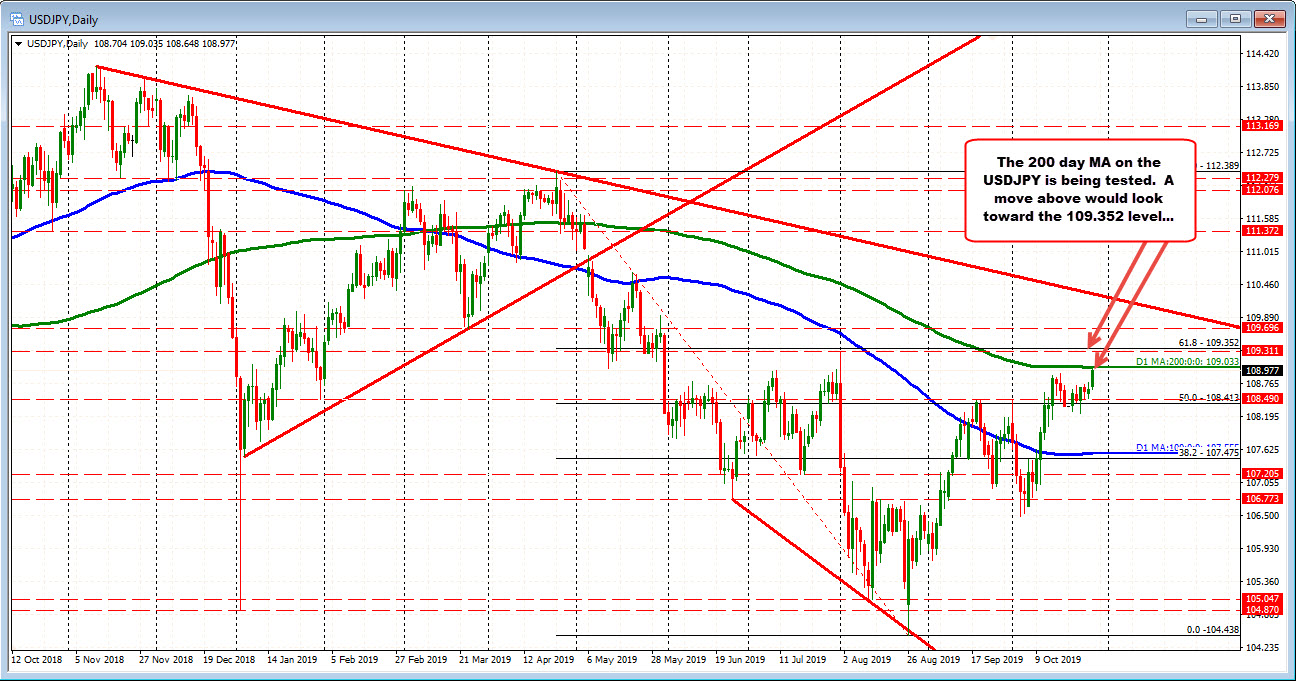

USDJPY 200 day MA at 109.033

The USDJPY has moved to another intraday high and in the process is testing its 200 day MA at 109.033. The high price (bid side) has reached 109.035.

Can the buyers keep the upside momentum going?

Close risk for the buyers is the old high for the day/month at 108.933 area (maybe down to 108.893). Stay above keeps the bullls more in control.

Can sellers lean against the 200 day MA?

Yes.

These key technical levels are where the buyers and sellers show their hand. If buyers turn to sellers and bears are interested, they will lean against the technical level and overwhelm the bueyrs. Those sellers will have stops on a momentum move above the 200 day MA.

Buyers, however, will be lookiing to help shove the market through that key level and trigger stops/more buying on the break above. If done. the 61.8% of the 2019 trading range at 109.352 will be the next major target.

Key target and bias levels for the buyers and the sellers.