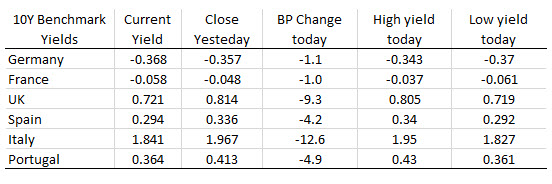

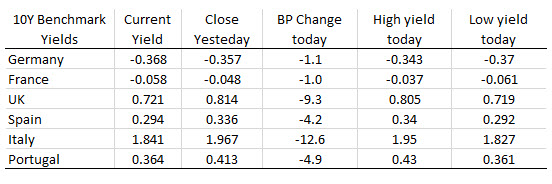

10 year yields are lower

- German DAX, +0.1%

- France’s CAC, +0.2%

- UK’s FTSE, +0.9%

- Spain’s Ibex, +0.3%

- Italy’s FTSE MIB, +0.65%

There isn’t much standing between it and a return to the lows. The fall today takes it below the 61.8% retracement of the June rally. On the USD side, the market is increasingly concerned that the Fed won’t cut as deeply as what’s priced into the market.

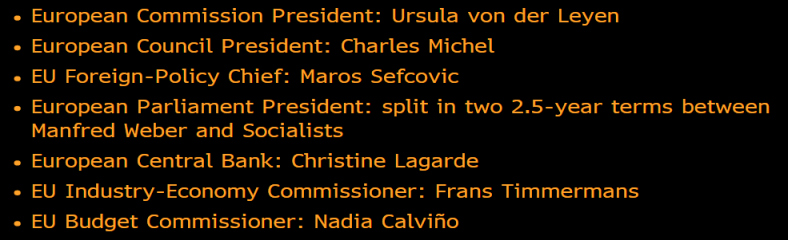

European leaders will now only begin their sit-down session at 1300 GMT after the start time has been delayed since the morning. Of course, all of this is happening as everyone is scrambling to negotiate with their respective parties and counter-parties in order to work out an agreement for who will take up Europe’s top jobs.

Italian government debt rallied after Rome’s populist government revised its spending plans in a bid to dampen budget tensions with the EU, sending yields on its two-year bonds negative for the first time since the crisis emerged in May last year.

The Italian government has been on a collision course with Brussels over its fiscal policies, sparking investor anxiety over the country’s rising debt burden which has bled into the bond markets. But on Monday evening ministers reached an agreement to adjust the budget in the hope of avoiding an EU excessive deficit procedure.

Analysts at Rabobank said news that an EU meeting over the excessive debt procedure had been postponed has also helped fuel the rally in Italian government debt.

The yield on Italy’s two-year bonds, which moves inversely to prices and is particularly sensitive to economic and monetary policy, fell 9 basis points (0.09 percentage points) to a low of minus 0.003 per cent, Reuters data showed. Tuesday marks the first time the short-dated paper has yielded negative since budget tensions blew up in May 2018.

The yield on 10-year debt has fallen below 2 per cent this week, again for the first time since May 2018.

“With this announcement and the broader backdrop that the ECB is standing ready to do whatever it takes, yet again, the notion of shorting Italy, even in the face of fiscal pressures, makes little sense,” Rabobank’s rates strategists said in a note.

The closely watched spread between Italian two-year government bonds and German Bunds of the same maturity narrowed to as low as 0.747 percentage points, suggesting that the risk premium investors place on Italian debt has narrowed significantly alongside easing tensions, having burst above 3 points in 2018.

Still, some do not think Italy is out of the woods yet. A measure from Frankfurt-based research house Sentix showed a small but growing number of investors believe Italy is likely to withdraw from the euro: 8.3 per cent of investors surveyed in late June see Italy leaving, up from 6.2 per cent the previous month.

The moves came as part of a broader rally in eurozone government debt, after manufacturing PMI data disappointed on Monday and the ECB reinforced its indications that it stands ready to launch stimulus if the inflation outlook failed to improve. Ten-year bond yields for two other so-called ‘periphery’ countries, Spain and Portugal, dropped to new record lows on Tuesday.

That’s hardly news as this has already been made somewhat official since the weekend. The source adds that the official pact will be signed soon. But at least we know there aren’t any hiccups along the way I guess.