Charlie Munger attributes his investing success to simply “being rational”.

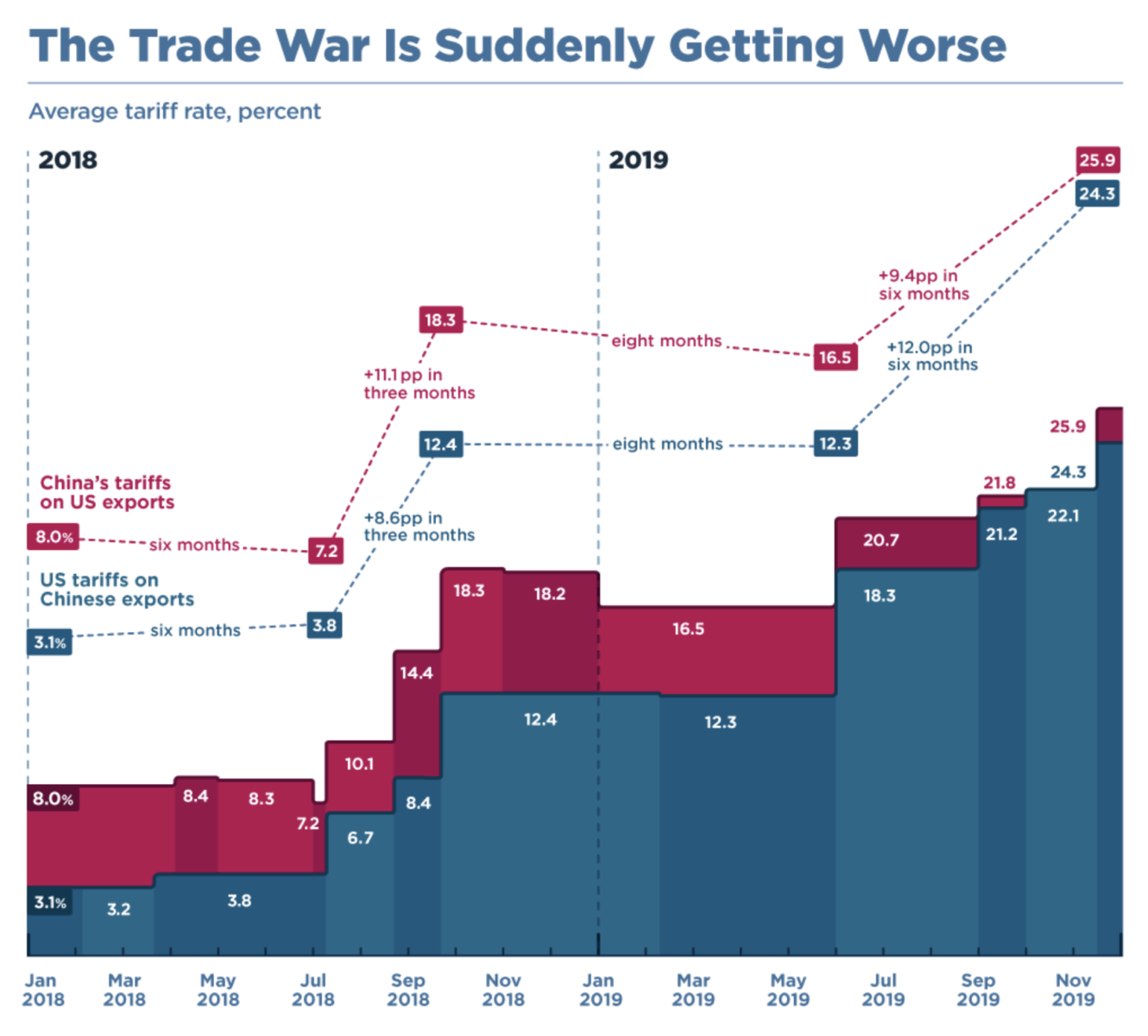

The U.S. slapped fresh tariffs on Chinese goods on Sunday to bring the average to more than 20%, comparable with levels seen during the protectionist era preceding World War II.

At 12:01 a.m. EDT, the U.S. imposed additional tariffs of 15% on about $110 billion in imports from China, covering 3,243 items. Consumer goods account for about half — far more than the 20%-plus of the previous round last September, which included such products as furniture. China’s corresponding tariffs against U.S. products took effect at the same time.

U.S. President Donald Trump postponed tariffs on 555 items on the original list — including smartphones — until Dec. 15 to soften the impact on the year-end shopping season. More than 80% of American imports of these goods come from China, and finding alternative sources is difficult. Higher tariffs are likely to lead to price increases, which risk weighing on consumer spending and thus the broader economy.

Digital consumer devices such as smartwatches are among the largest import categories by value affected by Sunday’s tariffs. More than half of all apparel is taxed as well.

China is retaliating with additional duties of 5% to 10% on $75 billion in imports from the U.S. The first tranche covers 1,717 goods including soybeans and crude oil, while the second set being implemented Dec. 15 will cover 3,361 items including autos.

But all told, fewer than 1,800 of these items — only about 35%, including crude oil — are new additions. Most have already been hit by previous rounds of tit-for-tat tariffs.

Beijing has already imposed tariffs on about 70% of its imports from the U.S. by value, and after these rounds, the only items left untouched will be those that it would be disadvantageous to domestic industry to tax, such as large aircraft. Previous tariff rounds have already led to sharp declines in imports of affected goods, and further hikes are unlikely to have much of an effect.

With the September duties, the average American tariff on Chinese goods rises to slightly above 21%, up from about 3% before the trade war, according to Chad Bown of the Peterson Institute for International Economics. China’s average tariff on imports from the U.S. climbs to nearly 22%. (more…)

1. Never Overtrade. To take an interest larger than

the capital justifies is to invite disaster. With such an

interest a fluctuation in the market unnerves the

operator, and his judgment becomes worthless.

2. Never “Double Up”; that is, never completely and

at once reverse a position. Being “long,” for instance,

do not “sell out” and go as much “short.” This may

occasionally succeed, but is very hazardous, for should

the market begin again to advance, the mind reverts

to its original opinion and the speculator “covers up”

and “goes long” again. Should this last change be

wrong, complete demoralization ensues. The change

in the original position should have been made moderately,

cautiously, thus keeping the judgment clear

and preserving the balance of the mind.

3. “Run Quickly,” or not at all; that is to say, act

promptly at the first approach of danger, but failing

to do this until others see the danger, hold on or close

out part of the “interest.”

4. Another rule is, when doubtful, reduce the amount

of the interest; for either the mind is not satisfied with

the position taken, or the interest is too large for

safety. One man told another that he could not sleep

on account of his position in the market; his friend

judiciously and laconically replied: “Sell down to a

sleeping point.”