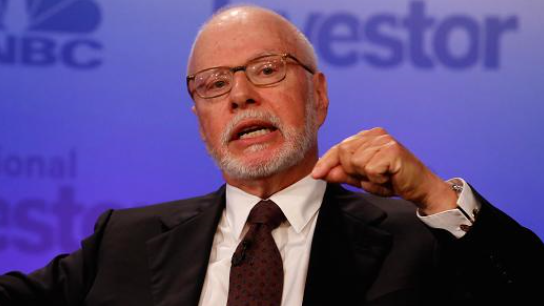

Paul Singer’s fund sends bearish letter

Vulture fund manager Paul Singer’s Elliott Management sent a letter to clients yesterday saying stocks could ultimately fall 50% from Feb levels. That would target 1700 in the S&P 500.

Singer is a legendary distressed debt manager and extremely combative market participant. He’s also been wildly successful, including winning a lawsuit against Argentina’s government on defaulted debt. His firm manages $40 billion.

“Our gut tells us that a 50% or deeper decline from the February top might be the ultimate path of global stock markets,” the letter said.

That said, they have bought some “shining bargains” in bonds and stocks.