Mu Changchun, deputy director of the People’s Bank of China’s payments department (a senior official at the PBOC)

- Libra, Facebook’s own cryptocurrency, must be put under the oversight of monetary authorities,

- Mu says that as a a convertible crypto asset (a type of stablecoin) Libra can flow freely across borders

- it “won’t be sustainable without the support and supervision of central banks”

Mu in communications with Bloomberg

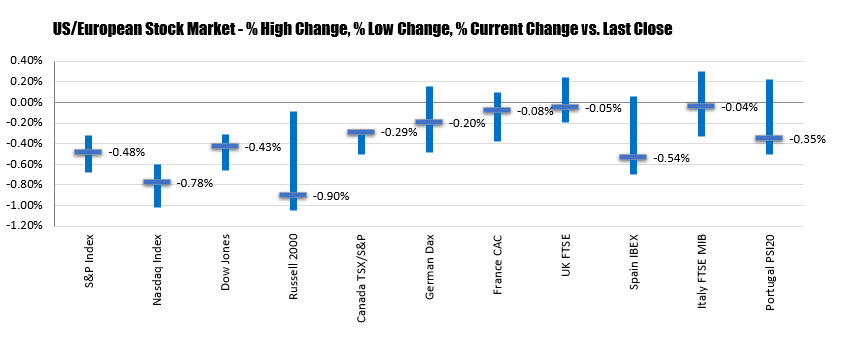

Meanwhile, Bitcoin is rallying hard in Asia today, following overnight gains: