The latest numbers are up

If you’re new to oil, there are delivery points for crude all over the world and in the US. They often trade on spreads to WTI but those can vary and disconnect.

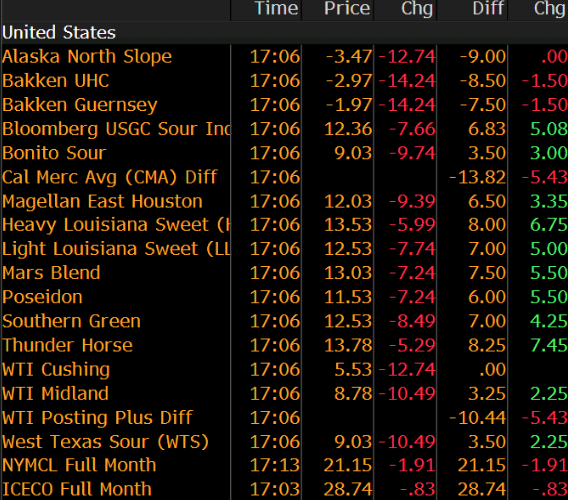

These were updated a few minutes ago:

- Alaska north slope -$3.47/barrel

- Bakken UHC -$2.97/barrel

- Bakken Guernsey -$1.97/barrel

The high in the continent is Heavy Louisiana Sweet at $13.53, down $7.74 today.

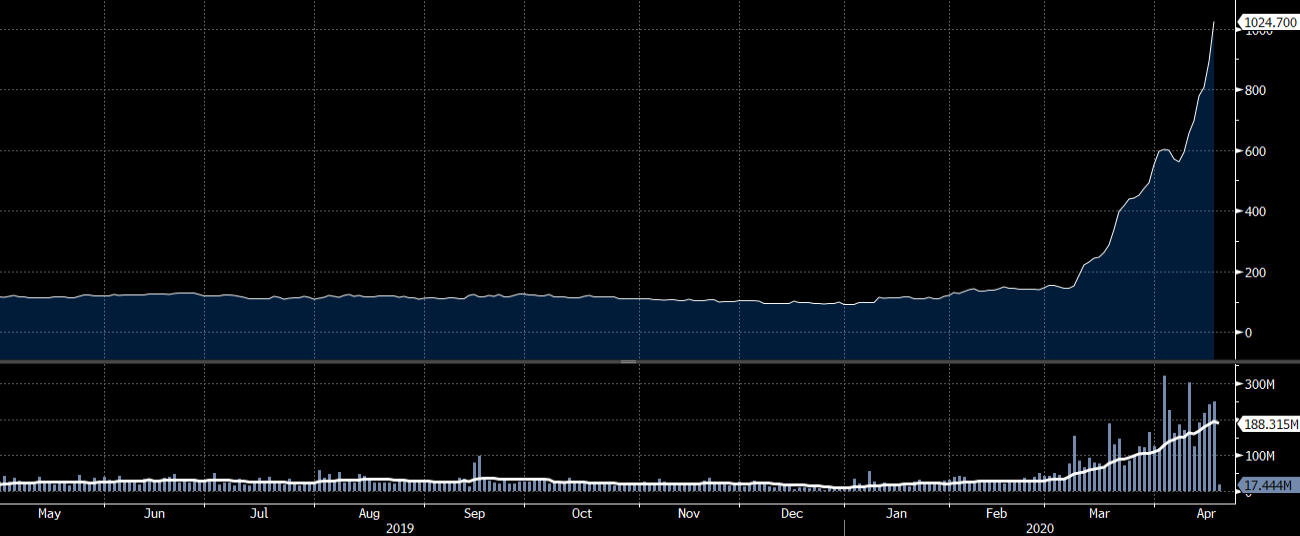

On March 17 with oil at $28 I wrote: There is a very real possibility that oil goes to zero …they were laughing then.