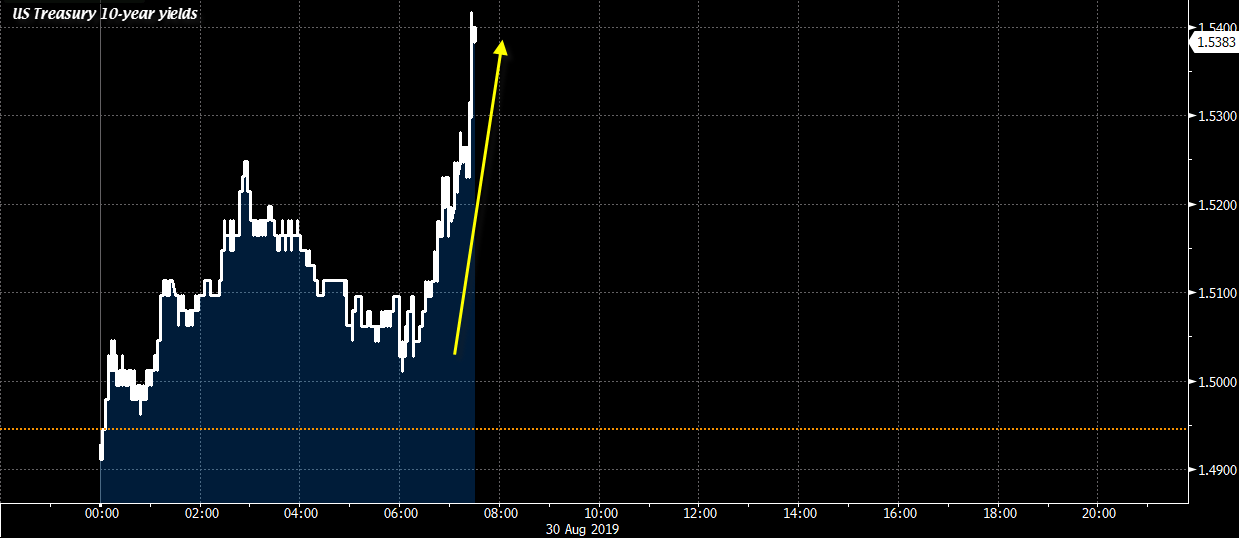

Pres Trump says tariffs will go on as planned on Sunday.

Before departing the White House for the weekend told reporters,

- He can’t say whether he will speak to Xi, but US is speaking to China

- Tariffs set to go in place on Sunday against China are still on

- “We are going to win the fight” with China

- Trade meeting with China in September is still on, it has not been canceled

- US is in incredible negotiating position with China because of tariffs it has placed on Chinese imports

- He sees a connection between situation in Hong Kong and China trade talks

- Chinese response in Hong Kong will be much more violent if were not for the trade talks

- Repeats China wants to make a trade deal

On other topics:

- Too soon to call for evacuation Florida. Determination will likely be made on Sunday

- Asked if he would like to see negative interest rates in the United States, says no.

The squeeze remains on.