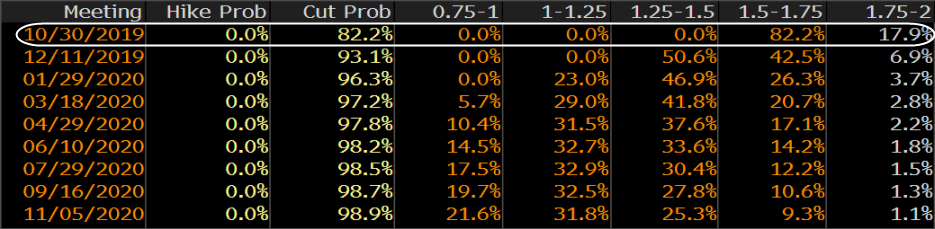

Odds of a 25 bps rate cut stays at ~82% currently

This has to be put into context, in that on 30 September, odds of a 25 bps rate cut only stood at ~40% so we’re more than double that currently.

However, any news of a partial US-China trade deal will no doubt bring down the above odds rather dramatically and the Fed still has one week to walk back expectations if such an event transpires – if they see fit that is.

The US CPI data release may result in a bit of a push and pull but I wouldn’t look too much into that. It’s all about the outcome of trade talks in Washington right now.