Trump overruled advisors after ‘heated’ exchange

The Wall Street Journal

reports that Trump unilaterally decided that tariffs were needed after a failed round of trade talks last week.

Trump was frustrated after a briefing with Mnuchin and Lighthizer where he said neither could relay promises from Beijing to buy more agricultural goods.

“Tariffs,” Mr. Trump said to his team, one of the people said. Those present included his national-security adviser John Bolton, top economic adviser Lawrence Kudlow, China adviser Peter Navarro and acting chief of staff Mick Mulvaney.

All of them, save Mr. Navarro, a China hawk, adamantly objected to the tariffs, the people said. That spurred a debate lasting nearly two hours, one of the people said.

Trump told them his patience had worn thin.

In terms of what it means for the market this is a bad-news/good-news situation. The good news is that there is no grand, coordinated strategy here and that nearly all of the people advising Trump were against it. The bad news is that Trump is in love with tariffs and willing to overrule the people around him in order to get them.

Finally, you can’t rule out that this is a fake leak that’s part of some kind of strategy. Maybe that Mnuchin and Lighthizer go to the next round of talks and say “we need to bring back something or Trump is going to raise the tariffs to 25%.” But that seems to be a pretty questionable strategy to me.

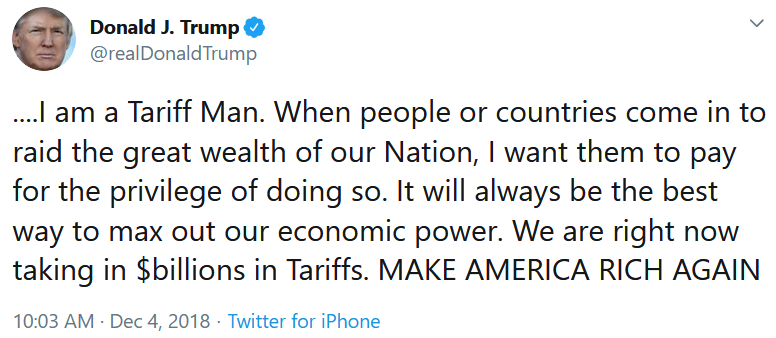

This tweet from December remains the most-telling tweet of Trump’s Presidency.