Greece is facing a snap general election after prime minister Alexis Tsipras and his ruling Syriza party suffered a heavy defeat in voting for the European Parliament last month.

The vote will be held on July 7, almost four months before the leftwing Syriza government’s term was due to expire. Mr Tsipras tendered his resignation to President Prokopis Pavlopoulos on Monday, saying the country had “entered a prolonged pre-electoral period from the day after the European elections.”

“I believe this could presage risks for the smooth course of the economy . . . endangering the virtuous circle we have entered and the sacrifices the Greek people have made,” he said.

Mr Pavlopoulos approved the premier’s request immediately.

The European Commission warned last week that handouts legislated by the Syriza government ahead of the European vote could derail Greece’s target for a primary budget surplus — before debt servicing costs — of 3.5 per cent of gross domestic product for this year.

The centre-right New Democracy party topped the polls on May 27, finishing 9.5 percentage points ahead of Syriza. (more…)

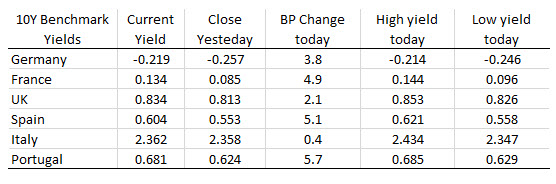

The German 10 year yield is below the 2016 low at -0.189% still.

The German 10 year yield is below the 2016 low at -0.189% still.