A closer look at the companies developing vaccines to combat COVID-19

According to many experts in the healthcare sphere, the spreading of COVID-19 over the world has not reached its peak, and we do not have a vaccine against this disease yet.

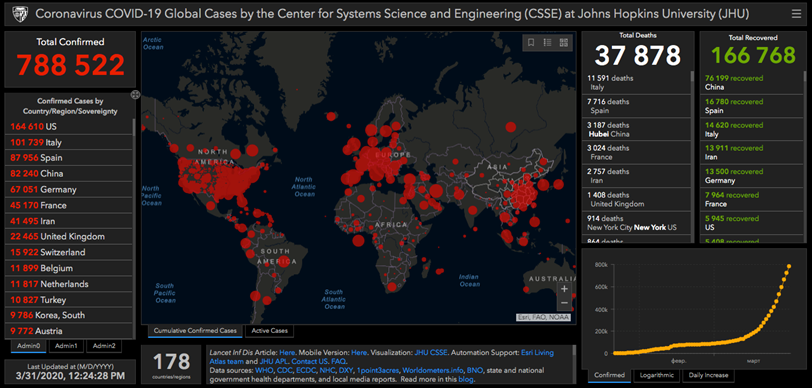

Currently, the first place in terms of the number of diseased among countries is taken by the USA. China, though it was the source of the infection, has managed to stop its spreading, so now it occupies the third place in terms of the number of the sick.

Note that stopping the spreading of the virus is not the same as learning to cure people of it. There is no vaccine yet, and now it is very important to mark time until we get the vaccine. Hence, quarantine is the only way of fighting the virus.

Pharmaceutical companies have long started inventing a vaccine against the enemy; however, before it gets to the market, it has to pass all the stages of trials. As long as the WHO has announced a pandemics, the number of the stages is decreased.

For example, in normal conditions, pre-clinical testing (when the drug is tested on animals) takes 1 to 2 years, but in the present circumstances, this stage takes 1-2 months. The permission to sell the drug usually takes 4 years to receive, but this time the company may only need 4 months to get it.

In this article, we will discuss what companies are closer to the final stage of testing than others. The stocks of such companies will attract the most vivid attention of investors because the demand for the vaccine will exceed its production power, which means the company will make a maximum profit selling it.

Testing drugs (more…)

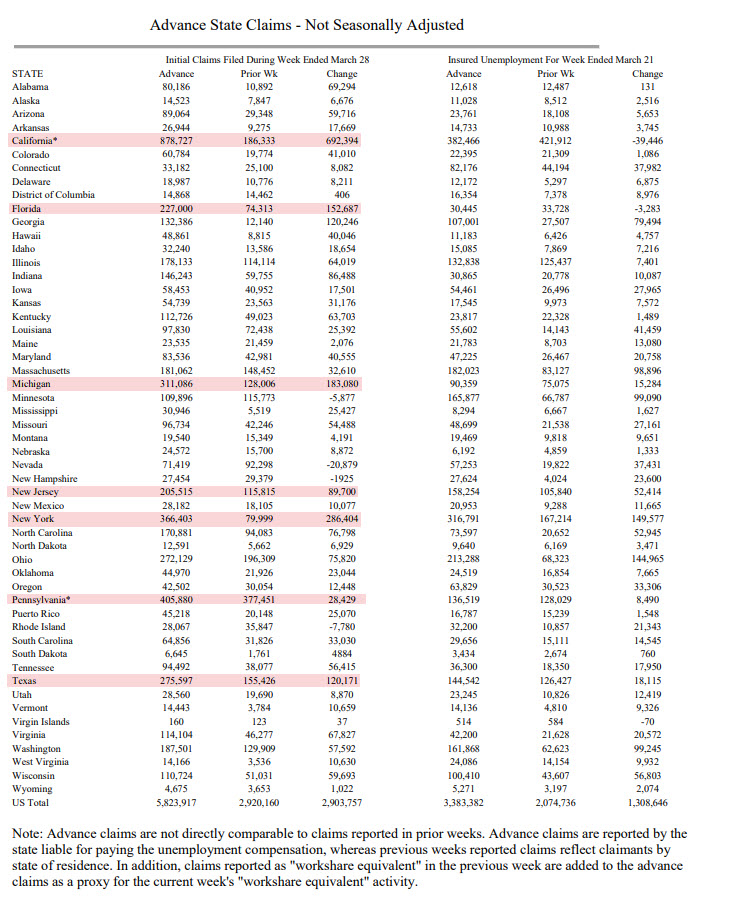

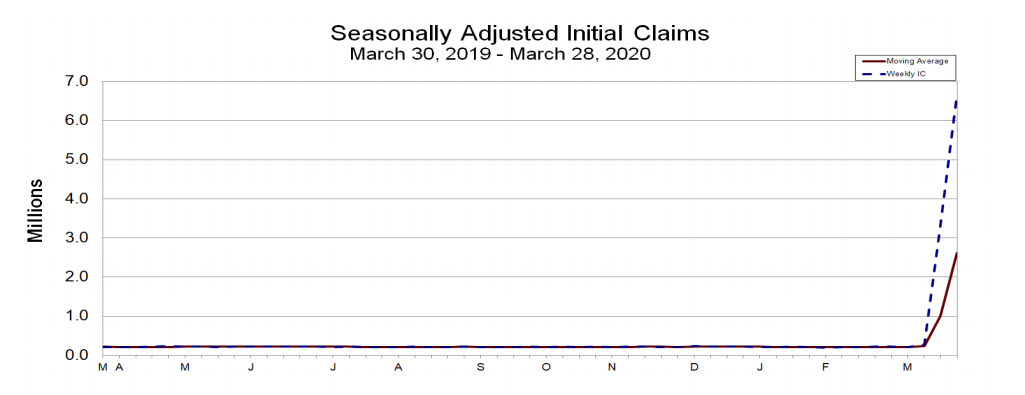

Below is a look at the advanced state claims not seasonally adjusted. California claims search by 692K. New York search by 286K. It might be expected that New York is lagging as processing may have a backlog. Him him

Below is a look at the advanced state claims not seasonally adjusted. California claims search by 692K. New York search by 286K. It might be expected that New York is lagging as processing may have a backlog. Him him