Initial jobless claims top the economic calendar

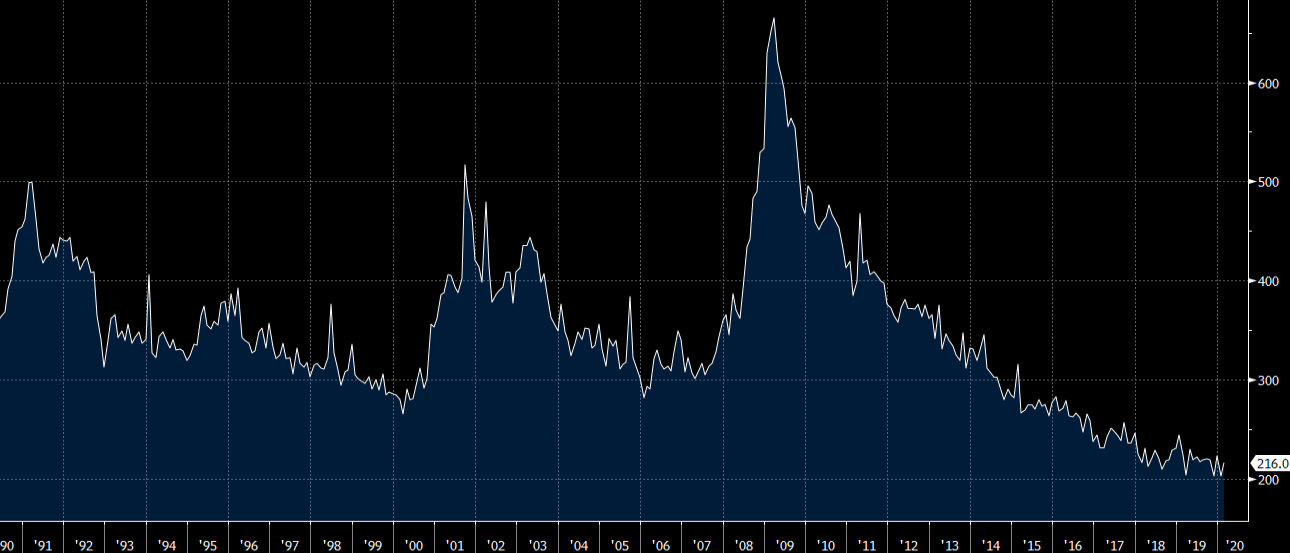

The weekly initial jobless claims report at the bottom of the hour is for the week ending March 14 so it’s before the real coronavirus crunch, which is a week or two away.

Last week was 211K and the ‘consensus’ this week is 220K but that’s far lower than what the market is expecting. State unemployment claims in some places are up 5x to 10x.

Last week I was warning about this and when I wrote that ‘The coming wave of unemployment claims is going to be unprecedented‘ there were comments like this:

Where are you guys coming up with this stuff… I was out last night eating and food places are full stores are full… you are acting like this is the end of the world…this is being blow up to be way way more that what it is… which is nothing more than a cold with a twist on it that has not even gone above last year flu session. This is completely stupid what the news media is doing.

Now it’s conventional wisdom.

What we haven’t figured out is if the bureaucracy can handle and process the level of claims to actually get people the money. That’s more important right now than a $1 trillion piece of legislation the White House is proposing to get people money at the end of April.