Ignores the 2-10 going negative again

The US stocks erased the declines from yesterday (and then some). The gains also ignored what was a flattening of the yield curve to flat 2-10s again (although positive now by a basis point or two).

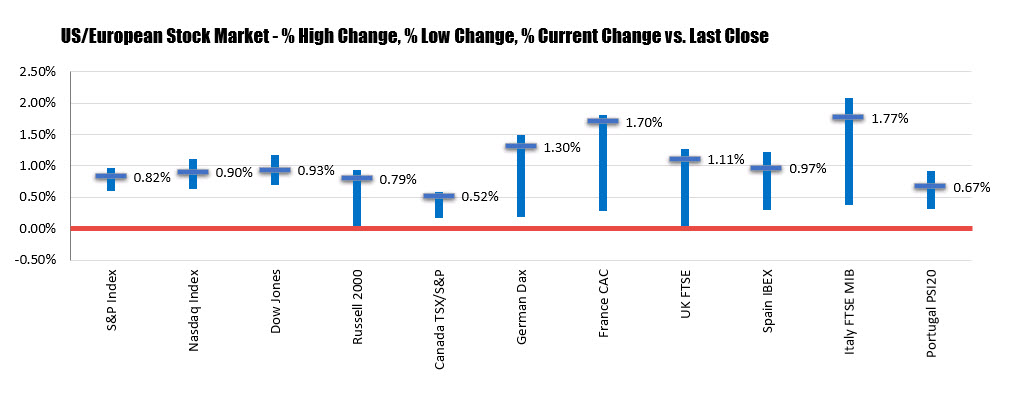

The final numbers are showing:

- The S&P index +23.92 points or 0.82% at 2924.43

- The NASDAQ index of 71.646 points or 0.90% at 8020.20

- The Dow industrial average of 240.29 points or 0.93% at 26202.73.

Below is a summary of the % change high/% change low/% change close for the North American and European major indices. Most European indices had an even better day.

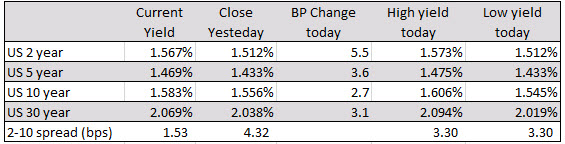

Below are the changes and ranges for the US debt curve (from 2-30 years). The 2-10 spread is 1.53 bps currently, down from 4.32 bps at the close yesterday. The thing about today’s move is the yields are higher across the board with the shorter end up more due to the taking out more of the 50 BP cut idea.

Below are the changes and ranges for the US debt curve (from 2-30 years). The 2-10 spread is 1.53 bps currently, down from 4.32 bps at the close yesterday. The thing about today’s move is the yields are higher across the board with the shorter end up more due to the taking out more of the 50 BP cut idea.