Closing changes for the main European bourses:

- UK FTSE +1.0%

- German DAX +1.2%

- French CAC +1.5%

- Italy MIB +1.8%

- Spain IBEX +0.7%

Italy got an extra lift as politicians work to form a new government, avoiding elections.

Italy got an extra lift as politicians work to form a new government, avoiding elections.

“If there is a shock, the exchange rate ought to be part of the adjustment and should be allowed to depreciate. That is what exchange rates are for,” Schipke said, adding that the exchange rate should be decided by market forces. “In principle let the market decide,” he said.

China has been leaning against yuan weakness by setting the mid-point at levels below the market. The currency has fallen about 4% this month.

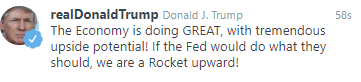

Trump is also tweeting about the economy:

The latest GDP report showed growth at a 2.0% annualized pace.

The latest GDP report showed growth at a 2.0% annualized pace.