Crude Oil +429 Light Distillates -1,114 Middle Distillates -3,562 Heavy & Residues +1,238 Total Distillates -3,437 Total (Crude + Distillates) -3,008

Archives of “October 2019” month

rssNorth Korean state media on yesterday’s missile test – self-defence

KCNA say the submarine launched ballistic missile (SLBM) launched on 2 October 2019 is:

- to contain outside forces threat and bolster military self-defence

—-

One thing is for sure – expect more!

US stock markets battered for the second day

Closing changes in the US

- S&P 500 -52 points, or 1.8%, to 2887

- DJIA -481 to 26041

- Nasdaq -123 to 7785

In percentage terms, tech outperformed but it was generally ugly all around. If there’s a glimmer of optimism it’s that the S&P 500 closed 13 points off the lows.

Thought For A Day

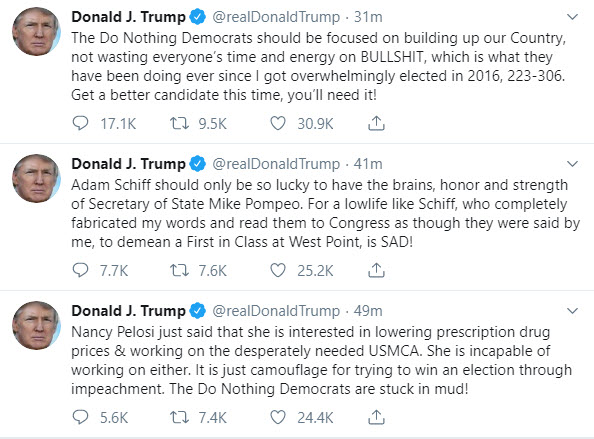

Pres. Trump sounds off….

…Stocks are not liking the optics of it all

Pres. Trump is sounding off as he defends himself in the way he knows how. Below are a sampling of the recent tweets:

He is also on the wires saying:

- He thinks the whistleblower should be protected if he is a legitimate whistleblower

But adds:

- Person who provided whistleblower information is a spy

What does it have to do with the market?

Stocks continue to suffer, as things are seemingly more and more in disarray.

The S&P is currently down 56 points or -1.9% at 2884.30. The NASDAQ is down 142 points or -1.8% at 7766. Both are near lows for the day.

Gold prices remain elevated at plus $21.50 or 1.45% at $1500.50.

The USD is mixed

- The USDJPY is seeing the safe haven flows and trades near lows for the day

- The USDCHF, which was up near 90 pips earlier after weaker CPI inflation, has moved back to mid range.

- The EURUSD moved to new highs on some dollar selling

- The GBPUSD has also recovered (dollar selling) after being lower on Brexit concerns earlier.

3

…Stocks are not liking the optics of it all

Pres. Trump is sounding off as he defends himself in the way he knows how. Below are a sampling of the recent tweets:

He is also on the wires saying:

- He thinks the whistleblower should be protected if he is a legitimate whistleblower

But adds:

- Person who provided whistleblower information is a spy

What does it have to do with the market?

Stocks continue to suffer, as things are seemingly more and more in disarray.

The S&P is currently down 56 points or -1.9% at 2884.30. The NASDAQ is down 142 points or -1.8% at 7766. Both are near lows for the day.

Gold prices remain elevated at plus $21.50 or 1.45% at $1500.50.

The USD is mixed

- The USDJPY is seeing the safe haven flows and trades near lows for the day

- The USDCHF, which was up near 90 pips earlier after weaker CPI inflation, has moved back to mid range.

- The EURUSD moved to new highs on some dollar selling

- The GBPUSD has also recovered (dollar selling) after being lower on Brexit concerns earlier.

Trump blames the stock market decline on ‘impeachment nonsense’

Trump turns his eye away from the Fed

He’s not entirely wrong, the market didn’t like the impeachment headlines when they first hit. But I’d argue that’s because impeachment is more likely to make him erratic and reactionary, if not dangerous.

As for what’s caused the latest leg of US stock market selling, allow me to draw some conclusions:

Here’s his tweet:

All of this impeachment nonsense, which is going nowhere, is driving the Stock Market, and your 401K’s, down. But that is exactly what the Democrats want to do. They are willing to hurt the Country, with only the 2020 Election in mind!

However I think in the big picture, you’re going to have a US election in 13 months. How do you have any confidence in stocks on a Warren vs Trump election? That’s a binary outcome.

If the impeachment talk had any bearing, it was because it hurt Biden as much as Trump and that solidified Warren’s lead. She went from +200K in betting odds on Sept 12 to +110 now.

European shares are beaten down. German DAX falls -2.5%. France’s CAC -2.9%

Ouch. European shares take a beating.

The European major indices are closed and the provisional closes are not looking good. The major indices are all beaten down by 2%-3% declines.

The provisional closes are showing:

- German DAX, -2.5%

- France’s CAC, -2.9%

- UK’s FTSE, -3.2%

- Spain’s Ibex, -2.7%

- Italy’s FTSE MIB, -2.8%

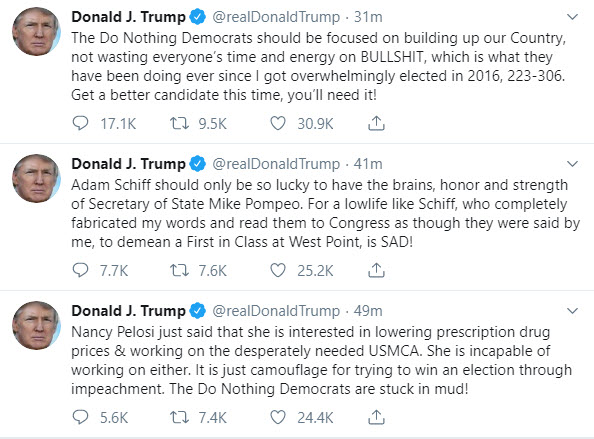

In the European debt market, the benchmark 10 year yields are ending the session higher, but off the highest levels of the day. Below is a snapshot of the current yields, changes and high low yields.

US stocks are also down sharply and trading near lows.

- S&P index, -1.91%

- NASDAQ index, -1.75%

- Dow industrial average, -2.0%

In other markets:

- spot gold is surging and back above the $1500 level. The price is up $22.34 or 1.51% at $1501.50.

- WTI crude oil futures is trading down $1.35 on expectations of slower growth. That is down 2.5% at $52.28. The inventory data showed a higher build then expectations today

In the forex, the JPY remains the strongest currency on flight to the relative safety of the JPY. The CAD has taken over as the weakest. The USDCAD is now trading back above its 200 day moving average at 1.3288.

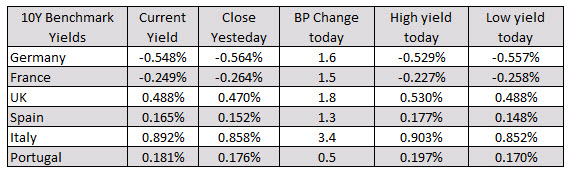

Global Asset Capitalizations

Australian Dollar at 10-year low vs. US Dollar, down 40% from its 2011 high. $AUDUSD

JPMorgan on impeachment and the markets

Scanning a few bits an pieces and noticed some comments from JPM

- “Despite the drama this process will inject into the rest of the President’s first term, there is little justification for altering asset allocation now, unless one thinks that this issue is the decisive one that tips the US economy into sub-trend growth and/or a profits recession,”

- “To us, impeachment more seems yet another constraint on returns over the next year, given the newer uncertainties created around international and domestic policy.”

More at this link