That’s a little higher than expectations

White House economic advisor Hassett is on FOXNews saying:

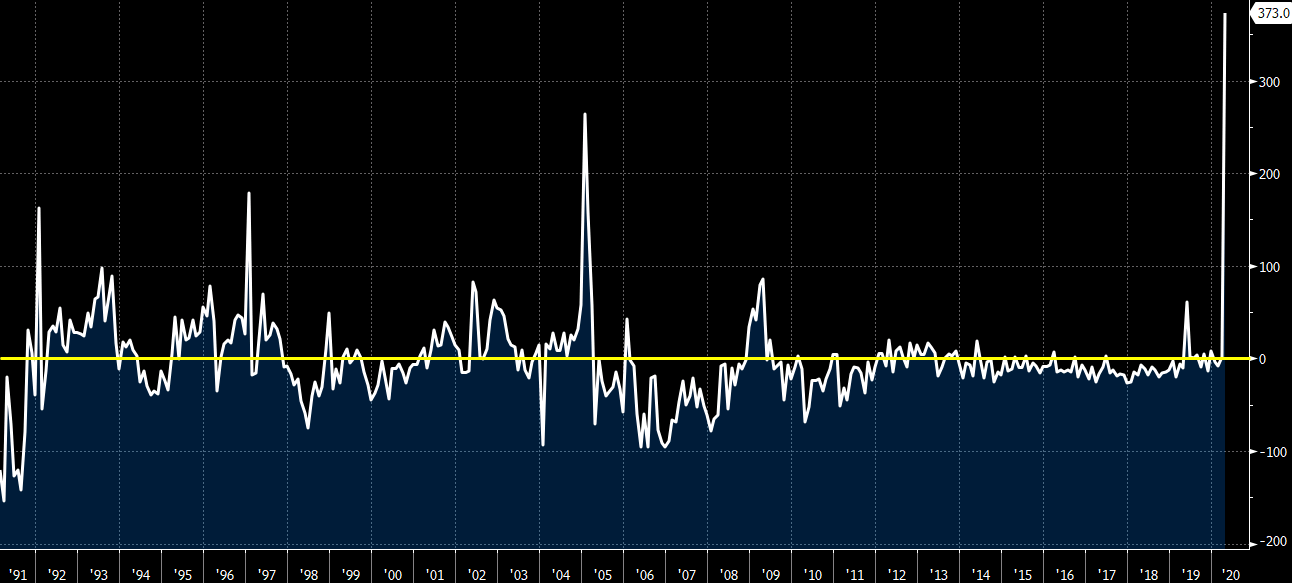

- expects April jobs report to show unemployment rate at around 19%

- economy could potentially be turned right back on if coronavirus is under control soon

- White House it should have better ideas soon if more stimulus for economy needed

The 19% level is a bit high compared to market expectations. The meeting estimate as per Bloomberg is 16.3%. The average is 15.12% with a high estimate of 22%.

Does he know something or is he sandbagging hoping that the number is better, or does he not know.