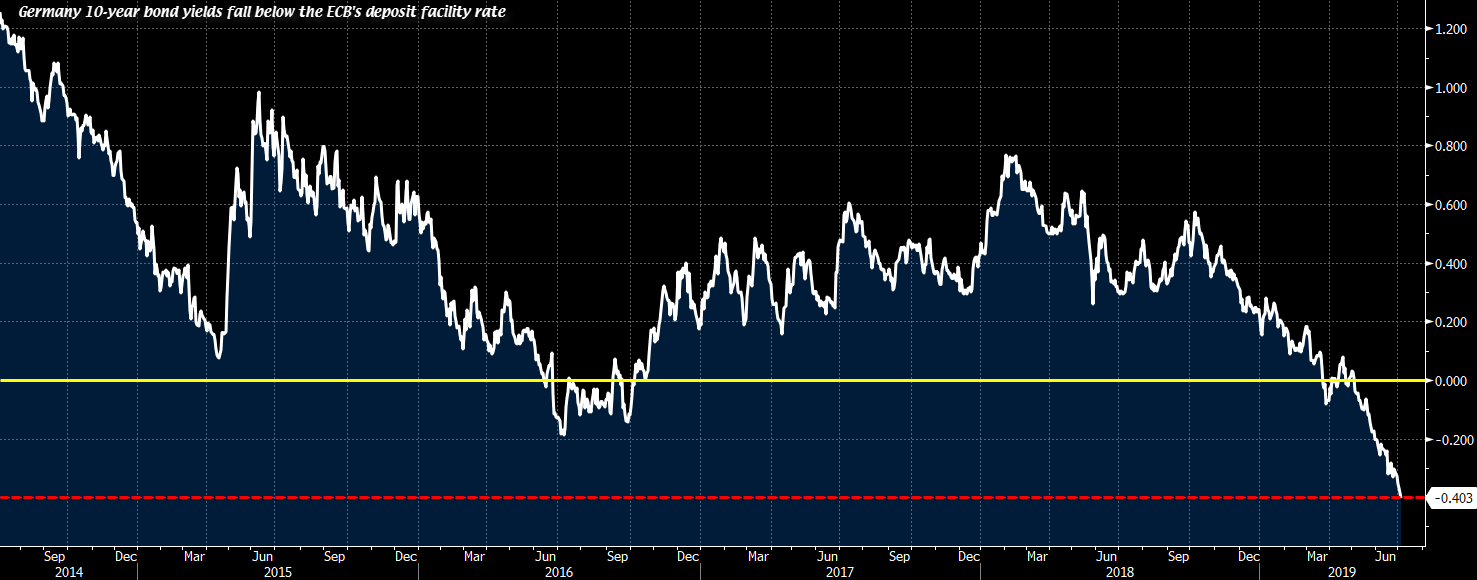

German 10s fall below ECB deposit rate

The bond market in Europe is absolutely on fire.

Yesterday’s announcement from European leaders that Italy wouldn’t face penalties for its deficit continued the insane rally in sovereign bonds. The market is also convinced that Christine Lagarde will be unafraid to dive deeper into experimental monetary policy. In the past five hours it finally ebbed with yields hitting cycle lows only to bounce in what looked like the final stretches of a short squeeze.

The moves have left sovereign curves in the eurozone at levels that were unthinkable years ago. The German curve is now sub-zero out to 20 years. Importantly, the bund yield also fell below the deposit rate of -0.40% for the first time.

German 10s fall below ECB deposit rate

So while equity markets are cheering everything at the moment, the bond market continues to say that something is terribly sick in the eurozone and the global economy.