China Baowu Steel Group, the world’s second-largest steelmaker, will merge with domestic rival Magang (Group) Holding to come within striking distance of global top player ArcelorMittal.

Anhui Province’s State-owned Assets Supervision and Administration Commission, which owns Magang, will transfer a 51% stake to Baowu, according to a filing by listed Magang unit Maanshan Iron & Steel on the Shanghai Stock Exchange website Sunday.

The merger aims to strengthen international competitiveness, the Shanghai announcement said. The consolidation comes as China looks to boost profitability at domestic steelmakers in preparation for a drawn-out trade war with the U.S.

“This is a major step toward reaching the goal of 100 million tons a year,” a Baowu source said. Baowu’s current production volume is 67.43 million tons. Adding Magang’s 19.64 million tons will result in combined output of nearly 90 million tons — almost on a par with ArcelorMittal’s 92.5 million tons.

“We just need one more addition to the group to become the world’s No. 1,” the source said.

The Chinese government aims to push consolidation within the industry so that the top 10 players in China account for 60% of steel production, up from 35% today.

Baowu, China’s top steelmaker, is wholly owned by the central government’s State-owned Assets Supervision and Administration Commission.

The Baowu-Magang alliance’s bigger war chest would enable stepped-up capital investment as well as research and development.

Magang said it will push ahead with supply-side reform in conjunction with the direction set by Chinese President Xi Jinping. Consolidation of major steelmakers here will continue going forward, a brokerage analyst predicted. Reducing the number of companies will likely help resolve the issue of oversupply and boost the competitiveness of Chinese players.

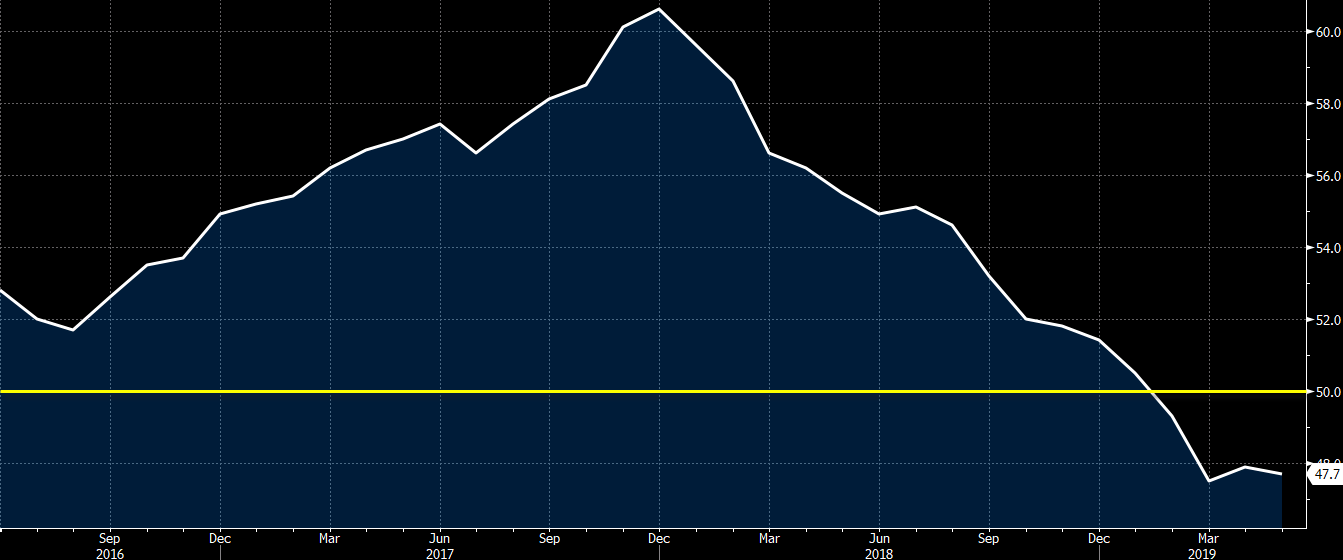

China accounts for roughly half of global steel production. Production in the first four months of 2019 grew around 10% on the year, supported by demand for use in infrastructure projects.

Yet with automobile demand shrinking in China, and the outlook unclear for exports of home electronics with new tariffs kicking in, “China has to unite to strengthen the profitability of each steelmaker,” an industry insider said.

In the broader steel industry, the planned merger of India’s Tata Steel and Germany’s ThyssenKrupp was recently called off over fears that that the European Union would block a deal that would create a virtual duopoly in the common market. ArcelorMittal has announced that it will reduce production in Europe.

Amid uncertainties in the global economy, the consolidation in the Chinese steel industry — which accounts for half of the world’s top 10 steelmakers — will impact decision-making at each of the global players.