market preview

US secretary of state Pompeo is on the wires saying:

Trade war in full swing & rate cuts late in the cycle with stocks at absurd valuations. What’s left for the bulls?

Lao-Tzu was an ancient Chinese philosopher and writer who coined the following phrase:

‘If you are depressed you are living in the past.

If you are anxious you are living in the future.

If you are at peace you are living in the present’

In relation to trading, living in the past may relate to a bad trade you made. Maybe you risked too much and took a heavy loss. Or perhaps you made an impulse trade centred on FOMO which ended badly.

If you replay negative experiences over and over, it can lead to depressing thoughts. And an inability to move forward, clean the slate and inability to execute the next trade. It can also lead to revenge trading and the urge to make up for past losses quickly.

On the flip side if you are living in the future, anxiety can set in. You end up worrying about your future trades and the money side of things. The bills you have to pay. A list of endless hypotheticals start entering your mind.

Yet when it comes to trading, or anything else in life, living in the NOW is crucial. Learning from the past and planning for the future are ok. Yet executing and focusing on what you are doing right now is most important.

We need to remember as well that the market doesn’t care about our past losses. Nor does it care about our future bills. So although worrying about these things is natural, it’s not going to help us succeed with our next trade. In fact it will likely create unwanted blockages towards future success.

Being and working in the present though eliminates negative thoughts and reduces anxiety. It means you are working afresh from a blank slate. With that next trade being completely independent of any other you have recently made.

Doing the right thing right now is what is important. Not the mistake you made last time. That is ‘old news’ and no longer matters. So focus purely on what is in front of you. Plan the trade, trade the plan and refuse to be tempted by impulse or micromanagement. Two actions that are often influenced by past actions combined with future expectations.

Trade in the NOW and affirm to yourself that the NOW is all that matters when it comes to executing that next trade.

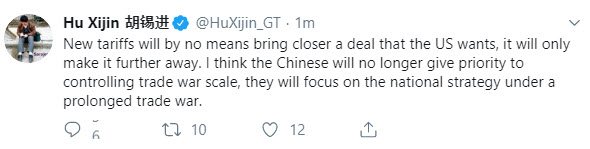

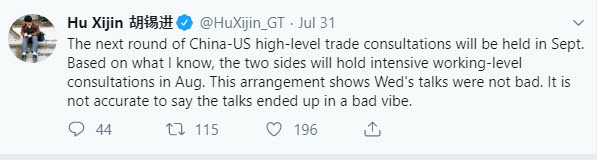

There is a headline saying that the president announced tariffs after a tense oval office meeting. According to the report, the president ruled out Treasury Secretary’s Mnuchin’s proposal to warn China of potential new tariffs.