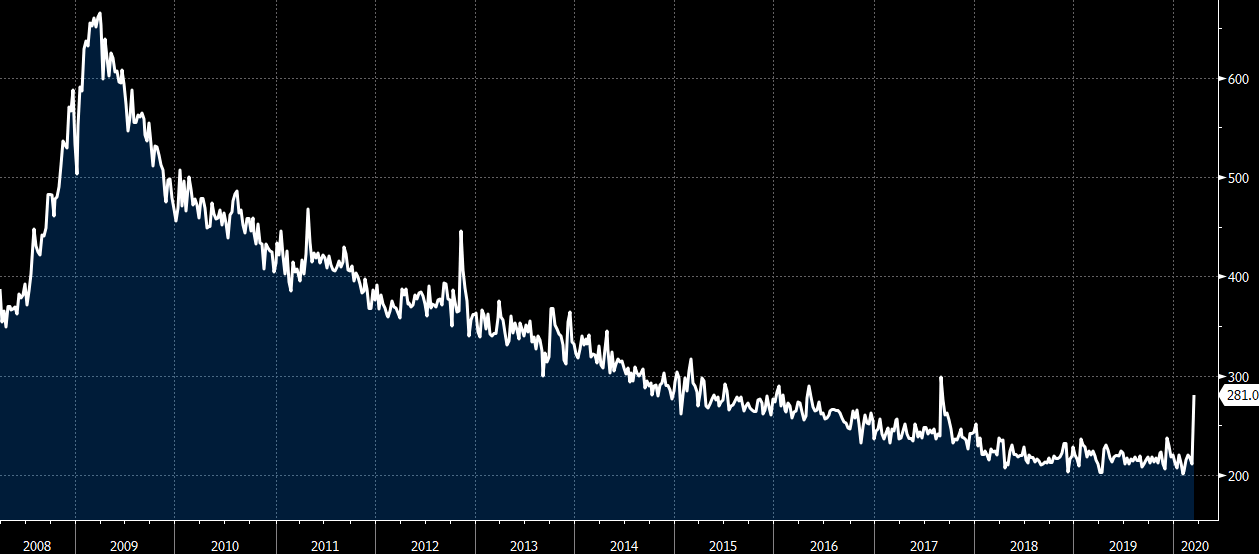

Oops! Dow Jones erases all gains since Trump election.

The Federal Reserve is committed to using its full range of tools to support households, businesses, and the U.S. economy overall in this challenging time. The coronavirus pandemic is causing tremendous hardship across the United States and around the world. Our nation’s first priority is to care for those afflicted and to limit the further spread of the virus. While great uncertainty remains, it has become clear that our economy will face severe disruptions. Aggressive efforts must be taken across the public and private sectors to limit the losses to jobs and incomes and to promote a swift recovery once the disruptions abate.

The Federal Reserve’s role is guided by its mandate from Congress to promote maximum employment and stable prices, along with its responsibilities to promote the stability of the financial system. In support of these goals, the Federal Reserve is using its full range of authorities to provide powerful support for the flow of credit to American families and businesses. These actions include:

In addition to the steps above, the Federal Reserve expects to announce soon the establishment of a Main Street Business Lending Program to support lending to eligible small-and-medium sized businesses, complementing efforts by the SBA.

The PMCCF will allow companies access to credit so that they are better able to maintain business operations and capacity during the period of dislocations related to the pandemic. This facility is open to investment grade companies and will provide bridge financing of four years. Borrowers may elect to defer interest and principal payments during the first six months of the loan, extendable at the Federal Reserve’s discretion, in order to have additional cash on hand that can be used to pay employees and suppliers. The Federal Reserve will finance a special purpose vehicle (SPV) to make loans from the PMCCF to companies. The Treasury, using the ESF, will make an equity investment in the SPV.

The SMCCF will purchase in the secondary market corporate bonds issued by investment grade U.S. companies and U.S.-listed exchange-traded funds whose investment objective is to provide broad exposure to the market for U.S. investment grade corporate bonds. Treasury, using the ESF, will make an equity investment in the SPV established by the Federal Reserve for this facility.

