Gold price projections from Goldman Sachs:

- 3 months $1450 (prior forecast was at $1350)

- 6 months $1475 (from $1350)

- 12 months $1475 (from $1425)

Reasoning from GS:

- gold supported by central bank buying, GS expect the buying to be more than 100 tonnes over last year’s levels

- lower real interest rates to support gold

More:

- base case scenario is global growth gradually improves in H2 of 2019

- recession worries recede

- should eventually lead to a gradual moderation in “fear” driven investment demand for gold

- Emerging market GDP growth gradually improves

GS say they see less tactical upside for gold

- but weak growth in DM is a positive strategically (portfolio diversification)

- if slow growth in DM persists, GS expect 2016 to repeat (ETF buying increased by 800 tonnes Jan to Sep that year) – this could take gold prices above $1600

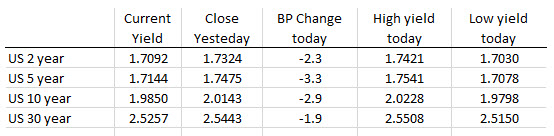

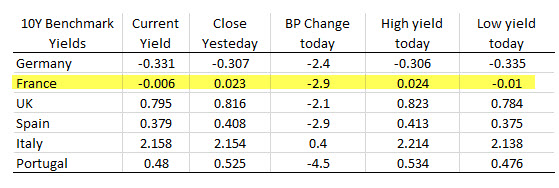

In other markets as London/European traders look to exit are showing:

In other markets as London/European traders look to exit are showing: