Trade optimism sees gold keep lower on the day

Gold buyers tried for a move higher to seize near-term control on Friday but the break was hit by a stronger dollar following more solid US data. That helped to give sellers a reason to claim near-term control and price is now at one-week lows under $1,460.

Price is currently more or less testing minor support around $1,456.45 with a break there likely to see price action move towards a test of the $1,450 level next.

The poor start to today isn’t helped by more positive US-China trade headlines and the worry for gold will be if this sort of narrative keeps up over the next few weeks.

On the daily chart, price is already under the 100-day moving average @ ~$1,483 and we could see a sharper correction if the fundamentals continue to go against gold – especially once price firmly locks in a move below $1,450.

With the Fed also seen on the sidelines now and there being some green shoots about a global economic recovery, I reckon the potential secondary push higher in gold may have to rest for a little bit before gaining real traction again.

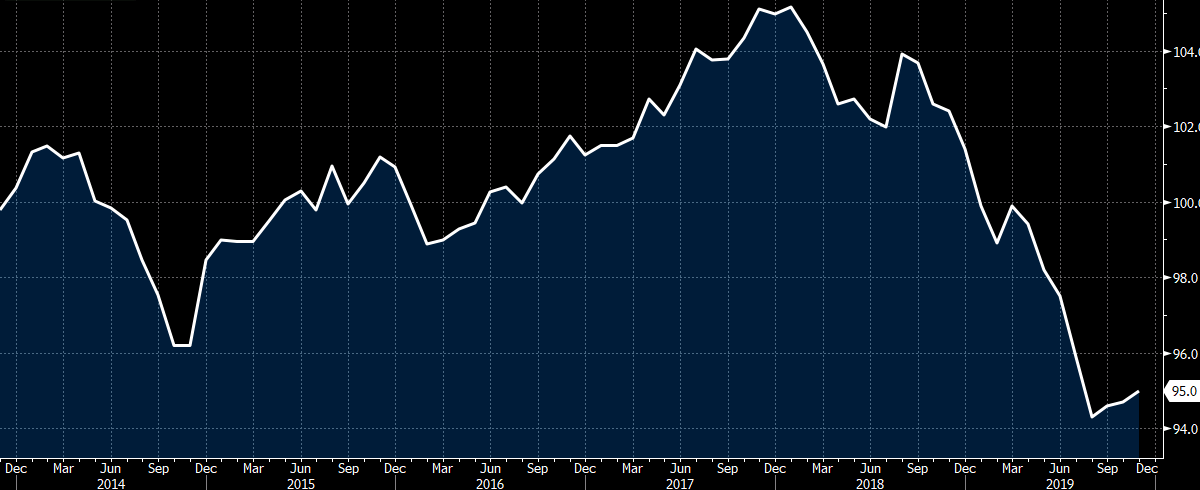

That said, one thing to watch as we look towards late December and January is the seasonal factor. Gold tends to see solid gains ahead of the Lunar New Year with January easily being the best month of gains (six years in a row now) with some spillovers to late December observed over the last two years too:

% change in gold for each month during the last 10 years

% change in gold for each month during the last 10 years

% change in gold for each month during the last 10 years

% change in gold for each month during the last 10 years