Thought For A Day

German 10s fall below ECB deposit rate

The bond market in Europe is absolutely on fire.

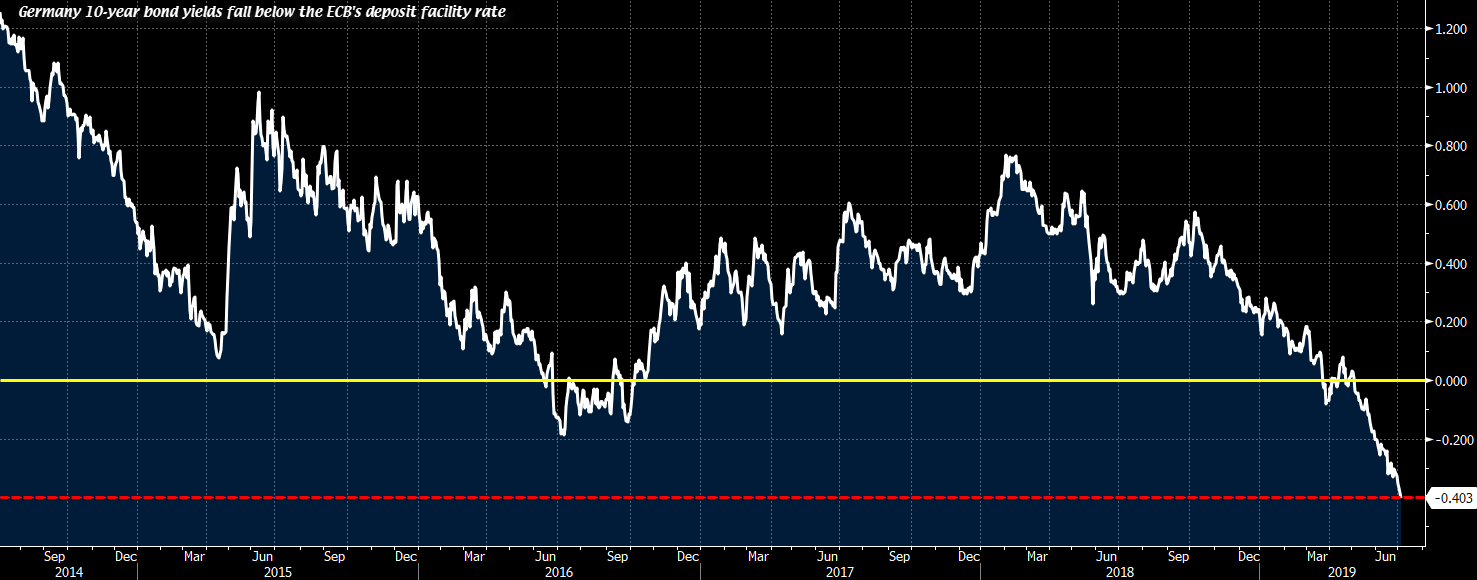

Yesterday’s announcement from European leaders that Italy wouldn’t face penalties for its deficit continued the insane rally in sovereign bonds. The market is also convinced that Christine Lagarde will be unafraid to dive deeper into experimental monetary policy. In the past five hours it finally ebbed with yields hitting cycle lows only to bounce in what looked like the final stretches of a short squeeze.

The moves have left sovereign curves in the eurozone at levels that were unthinkable years ago. The German curve is now sub-zero out to 20 years. Importantly, the bund yield also fell below the deposit rate of -0.40% for the first time.

German 10s fall below ECB deposit rate

So while equity markets are cheering everything at the moment, the bond market continues to say that something is terribly sick in the eurozone and the global economy.

Have a great Independence Day, folks! Enjoy the beach, BBQ, and fireworks but let us never, ever forget what we celebrate.

E pluribus unum over and out!

Russia has admitted a submersible involved in the country’s worst naval accident in more than a decade was nuclear powered, nearly three days after it caught fire during a top secret mission off the northern coast.

Defence minister Sergei Shoigu told president Vladimir Putin that the submersible’s nuclear reactor was “completely isolated and unmanned” and in full working condition, according to a transcript published on the Kremlin’s website on Thursday.

Mr Shoigu said the fire began in the submersible’s battery compartment, which then spread, killing 14 sailors from smoke inhalation and injuring an unspecified number of others. The sailors evacuated some of the people on board, then isolated the fire at the cost of their own lives, Mr Shoigu said.

The Kremlin has said it will not name the ship or clarify its mission. Russian media have reported that the fire broke out on an AS-31 submarine complex known as the Losharik, which normally travels under a larger submarine to avoid detection and can itself release another, smaller submersible.

One of the Russian navy’s most secret vessels, the Losharik is built to dive much deeper than an ordinary submarine and can survey the ocean floor.

The accident was Russia’s most fatal submarine tragedy since a fire killed 20 and injured 21 during sea trials of a nuclear-powered submarine in the Sea of Japan in 2008.

In case you missed the headline overnight, Trump mentioned that “China and Europe are playing a big currency manipulation game” and urged that the US should do the same to match. This isn’t anything new and has been an ongoing ordeal since about forever now.