Archives of “September 9, 2019” day

rssThe question is not if but how much will the ECB deliver this week – Danske Bank

The firm outlines its expectations ahead of the ECB meeting this week

Analysts at the firm say that “the question is not if the ECB will announce new initiatives but how much it will deliver” instead. I think that’s an argument that everyone already has figured out by now. So, let’s see what they are expecting:

“We expect the ECB to announce (1) a 20bp cut in the deposit rate (other key rates unchanged) and that the extended forward guidance (‘at present or lower…well past the horizon of net asset purchases’) will remain; (2) a 12-month QE restart of €45-60bn per month, albeit also acknowledging the downside risks given the recent hawkish communications from a few Governing Council members; and (3) a tiering system.”

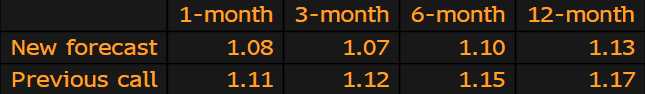

Tariffs threat to see euro fall to 1.07 against the dollar in three months – ING

ING lowers their forecasts for the euro

The firm argues that the euro will weaken to levels last seen in 2017 against the dollar due to threats stemming from US trade policy. Noting that:

“Further deterioration in the US-China trade war will drive the euro lower. But there is also a non-negligible risk of the US imposing, or at least threatening to impose auto tariffs on Eurozone exports. An overhang of such tariffs should weigh on the euro.”

“This means that EUR shorts can still be built and positioning does not act as a limiting factor behind the EUR/USD fall.”

Iraq oil minister says that it is too early to talk about deeper production cuts

This just reaffirms expectations heading into this week’s meeting

A similar message to what we heard from Oman earlier in the session. As such, don’t expect any major announcements – though there may be rumoured headlines to slip through – to follow after the OPEC+ JMMC meeting this Thursday.

Fed rate cut this month still on track after Friday’s NFP

Friday’s August jobs report data is here:

- August non-farm payrolls +130K vs +160K expected

- still-growing labour market and “average hourly earnings was stronger than expected, good news for wage inflation”

Here is UK PM Johnson’s cunning plan to stop Brexit extension beyond October 31

Earlier post on the UK media report on Prime Minister Boris Johnson plan to sabotage Brexit extension

- UK press reports on UK PM’s plan to sabotage any Brexit extension

- EU officials adamant on no further Brexit extension

Big German banks warn against further rate cuts (expected from the ECB this week)

Both Deutsche and Commerzbank Banks have weighed in against forecast further cuts from the European Central Bank this week:

- would benefit those with assets

- further burdening savers.

- neither sustainable, nor responsible

- Germany July industrial production -0.6% vs +0.4% m/m expected

- EUR/USD to stay weak, ECB next week

- Risk for EUR is positive for next week’s ECB meeting – BAML

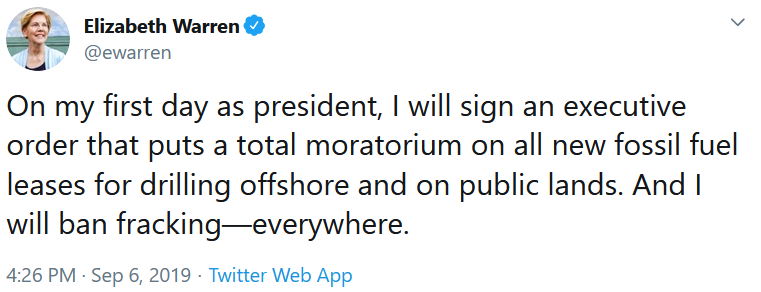

Can you imagine what the oil market would look like the day after this?

A ban on fracking?

On my first day as president, I will sign an executive order that puts a total moratorium on all new fossil fuel leases for drilling offshore and on public lands. And I will ban fracking-everywhere.

Thought For A Day