Ifo cuts its GDP forecast for the German economy

- Sees 2019 GDP growth forecast at 0.5% (previously 0.6%)

- Sees 2020 GDP growth forecast at 1.2% (previously 1.7%)

- Expects Q3 GDP to fall by 0.1% q/q; possible slight recovery in Q4

Wall Street advanced on Wednesday with the S&P 500 closing above 3,000 for the first time since late July as a rally in tech and healthcare boosted US stocks and investors kept an eye on trade developments. The S&P 500 was up 0.7 per cent, edging closer to a fresh record high, led by healthcare and tech which were both up more than 1 per cent. The Dow Jones Industrial Average rose 0.9 per cent, its sixth consecutive daily rise and its longest winning streak since June. Meanwhile, the Nasdaq Composite gained 1.1 per cent, eyeing its first advance in four days. Apple shares gained more than 3 per cent with the tech company’s market capitalisation climbing back above the $1tn mark on Wednesday as investors cheered its lower-priced iPhone 11 and Apple TV+ subscription. Investors are also looking ahead to key central bank meetings.

The European Central Bank is expected to cut interest rates and detail plans for stimulus measures when it concludes its meeting on Thursday. Next week, investors expect the Federal Reserve to deliver a 25 basis-point rate cut. President Donald Trump on Wednesday renewed his attack on the Fed, calling for the “boneheads” at the central bank to cut interest rates to zero or lower. Trade was also on the agenda as China on Wednesday moved to exempt 16 types of US-exported goods from import tariffs ahead of the latest round of trade talks. The State Council’s tax regulator will next look to further expand exemptions on US goods and release follow-up lists when they are ready, it said.

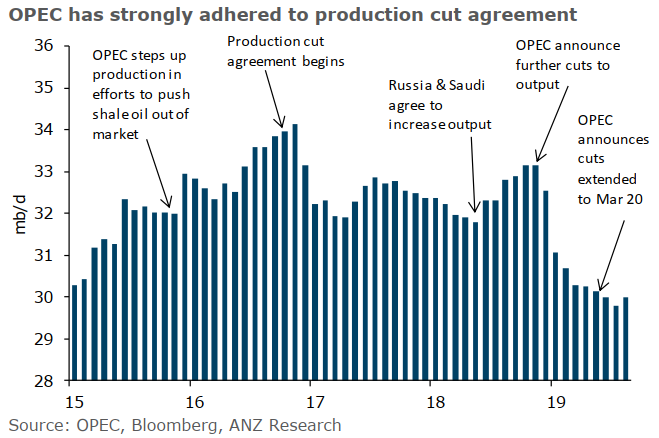

The moves in US markets followed gains in Europe, where the Stoxx 600 rose 0.9 per cent and the Frankfurt-based Dax added 0.7 per cent, while London’s FTSE 100 climbed 1 per cent. Overnight in Asia, the Topix climbed 1.7 per cent, extending the Japanese benchmark’s positive streak into a fifth day. Hong Kong’s Hang Seng gained 1.8 per cent, lifted by a strong showing from banks including HSBC and Standard Chartered and local developer stocks. In commodities markets, oil prices fell sharply after a report that Mr Trump discussed easing sanctions against Iran. Brent, the international oil marker, reversed its gains and fell 2.1 per cent to $61.08 a barrel, while West Texas Intermediate, the US benchmark, was down 2.4 per cent to $56.03 a barrel. Sovereign bonds extended their sell-off, with the yield on the US 10-year up 4.2 basis points to 1.7437 per cent. The German Bund rose 0.5 basis points to minus 0.562 per cent. Yields move inversely to price.