Major indices close near session highs

The major US stock indices are ending the day with positive gains for the 1st time in 3 weeks. The major indices are also closing near session highs for the day.

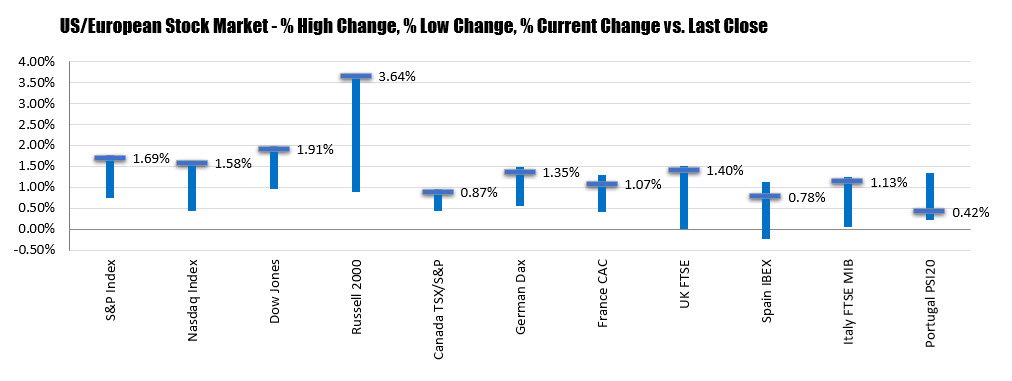

The gains today were led by the small-cap Russell 2000 index. That index rose by 3.64%, far outpacing the next largest gain from the Dow industrial average (up 1.91%). The Russell 2000 index of small-cap stocks has been hit particular hard this year and still is lower by around -20% on the year.

The final numbers for the major indices are showing:

- The S&P index +48.61 points or 1.69% at 2929.80. The high price reached 2932.61. The low reached 2902.88

- The NASDAQ index close up 141.65 points or 1.58% and 9121.32. It’s high price reached 9125.98, while the low was at 9018.21. The NASDAQ index erased all declines this weekend is closing up on the year for the 1st time since March 4.

- The Dow industrial average rose by 455.43 points or 1.91% at 24331.32. The high price reached 24349.90. The low extended to 24107.05.

For the trading week, the major indices all closed higher led by the NASDAQ index:

- S&P index rose by 3.5%

- NASDAQ index rose by an even 6.0%

- Dow industrial average rose by 2.56%

As mentioned, the NASDAQ index closed in the black since the 1st time since early March. The NASDAQ index was down some -26% from the end of year level at the year lows in April.The S&P index and Dow industrial average are still lagging will behind the gains from the NASDAQ.

The year to date percentage changes currently shows:

- S&P index -9.32%

- NASDAQ index +1.66%

- Dow industrial average -14.74%

As mentioned the Russell 2000 index of small-cap stocks was the largest percentage gainer for the day. For the week the Russell 2000 rose by 5.41%, and for the year the index it is still lower by -20.36%.