That would be big

That’s not a good sign for trade talks.

Bloomberg reports that the White House is discussing ways to limit US investors portfolio flows into China in a move that would be akin to capital restrictions.

It would be a major escalation in the trade war.

They’re also considering de-listing Chiense companies from US exchanges, examining limits on the Chinese companies included in stock indexes managed by US firms.

The report says Trump has given a greenlight to the discussions but that any plan would be subject to his approval.

This sounds a bit like a leak to put pressure on China but the trade is to de-risk and ask questions later. Chinese stocks are getting hit particularly hard.

I find it hard to believe that we’re headed towards a true, lasting trade deal when this kind of thing is on the table.

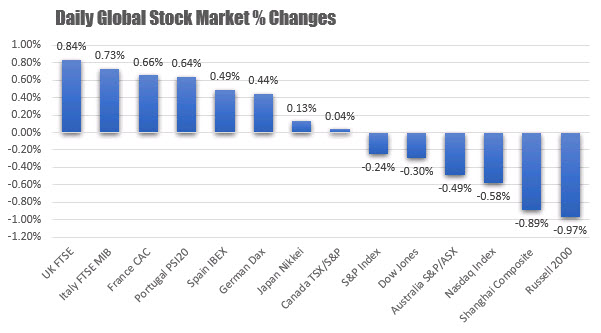

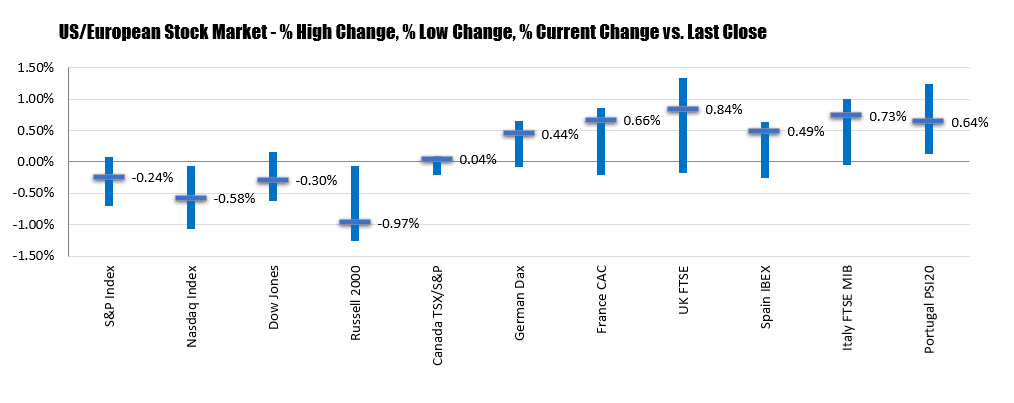

Ranking the winners and losers globaly, the UK FTSE was the biggest winner, while the Russell 2000 in the US was the weakest.

Ranking the winners and losers globaly, the UK FTSE was the biggest winner, while the Russell 2000 in the US was the weakest.