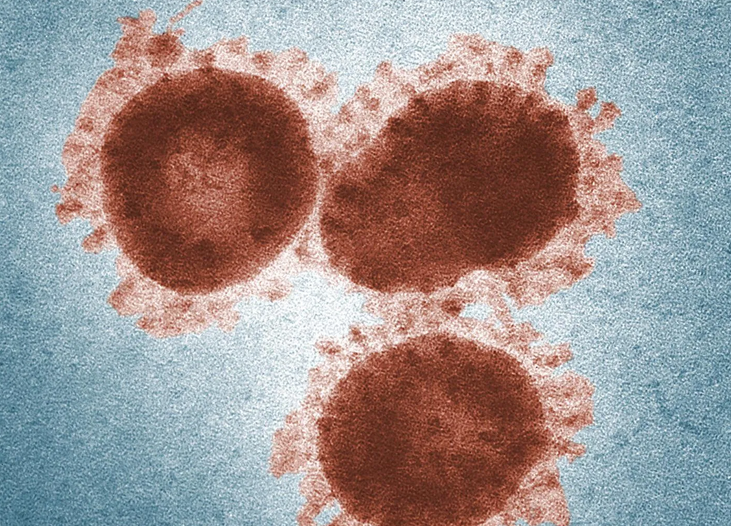

The whole of Europe is certainly getting very frustrated right now as the coronavirus crisis has certainly stretched relations within the bloc to very fine margins at the moment.

This is going to be a key risk factor to consider for the single currency in the bigger picture as we continue to navigate through these testing times.