Archives of “April 23, 2020” day

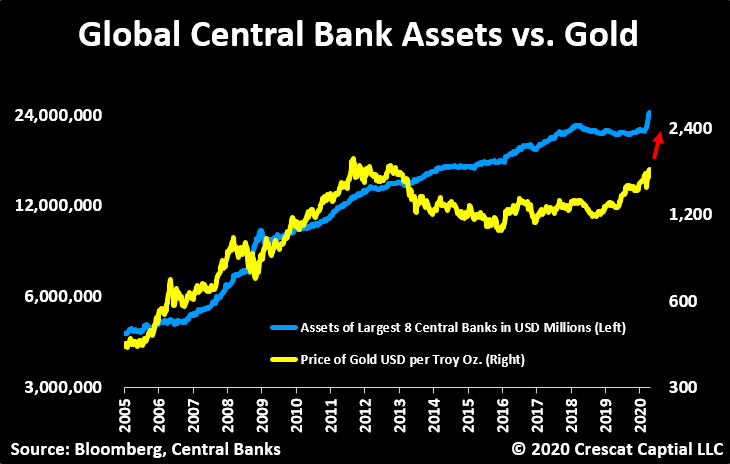

rssWho says you can’t value gold?

Money printing only supports asset bubbles for so long. Ultimately, QE drives flows out of overvalued stocks and credit and into the precious metals. It’s still early in the game.

Gildead drug Remdesivir flops in first trial – report

Stocks fall on the report

A potential antiviral drug for the coronavirus has flopped in its first randomised clinical trial, disappointing scientists and investors who had high hopes for remdesivir, according to draft documents published accidentally by the World Health Organization and seen by the Financial Times.The Chinese trial showed remdesivir – developed by California-based Gilead Sciences – did not improve patients’ condition or reduce the pathogen’s presence in the bloodstream. Researchers studied 237 patients, giving the drug to 158 and comparing their progress with the remaining 79.

The BOJ has announced unlimited QE at this level.

Net worth of the richest American since 1982.

Oil production and consumption in the world.

Merkel said to tell EU leaders virus response must be ‘huge’

German fiscal restraint is dead

Armageddon in the oil market reportedly cost Bank of China customers $85 million

A painful lesson for retail investors

The outrage against the Bank of China has been a trending topic on social media this week, as thousands of retail investors saw their life savings vanquished in betting on the oil market via the bank’s wealth management products.

Swiss government now sees 2020 GDP down 6.7% compared to -1.5% previously

Swiss government out with new forecasts

- Sees 2020 jobless rate at 3.9% and 2021 at 4.1%

- Sees economy rebounding 5.2% in 2021 vs -3.3% previously

- Sees ‘significantly greater risk’ of pressure on the franc

Forecasting is a fool’s game right now. There was hardly an economist in the world that was remotely close to the PMI numbers in Europe that were just released. That said, there’s this strong consensus among economists about big bounces in 2021 and a strong consensus from scientists that COVID-19 isn’t going away next year. That’s tough to square.

Japan government offers bleakest view of the economy since the global financial crisis

Japan downgrades its economic assessment for a second straight month

The government says that “the economy is worsening rapidly and is under an extremely severe situation due to the coronavirus”, adding that “economic conditions will likely remain extremely severe”; essentially its bleakest outlook since May 2009.