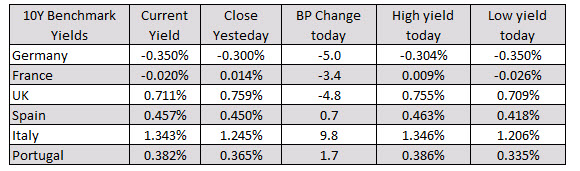

Yields are mixed

The major European stock indices are closing the day mostly lower. The provisional closes are showing:

- German DAX, -0.32%

- France’s CAC, -0.11%

- UK’s FTSE 100, -0.67%

- Spain’s Ibex, -0.17%

- Italy’s FTSE MIB, -0.41%

A look at the benchmark 10 year yields is showing a mixed picture with Germany France and UK yields moving lower, while the more risky Spain Italy and Portugal moving higher.