Under the TALF, the Federal Reserve will lend on a non-recourse basis to holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans. The Federal Reserve will lend an amount equal to the market value of the ABS less a haircut and will be secured at all times by the ABS. Treasury, using the ESF, will also make an equity investment in the SPV established by the Federal Reserve for this facility. The TALF, PMCCF and SMCCF are established by the Federal Reserve under the authority of Section 13(3) of the Federal Reserve Act, with approval of the Treasury Secretary.

These actions augment the measures taken by the Federal Reserve over the past week to support the flow of credit to households and businesses. These include:

Taken together, these actions will provide support to a wide range of markets and institutions, thereby supporting the flow of credit in the economy.

The Federal Reserve will continue to use it full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.

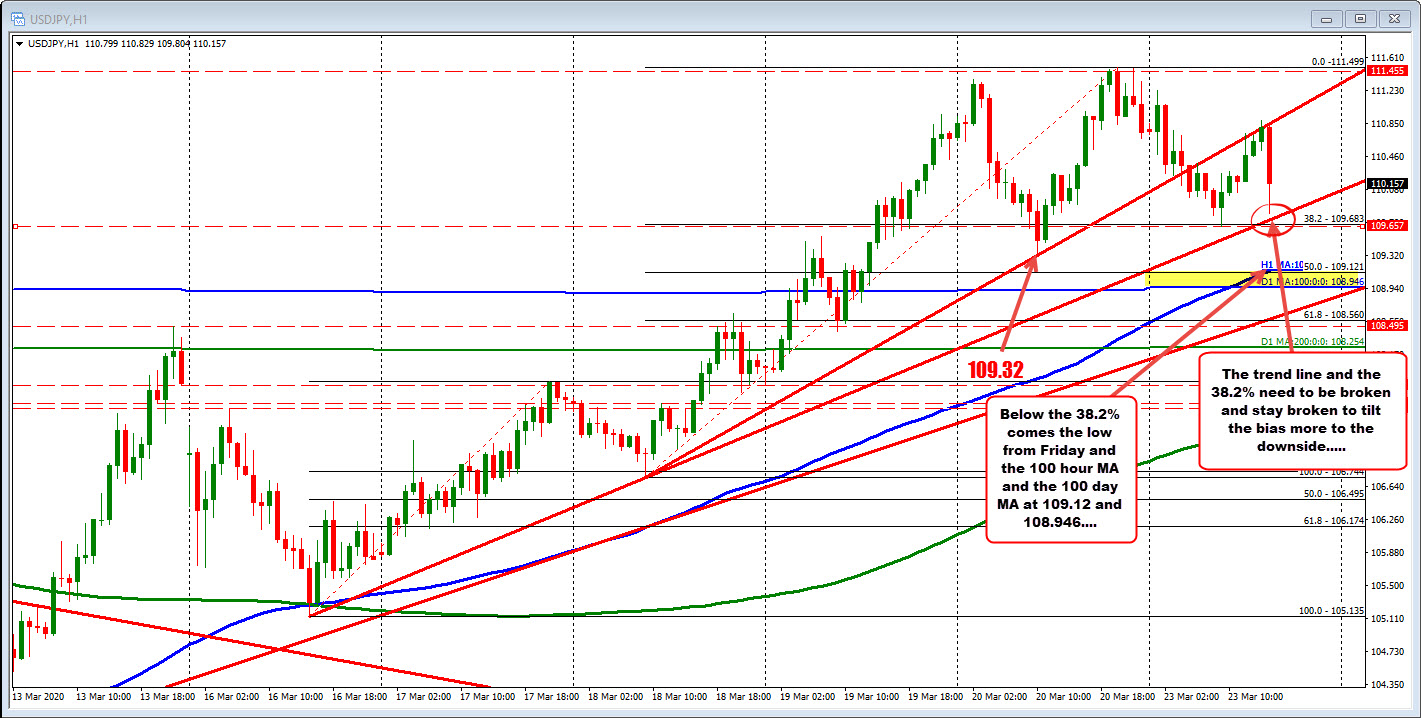

USDPY

It looks like Japan is slowly coming to terms with the notion the Olympics may not take place in the summer this year. They are now leaning towards the idea of postponing the dates but remain adamant that the games will not be cancelled altogether.

And this mostly comes after Japan had a long weekend with the BOJ continuing to buy up ETFs as well. Notably, Softbank shares are rebounding strongly after the company committed to more share buybacks earlier in the day.