Small changes in the major European indices

The provisional closes for the major European stock indices are showing mixed results:

- German DAX, -0.2%

- France’s CAC, -0.1%

- UK’s FTSE, +0.01%

- Spain’s Ibex, -0.6%

- Italy’s FTSE MIB, -0.04%

- Portugal PSI 20, -0.35%

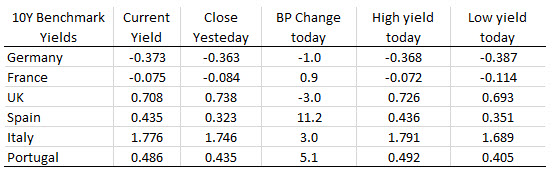

IN the benchmark 10 year note sector, Spanish yields have surged 11.2 basis points today as investors liquidate long positions.