Jesse Livermore’s Equity curve:

At the end of yesterday and into the Asian session, the price of the pair ping-ponged between the 134.60 level above and the 133.86-99 level below. The price based one last time at the support area (yellow area), broke above the 134.60 level and did not look back. This is what that looked like:

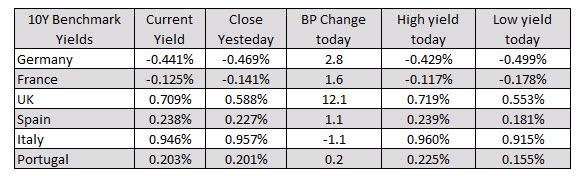

In the European debt market, the benchmark 10 year yields are mostly higher with UK yields soaring by 12.1 basis points on hopes for a Brexit deal.

China is offering to completely remove the requirement for forced joint ventures by Jan 2020. The Chinese would like to see if further tariffs could be suspended or rolled back. We will see if that is enough for the US Trade Team

The Chinese Securities and Regulatory Commission has announced that they will scrap foreign ownership limit on futures companies starting from 1 January 2020.